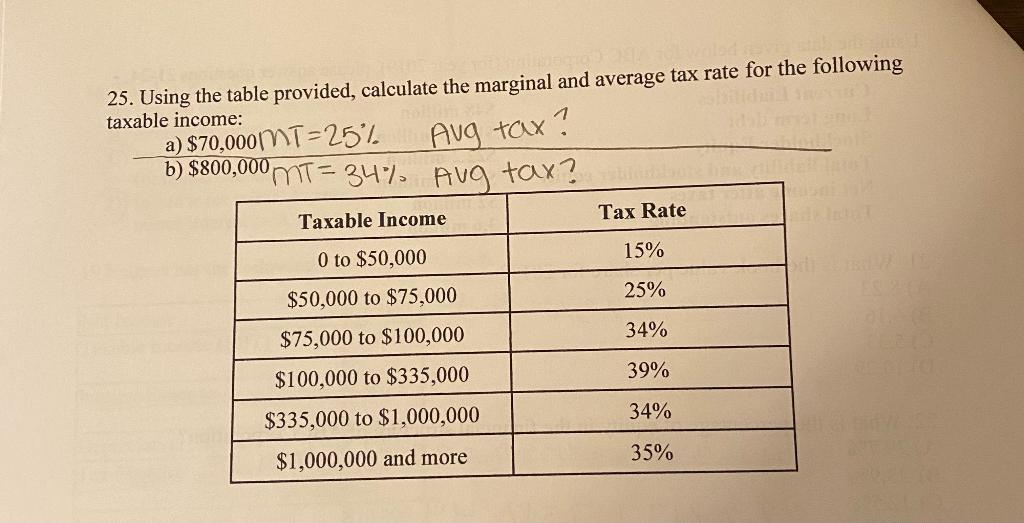

Question: 25. Using the table provided, calculate the marginal and average tax rate for the following taxable income: a) $70,000 MT-25% Aug tax? b) $800,000 MT=

25. Using the table provided, calculate the marginal and average tax rate for the following taxable income: a) $70,000 MT-25% Aug tax? b) $800,000 MT= 34% Aug tax? Tax Rate Taxable Income 15% 0 to $50,000 25% 34% $50,000 to $75,000 $75,000 to $100,000 $100,000 to $335,000 39% 34% $335,000 to $1,000,000 $1,000,000 and more 35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts