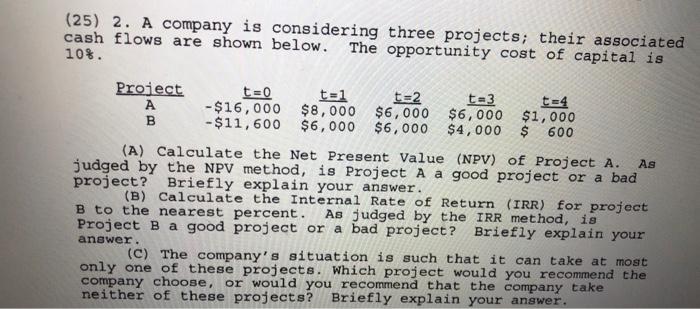

Question: (25) 2. A company is considering three projects; their associated cash flows are shown below. The opportunity cost of capital is 10%. Project t=0 t=1

(25) 2. A company is considering three projects; their associated cash flows are shown below. The opportunity cost of capital is 10%. Project t=0 t=1 t=2 t=3 t=4 A - $16,000 $8,000 $6,000 $6,000 $1,000 B -$11,600 $6,000 $6,000 $4,000 $ 600 (A) Calculate the Net Present Value (NPV) of Project A. As judged by the NPV method, is Project A a good project or a bad project? Briefly explain your answer. (B) Calculate the Internal Rate of Return (IRR) for project B to the nearest percent. As Judged by the IRR method, is Project B a good project or a bad project? Briefly explain your answer. (C) The company's situation is such that it can take at most only one of these projects. Which project would you recommend the company choose, or would you recommend that the company take neither of these projects? Briefly explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts