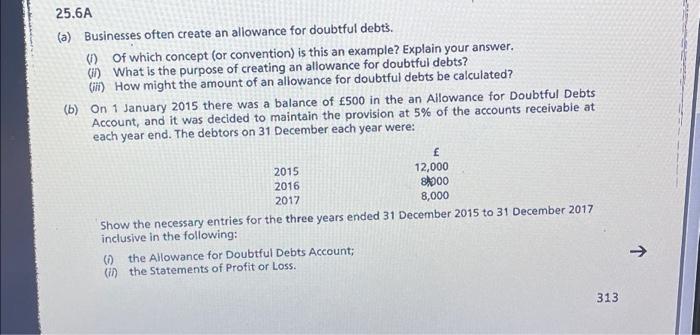

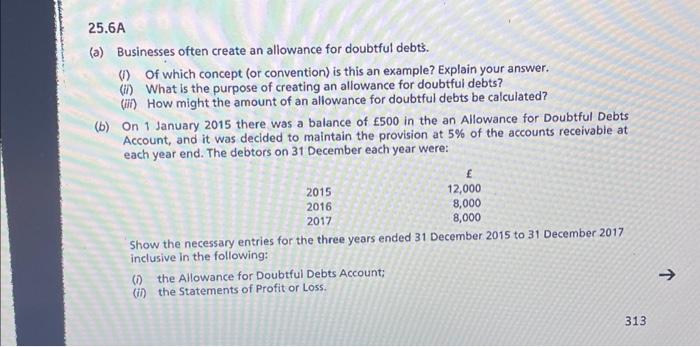

Question: 25.6A (a) Businesses often create an allowance for doubtful debts. (1) Of which concept (or convention) is this an example? Explain your answer. (ii) What

25.6A (a) Businesses often create an aliowance for doubtful debts. (i) Of which concept (or convention) is this an example? Explain your answer. (ii) What is the purpose of creating an allowance for doubtful debts? (iii) How might the amount of an allowance for doubtful debts be calculated? (b) On 1 January 2015 there was a balance of 500 in the an Allowance for Doubtful Debts Account, and it was decided to maintain the provision at 5% of the accounts receivable at each year end. The debtors on 31 December each year were: Show the necessary entries for the three years ended 31 December 2015 to 31 December 2017 inclusive in the following: (i) the Allowance for Doubtful Debts Account; (ii) the Statements of Profit or Loss. 25.6A (a) Businesses often create an allowance for doubtful debts. (i) Of which concept (or convention) is this an example? Explain your answer. (ii) What is the purpose of creating an allowance for doubtful debts? (iii) How might the amount of an allowance for doubtful debts be calculated? (b) On 1 January 2015 there was a balance of 500 in the an Allowance for Doubtful Debts Account, and it was decided to maintain the provision at 5% of the accounts receivable at each year end. The debtors on 31 December each year were: Show the necessary entries for the three years ended 31 December 2015 to 31 December 2017 inclusive in the following: (i) the Allowance for Doubtful Debts Account; (ii) the Statements of Profit or Loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts