Question: 26. Suppose that systematic risks are identified by two factors F and F2. The risk-free rate is 3%, and the risk premiums for a unit

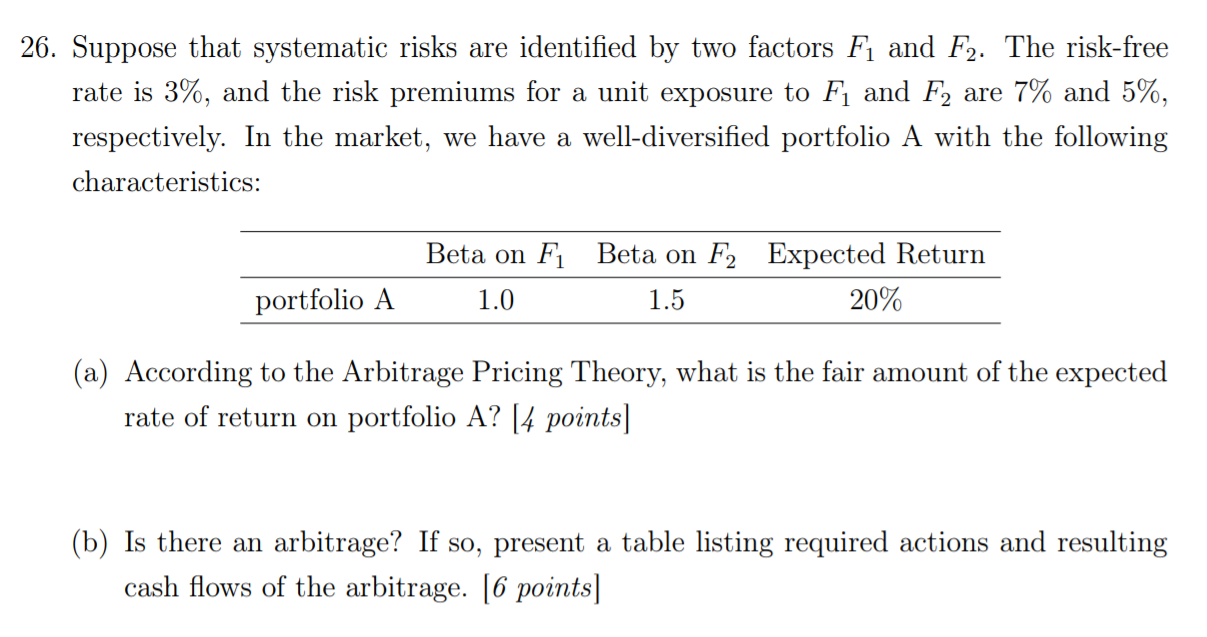

26. Suppose that systematic risks are identified by two factors F and F2. The risk-free rate is 3%, and the risk premiums for a unit exposure to Fi and F, are 7% and 5%, respectively. In the market, we have a well-diversified portfolio A with the following characteristics: Beta on F1 Beta on F2 Expected Return 1.5 20% portfolio A 1.0 (a) According to the Arbitrage Pricing Theory, what is the fair amount of the expected rate of return on portfolio A? (4 points] (b) Is there an arbitrage? If so, present a table listing required actions and resulting cash flows of the arbitrage. [6 points] 26. Suppose that systematic risks are identified by two factors F and F2. The risk-free rate is 3%, and the risk premiums for a unit exposure to Fi and F, are 7% and 5%, respectively. In the market, we have a well-diversified portfolio A with the following characteristics: Beta on F1 Beta on F2 Expected Return 1.5 20% portfolio A 1.0 (a) According to the Arbitrage Pricing Theory, what is the fair amount of the expected rate of return on portfolio A? (4 points] (b) Is there an arbitrage? If so, present a table listing required actions and resulting cash flows of the arbitrage. [6 points]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts