Question: QUESTION 30 Sofia and Jose are both 25 and plan to invest $5000 each year for the next 40 years for retirement. Sofia plans to

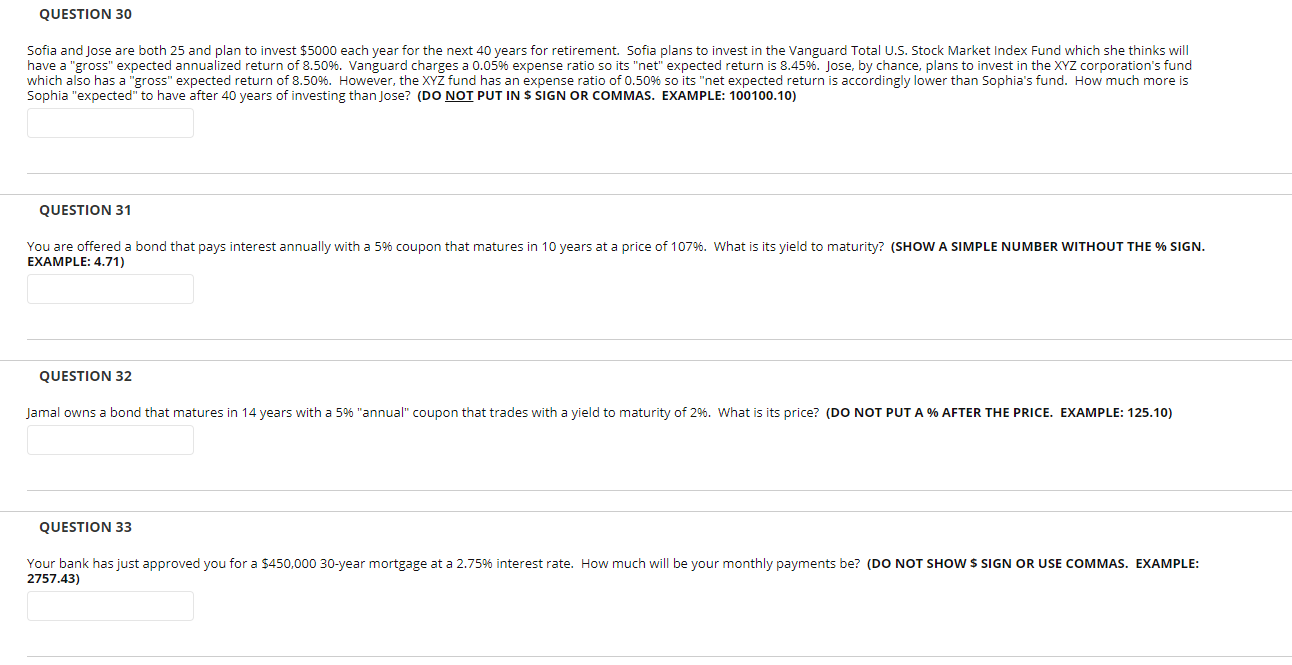

QUESTION 30 Sofia and Jose are both 25 and plan to invest $5000 each year for the next 40 years for retirement. Sofia plans to invest in the Vanguard Total U.S. Stock Market Index Fund which she thinks will have a "gross" expected annualized return of 8.50%. Vanguard charges a 0.059 expense ratio so its "net" expected return is 8.459. Jose, by chance, plans to invest in the XYZ corporation's fund which also has a "gross" expected return of 8.50%. However, the XYZ fund has an expense ratio of 0.50% so its "net expected return is accordingly lower than Sophia's fund. How much more is Sophia "expected" to have after 40 years of investing than Jose? (DO NOT PUT IN S SIGN OR COMMAS. EXAMPLE: 100100.10) QUESTION 31 You are offered a bond that pays interest annually with a 5% coupon that matures in 10 years at a price of 10796. What is its yield to maturity? (SHOW A SIMPLE NUMBER WITHOUT THE % SIGN. EXAMPLE: 4.71) QUESTION 32 Jamal owns a bond that matures in 14 years with a 5% "annual" coupon that trades with a yield to maturity of 296. What is its price? (DO NOT PUT A % AFTER THE PRICE. EXAMPLE: 125.10) QUESTION 33 Your bank has just approved you for a $450,000 30-year mortgage at a 2.7595 interest rate. How much will be your monthly payments be? (DO NOT SHOW $ SIGN OR USE COMMAS. EXAMPLE: 2757.43)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts