Question: 27 31 32 Please try to answer within 30 minutes not 3 days later. Then risk free rate is 8% and the expected return on

27

31

32

Please try to answer within 30 minutes not 3 days later.

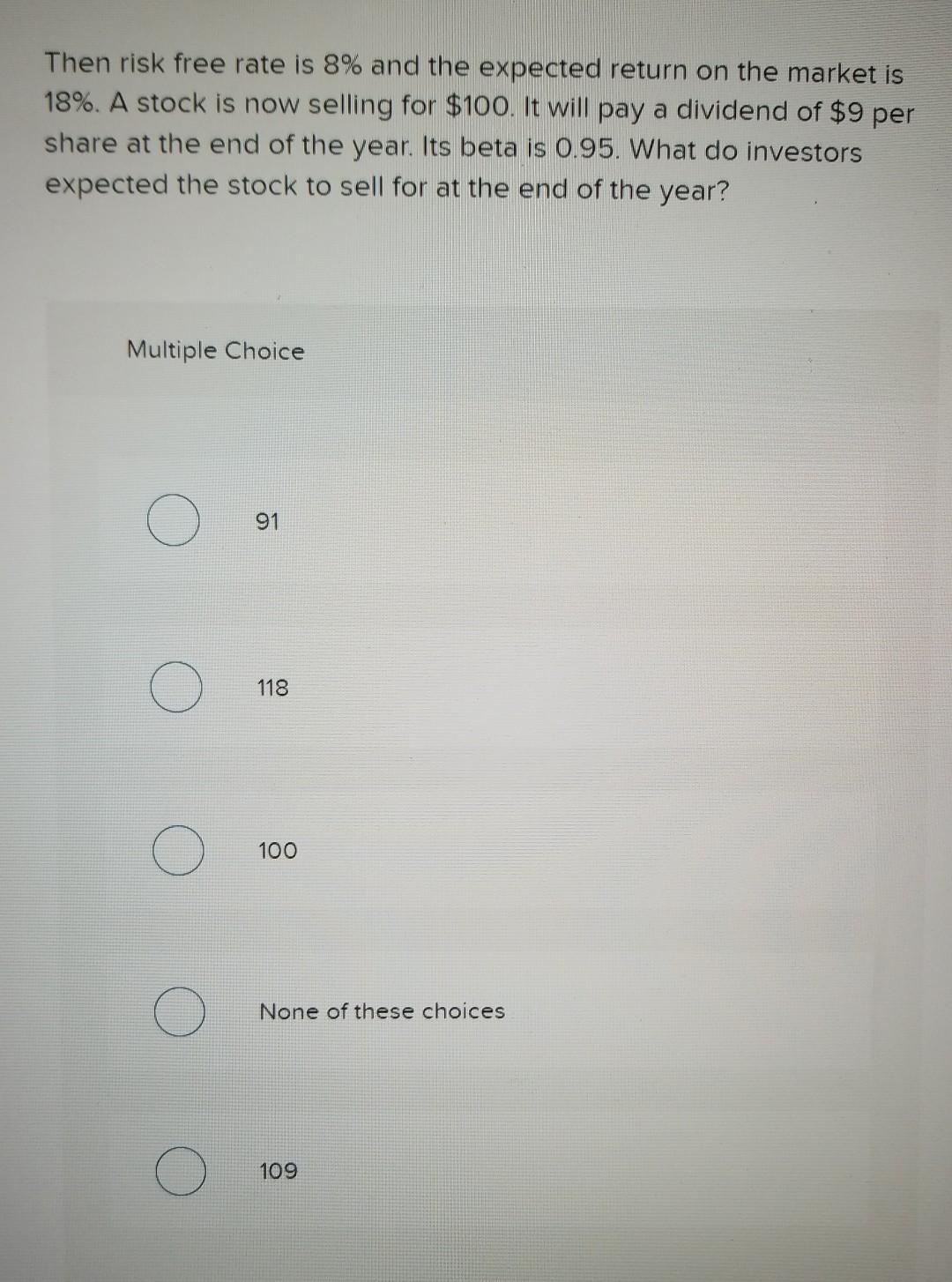

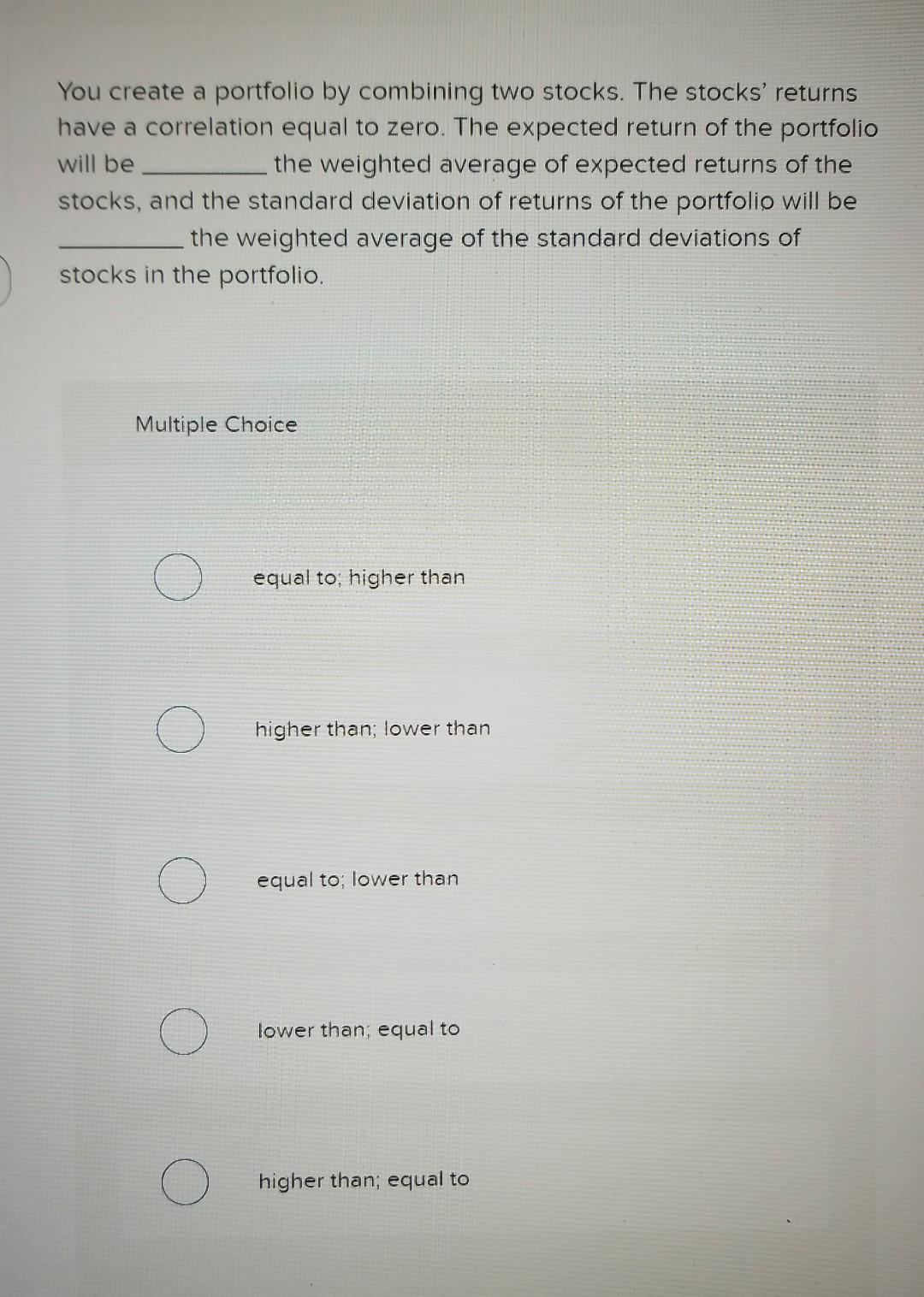

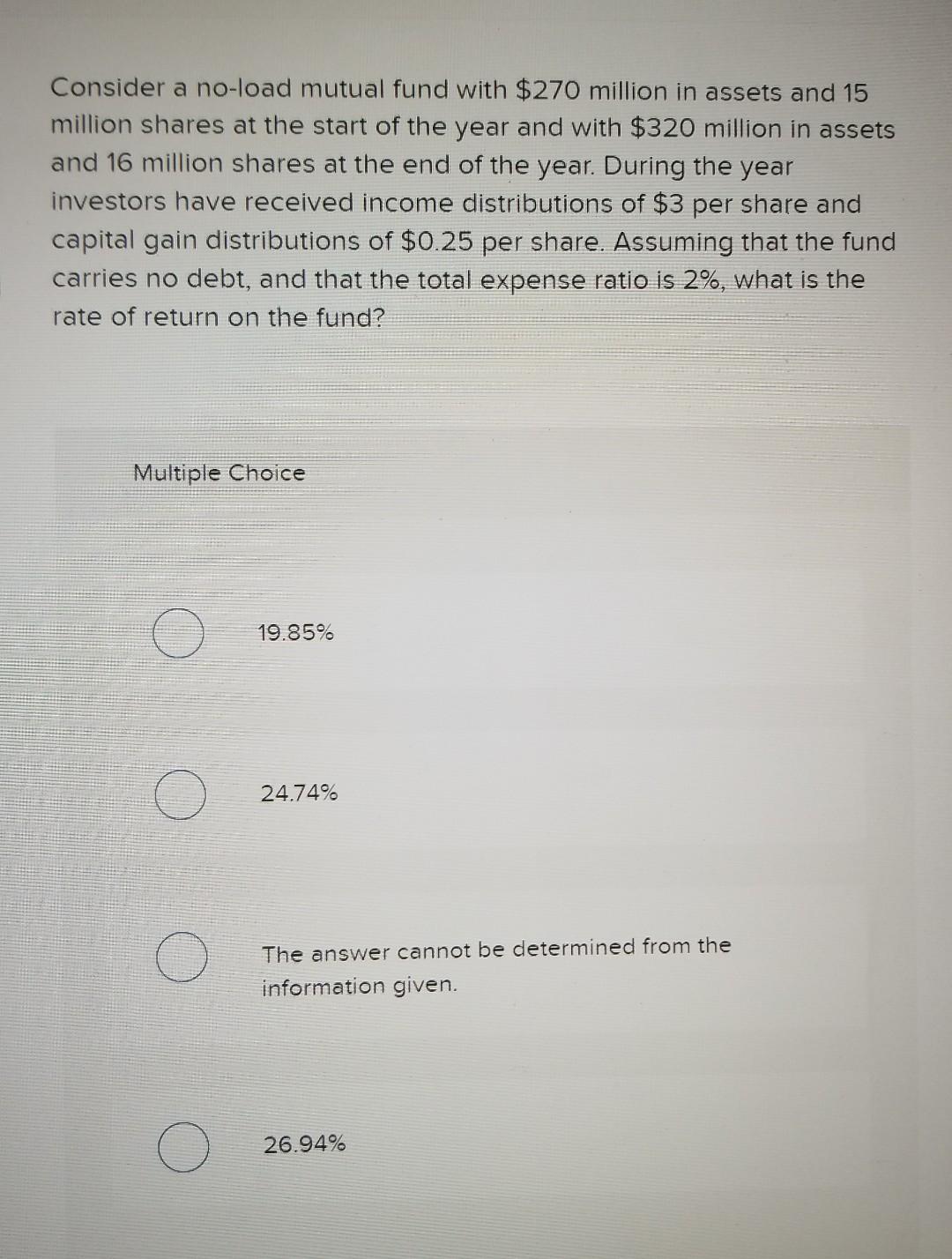

Then risk free rate is 8% and the expected return on the market is 18%. A stock is now selling for $100. It will pay a dividend of $9 per share at the end of the year. Its beta is 0.95. What do investors expected the stock to sell for at the end of the year? Multiple Choice 91 118 100 None of these choices 109 You create a portfolio by combining two stocks. The stocks' returns have a correlation equal to zero. The expected return of the portfolio will be the weighted average of expected returns of the stocks, and the standard deviation of returns of the portfolio will be the weighted average of the standard deviations of stocks in the portfolio. Multiple Choice equal to; higher than higher than; lower than O equal to; lower than O lower than; equal to higher than; equal to Consider a no-load mutual fund with $270 million in assets and 15 million shares at the start of the year and with $320 million in assets and 16 million shares at the end of the year. During the year investors have received income distributions of $3 per share and capital gain distributions of $0.25 per share. Assuming that the fund carries no debt, and that the total expense ratio is 2%, what is the rate of return on the fund? Multiple Choice ( ) 19.85% 24.74% The answer cannot be determined from the information given. 26.94%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts