Question: 25. Sofia and Jose are both 30 and plan to invest $10,000 each year for the next 35 years for retirement. Sofia plans to invest

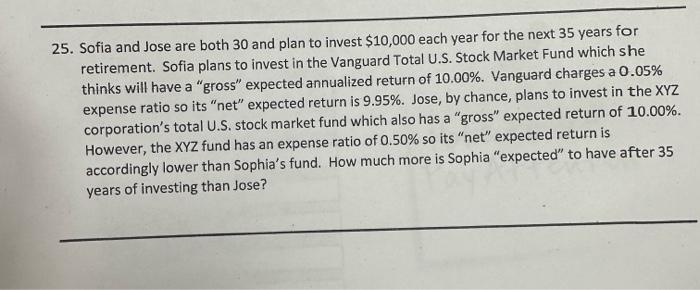

25. Sofia and Jose are both 30 and plan to invest $10,000 each year for the next 35 years for retirement. Sofia plans to invest in the Vanguard Total U.S. Stock Market Fund which she thinks will have a "gross" expected annualized return of 10.00%. Vanguard charges a 0.05% expense ratio so its "net" expected return is 9.95%. Jose, by chance, plans to invest in the XYZ corporation's total U.S. stock market fund which also has a "gross" expected return of 10.00%. However, the XYZ fund has an expense ratio of 0.50% so its "net" expected return is accordingly lower than Sophia's fund. How much more is Sophia "expected" to have after 35 years of investing than Jose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts