Question: 24&25 QUESTION 24 Based on the following information, calculate the product cost. Direct materials = $125,000 Direct labor = $55,000 Manufacturing overhead = $22,000 Selling

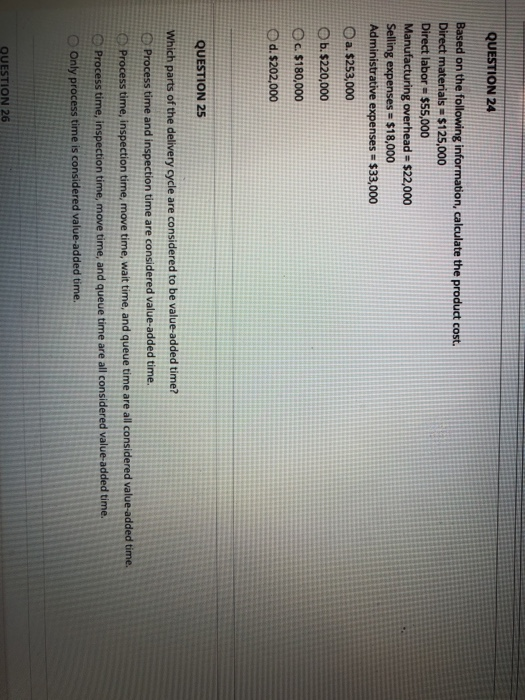

QUESTION 24 Based on the following information, calculate the product cost. Direct materials = $125,000 Direct labor = $55,000 Manufacturing overhead = $22,000 Selling expenses = $18,000 Administrative expenses = $33,000 a. $253,000 b. $220,000 Oc. $180,000 d. $202,000 QUESTION 25 Which parts of the delivery cycle are considered to be value-added time? Process time and inspection time are considered value-added time. Process time, inspection time, move time, wait time, and queue time are all considered value-added time. Process time, inspection time, move time, and queue time are all considered value-added time. Only process time is considered value-added time, QUESTION 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts