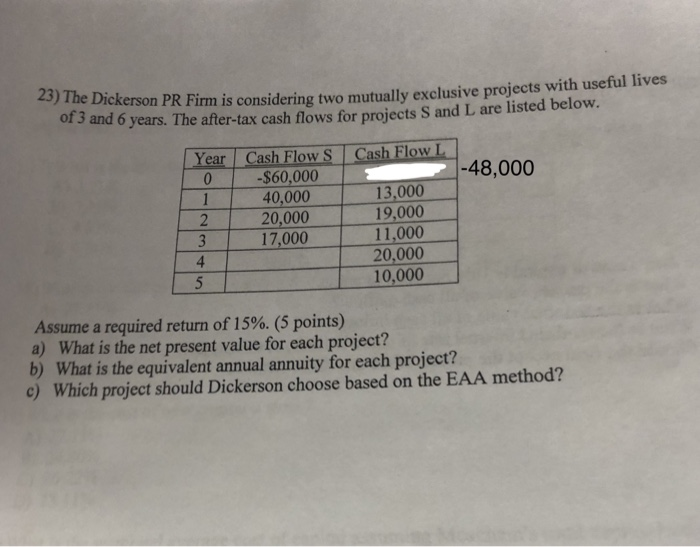

Question: 23) the Dickerson PR Firm is considering two mutually exclusive projects with useful lives of3 and 6 years. The after-tax cash flows for projects S

23) the Dickerson PR Firm is considering two mutually exclusive projects with useful lives of3 and 6 years. The after-tax cash flows for projects S and L are listed below. Year Cash Flow S Cash Flow L $60,000 40,000 20,000 17,000 -48,000 13,000 19,000 11,000 20,000 10,000 3 4 Assume a required return of 15% (5 points) a) What is the net present value for each project? b) What is the equivalent annual annuity for each project? c) Which project should Dickerson choose based on the EAA method

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock