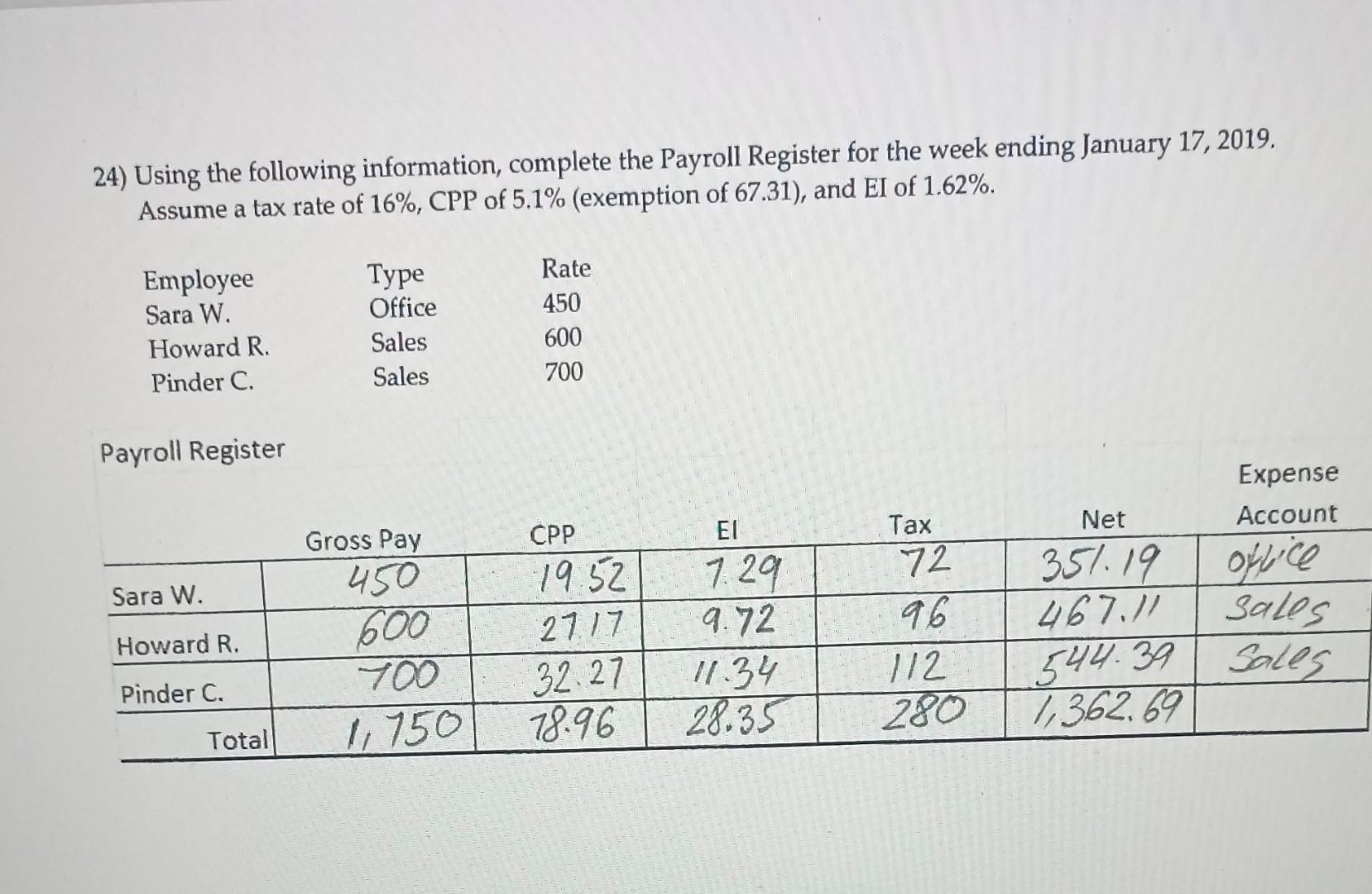

Question: 24) Using the following information, complete the Payroll Register for the week ending January 17, 2019. Assume a tax rate of 16%,CPP of 5.1% (exemption

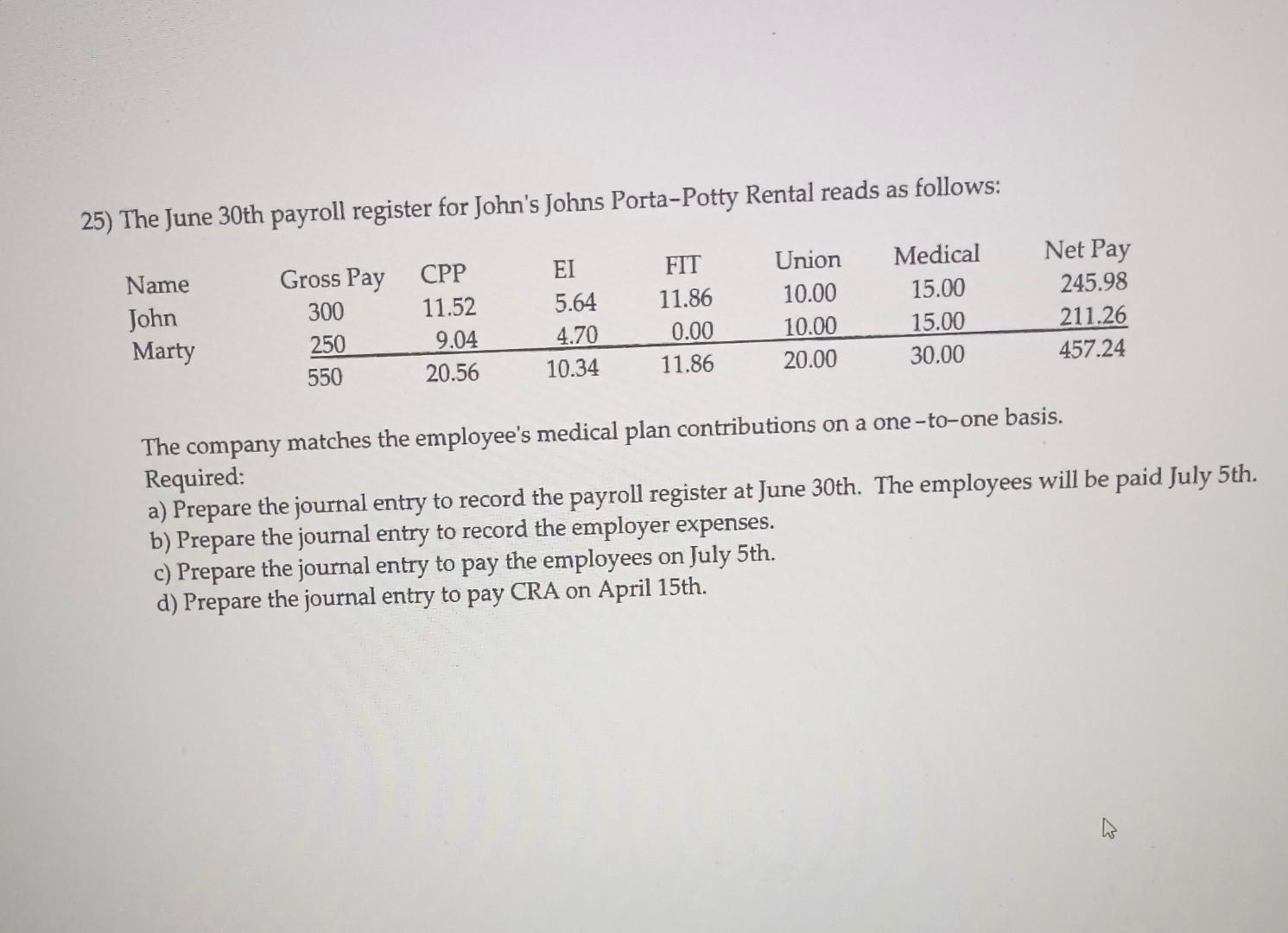

24) Using the following information, complete the Payroll Register for the week ending January 17, 2019. Assume a tax rate of 16%,CPP of 5.1% (exemption of 67.31 ), and EI of 1.62%. Payroll Register 25) The June 30th payroll register for John's Johns Porta-Potty Rental reads as follows: The company matches the employee's medical plan contributions on a one-to-one basis. Required: a) Prepare the journal entry to record the payroll register at June 30 th. The employees will be paid July 5 th. b) Prepare the journal entry to record the employer expenses. c) Prepare the journal entry to pay the employees on July 5 th. d) Prepare the journal entry to pay CRA on April 15 th

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts