Question: 24) Stock K is expected to return 12.4 percent while the return on Stock L is expected to be 8.6 percent. You have $10,000 to

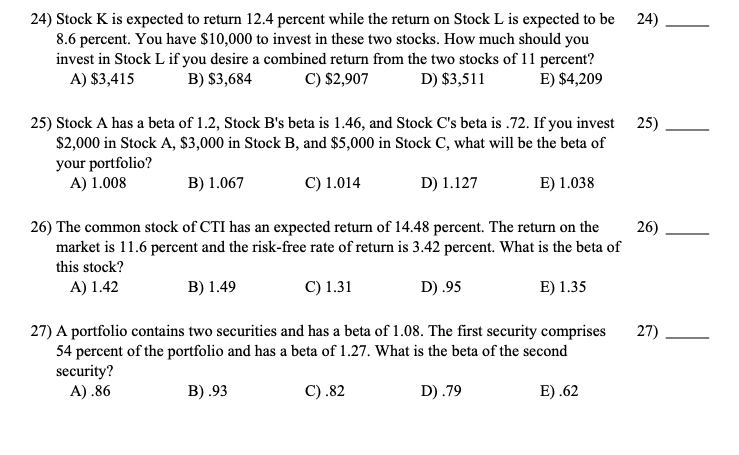

24) Stock K is expected to return 12.4 percent while the return on Stock L is expected to be 8.6 percent. You have $10,000 to invest in these two stocks. How much should you invest in Stock L if you desire a combined return from the two stocks of 11 percent? A) $3,415 24) D) $3,511 B) S3,684 C) $2,907 E) $4,209 25) Stock A has a beta of 1.2, Stock B's beta is 1.46, and Stock C's beta is .72. If you invest $2,000 in Stock A, $3,000 in Stock B, and $5,000 in Stock C, what will be the beta of your portfolio? 25) A) 1.008 B) 1.067 C) 1.014 D) 1.127 E) 1.038 26) The common stock of CTI has an expected return of 14.48 percent. The return on the market is 11.6 percent and the risk-free rate of return is 3.42 percent. What is the beta of this stock? 26) A) 1.42 B) 1.49 C) 1.31 D) .95 E) 1.35 27) A portfolio contains two securities and has a beta of 1.08. The first security comprises27) 54 percent of the portfolio and has a beta of 1.27. What is the beta of the second security? D).79 B).93 A).86 C).82 E).62

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts