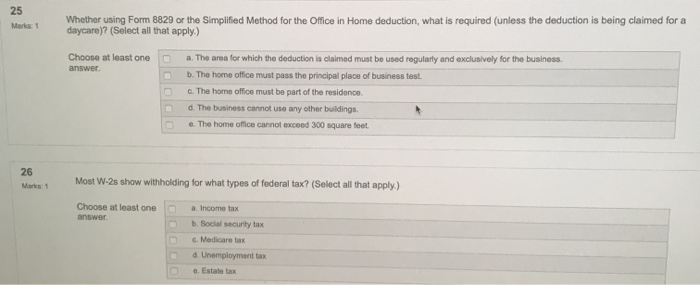

Question: 25 Whether using Form 8829 or the Simplified Method for the Office in Home deduction, what is required (unless the deduction is being claimed for

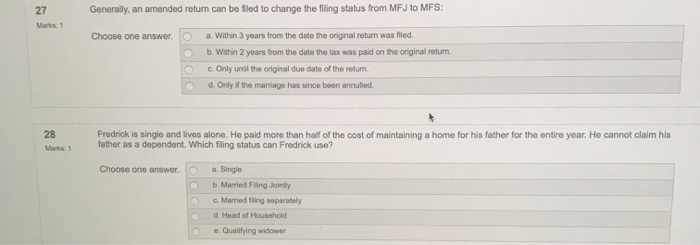

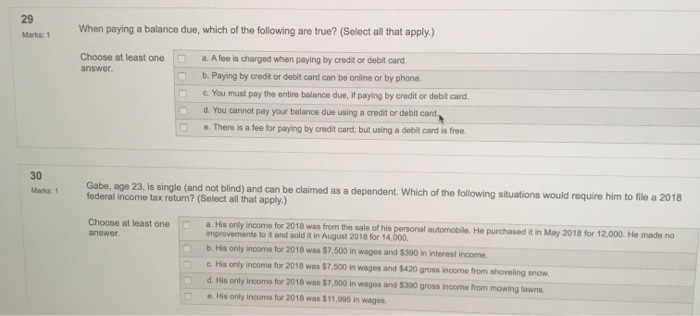

25 Whether using Form 8829 or the Simplified Method for the Office in Home deduction, what is required (unless the deduction is being claimed for a daycare)? (Select all that apply.) Choose at least one c answer a . The area for which the deduction is claimed must be used regularly and exclusively for the business. b. The home office must pass the principal place of business test C. The home office must be part of the residence d. The business cannot use any other buildings. e. The home office cannot exceed 300 square feet 26 Marks Most W-2s show withholding for what types of federal tax? (Select all that apply.) Choose at least one answer - Income tax b. Social security tax c. Medicare tax d. Unemployment tax . Estate tax Generally, an amended return can be filed to change the filing status from MFJ to MFS: Marks 1 Choose one answer. O a. Within 3 years from the date the original return was filed. b. Within 2 years from the date the tax was paid on the original return. c. Only until the original due date of the return d. Only if the marriage has since been annulled Fredrick is single and lives alone. He paid more than half of the cost of maintaining a home for his father for the entire year. He cannot claim his father as a dependent. Which filing status can Fredrick use? Choose one answer a Single b. Married Fang Joint C. Married fling separately d Head of Household Qualifying widower Marks: 1 When paying a balance due, which of the following are true? (Select all that apply.) Choose at least one answer a. A fee is charged when paying by credit or debit card b. Paying by credit or debit card can be online or by phone. c. You must pay the entire balance due, if paying by credit or debit card. d. You cannot pay your balance due using a credit or debit card e. There is a fee for paying by credit card: but using a debit card is free. 30 Manic Gabe, age 23, is single (and not blind) and can be claimed as a dependent. Which of the following situations would require him to file a 2018 federal income tax return? (Select all that apply.) Choose at least one answer a. His only income for 2018 was from the sale of his personal automobile. He purchased it in May 2018 for 12 000. He made no Improvements to it and sold it in August 2018 for 14.000 b. His only income for 2018 was $7.500 in wages and $390 in interest income c. His only income for 2018 was $7.500 in wages and $420 gross income from shoveling snow. d. His only income for 2018 was $7.500 in wages and $300 gross income from mowing towns His only income for 2018 was $11.995 in wages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts