Question: ! 23 Required information Financial Analysis: Procter & Gamble Part 1 of 3 The following questions are about key financials that impart useful insights into

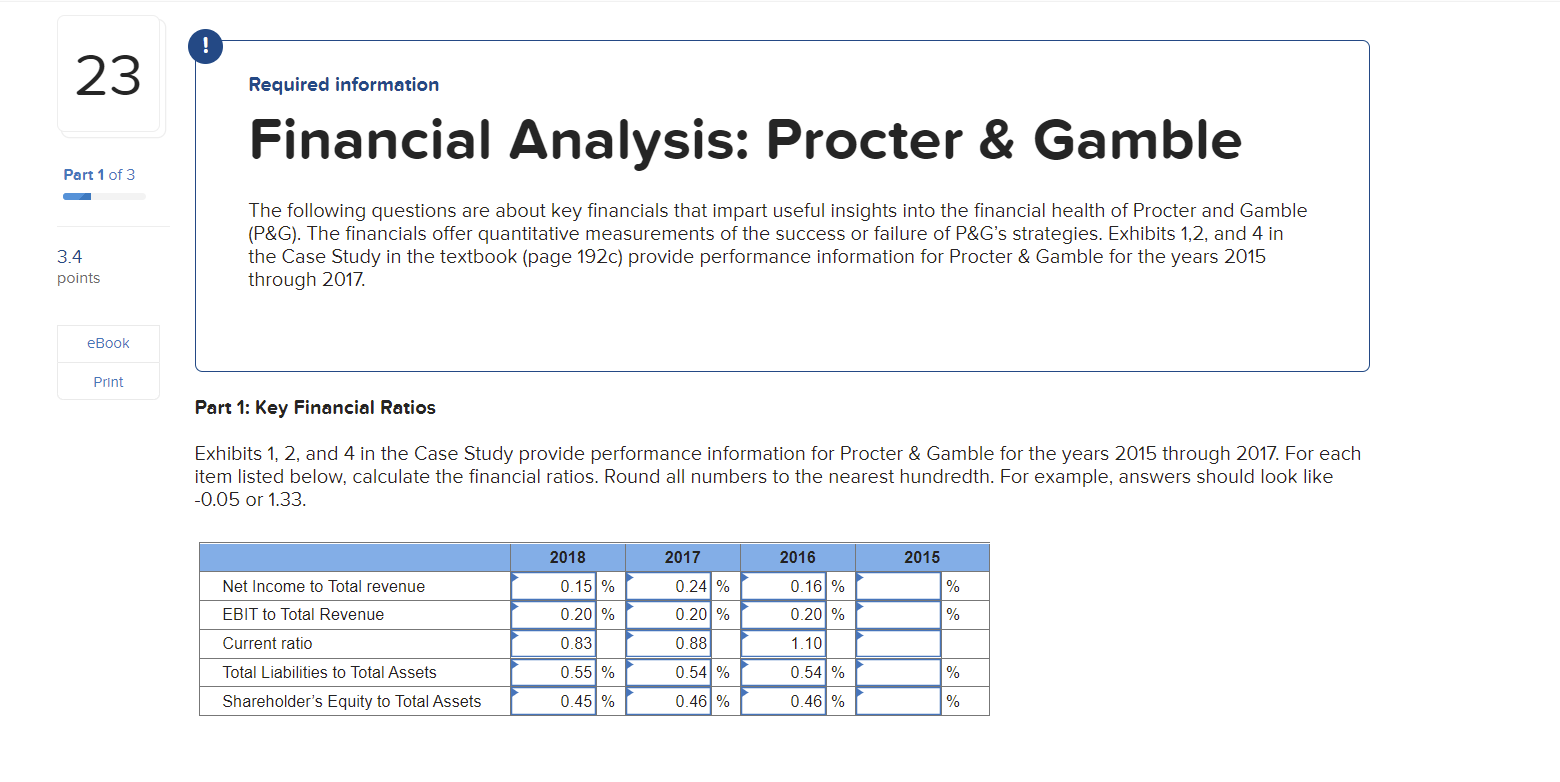

! 23 Required information Financial Analysis: Procter & Gamble Part 1 of 3 The following questions are about key financials that impart useful insights into the financial health of Procter and Gamble (P&G). The financials offer quantitative measurements of the success or failure of P&G's strategies. Exhibits 1,2, and 4 in the Case Study in the textbook (page 192c) provide performance information for Procter & Gamble for the years 2015 through 2017 3.4 points eBook Print Part 1: Key Financial Ratios Exhibits 1, 2, and 4 in the Case Study provide performance information for Procter & Gamble for the years 2015 through 2017. For each item listed below, calculate the financial ratios. Round all numbers to the nearest hundredth. For example, answers should look like -0.05 or 1.33. 2018 2017 2016 2015 0.15% 0.24% 0.16% % Net Income to Total revenue EBIT to Total Revenue 0.20% 0.201% 0.20% % Current ratio 0.83 0.88 1.10 0.54% % Total Liabilities to Total Assets Shareholder's Equity to Total Assets 0.55 % 0.45% 0.54% 0.46% 0.46% % ! 23 Required information Financial Analysis: Procter & Gamble Part 1 of 3 The following questions are about key financials that impart useful insights into the financial health of Procter and Gamble (P&G). The financials offer quantitative measurements of the success or failure of P&G's strategies. Exhibits 1,2, and 4 in the Case Study in the textbook (page 192c) provide performance information for Procter & Gamble for the years 2015 through 2017 3.4 points eBook Print Part 1: Key Financial Ratios Exhibits 1, 2, and 4 in the Case Study provide performance information for Procter & Gamble for the years 2015 through 2017. For each item listed below, calculate the financial ratios. Round all numbers to the nearest hundredth. For example, answers should look like -0.05 or 1.33. 2018 2017 2016 2015 0.15% 0.24% 0.16% % Net Income to Total revenue EBIT to Total Revenue 0.20% 0.201% 0.20% % Current ratio 0.83 0.88 1.10 0.54% % Total Liabilities to Total Assets Shareholder's Equity to Total Assets 0.55 % 0.45% 0.54% 0.46% 0.46% %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts