Question: 25. Two-part question: i) Based on the incremental ERR decision criterion (based on Excel's MIRR function), is the Alpha diner better than the Beta diner?

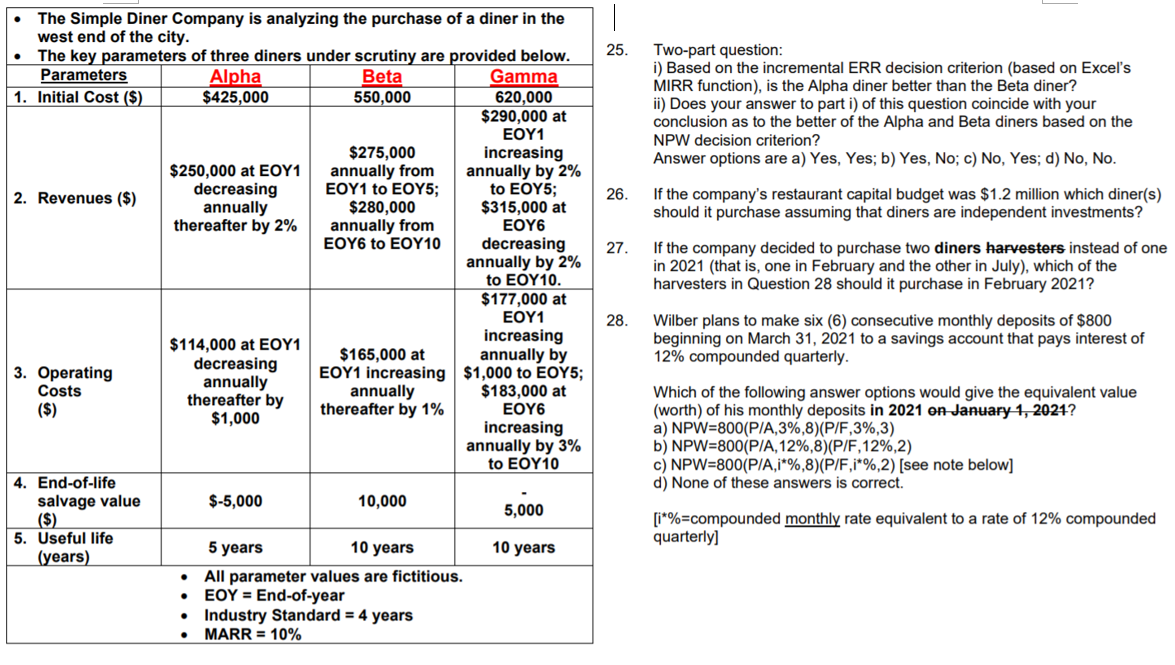

25. Two-part question: i) Based on the incremental ERR decision criterion (based on Excel's MIRR function), is the Alpha diner better than the Beta diner? ii) Does your answer to part i) of this question coincide with your conclusion as to the better of the Alpha and Beta diners based on the NPW decision criterion? Answer options are a) Yes, Yes; b) Yes, No; c) No, Yes; d) No, No. 26. If the company's restaurant capital budget was $1.2 million which diner(s) should it purchase assuming that diners are independent investments? 27. If the company decided to purchase two diners harvesters instead of one in 2021 (that is, one in February and the other in July), which of the harvesters in Question 28 should it purchase in February 2021? The Simple Diner Company is analyzing the purchase of a diner in the west end of the city. The key parameters of three diners under scrutiny are provided below. Parameters Alpha Beta Gamma 1. Initial Cost ($) $425,000 550,000 620,000 $290,000 at EOY1 $275,000 increasing $250,000 at EOY1 annually from annually by 2% 2. Revenues ($) decreasing EOY1 to EOY5; to EOY5; annually $280,000 $315,000 at thereafter by 2% annually from EOY6 EOY6 to EOY10 decreasing annually by 2% to EOY10. $177,000 at EOY1 $114,000 at EOY1 increasing $165,000 at annually by 3. Operating decreasing annually EOY1 increasing $1,000 to EOY5; Costs annually thereafter by $183,000 at ($) thereafter by 1% EOY6 $1,000 increasing annually by 3% to EOY10 4. End-of-life salvage value $-5,000 10,000 5,000 (S) 5. Useful life 10 years (years) All parameter values are fictitious. EOY = End-of-year Industry Standard = 4 years MARR = 10% 28. Wilber plans to make six (6) consecutive monthly deposits of $800 beginning on March 31, 2021 to a savings account that pays interest of 12% compounded quarterly. Which of the following answer options would give the equivalent value (worth) of his monthly deposits in 2021 on January 1, 2021? a) NPW=800(P/A,3%,8)(P/F,3%,3) b) NPW=800(P/A, 12%,8)(P/F, 12%,2) c) NPW=800(P/A,1*%,8)(P/F,i*%,2) (see note below] d) None of these answers is correct. [i*%=compounded monthly rate equivalent to a rate of 12% compounded quarterly] 5 years 10 years 25. Two-part question: i) Based on the incremental ERR decision criterion (based on Excel's MIRR function), is the Alpha diner better than the Beta diner? ii) Does your answer to part i) of this question coincide with your conclusion as to the better of the Alpha and Beta diners based on the NPW decision criterion? Answer options are a) Yes, Yes; b) Yes, No; c) No, Yes; d) No, No. 26. If the company's restaurant capital budget was $1.2 million which diner(s) should it purchase assuming that diners are independent investments? 27. If the company decided to purchase two diners harvesters instead of one in 2021 (that is, one in February and the other in July), which of the harvesters in Question 28 should it purchase in February 2021? The Simple Diner Company is analyzing the purchase of a diner in the west end of the city. The key parameters of three diners under scrutiny are provided below. Parameters Alpha Beta Gamma 1. Initial Cost ($) $425,000 550,000 620,000 $290,000 at EOY1 $275,000 increasing $250,000 at EOY1 annually from annually by 2% 2. Revenues ($) decreasing EOY1 to EOY5; to EOY5; annually $280,000 $315,000 at thereafter by 2% annually from EOY6 EOY6 to EOY10 decreasing annually by 2% to EOY10. $177,000 at EOY1 $114,000 at EOY1 increasing $165,000 at annually by 3. Operating decreasing annually EOY1 increasing $1,000 to EOY5; Costs annually thereafter by $183,000 at ($) thereafter by 1% EOY6 $1,000 increasing annually by 3% to EOY10 4. End-of-life salvage value $-5,000 10,000 5,000 (S) 5. Useful life 10 years (years) All parameter values are fictitious. EOY = End-of-year Industry Standard = 4 years MARR = 10% 28. Wilber plans to make six (6) consecutive monthly deposits of $800 beginning on March 31, 2021 to a savings account that pays interest of 12% compounded quarterly. Which of the following answer options would give the equivalent value (worth) of his monthly deposits in 2021 on January 1, 2021? a) NPW=800(P/A,3%,8)(P/F,3%,3) b) NPW=800(P/A, 12%,8)(P/F, 12%,2) c) NPW=800(P/A,1*%,8)(P/F,i*%,2) (see note below] d) None of these answers is correct. [i*%=compounded monthly rate equivalent to a rate of 12% compounded quarterly] 5 years 10 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts