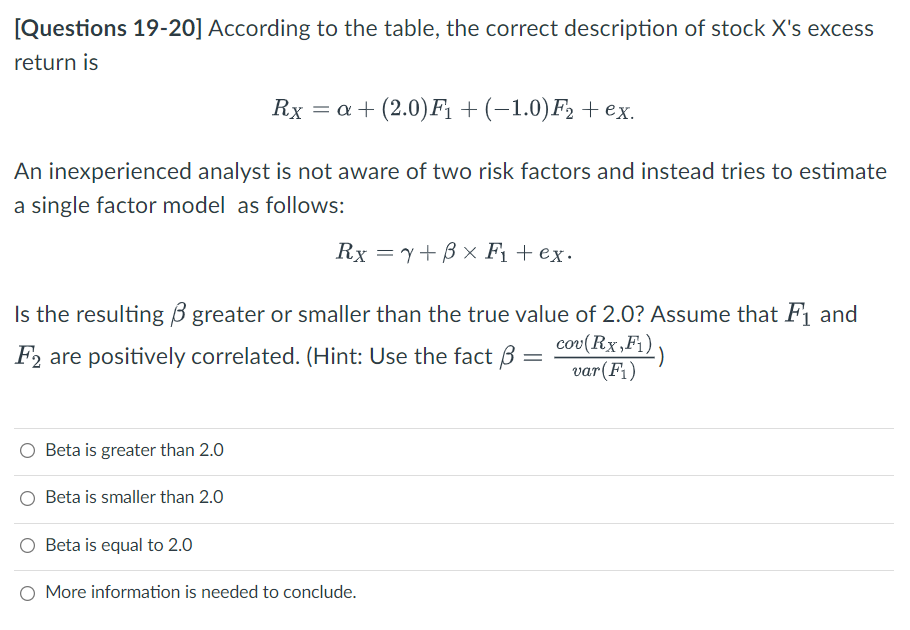

Question: [Questions 19-20] Suppose that systematic risks are identified by two factors F and F2. The risk-free rate is 2%. Two stocks X and Y have

![[Questions 19-20] Suppose that systematic risks are identified by two factors](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ffe9269451c_39866ffe9261bb73.jpg)

[Questions 19-20] Suppose that systematic risks are identified by two factors F and F2. The risk-free rate is 2%. Two stocks X and Y have the following characteristics: Stock Beta on F1 Beta on F2 Expected Return X 2.0 - 1.0 10% Y 0.0 1.5 8% Suppose that the given expected returns on X and Y are fairly determined by the Arbitrage Pricing Theory. What is the risk premium of Fi? O 2.0% O 4.0% O 6.0% O 7.7% [Questions 19-20] According to the table, the correct description of stock X's excess return is Rx = a + (2.0)Fi +(-1.0)F2 +ex. An inexperienced analyst is not aware of two risk factors and instead tries to estimate a single factor model as follows: Rx = y + B x Fi +ex. = Is the resulting B greater or smaller than the true value of 2.0? Assume that Fi and COU(Rx,F) F2 are positively correlated. (Hint: Use the fact . var(F1) , Beta is greater than 2.0 Beta is smaller than 2.0 Beta is equal to 2.0 O More information is needed to conclude

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts