Question: 32 31 11 Please try to answer within 30 minutes not 3 days later. eate a portfolio by combining two stocks. The stocks a correlation

32

31

11

Please try to answer within 30 minutes not 3 days later.

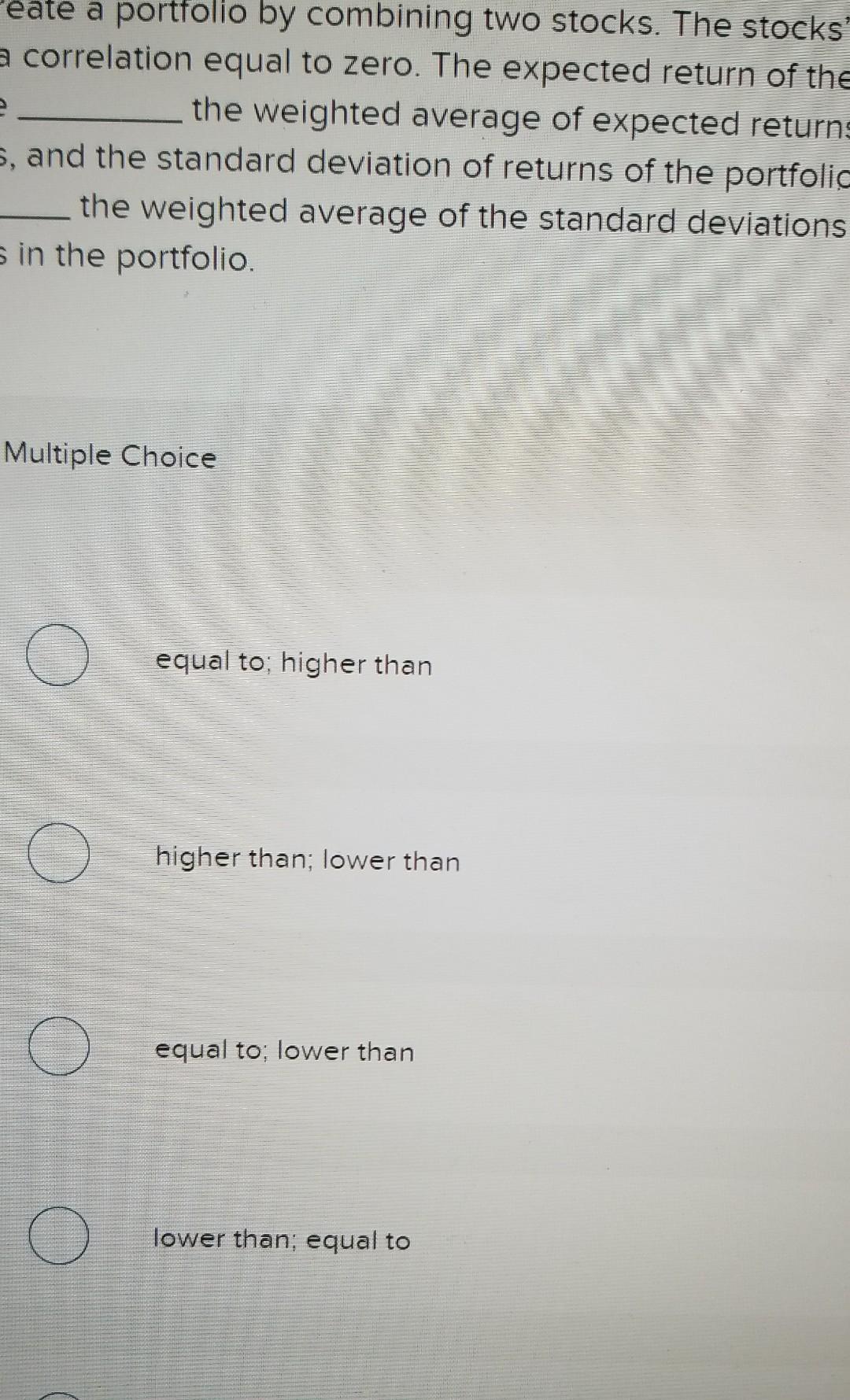

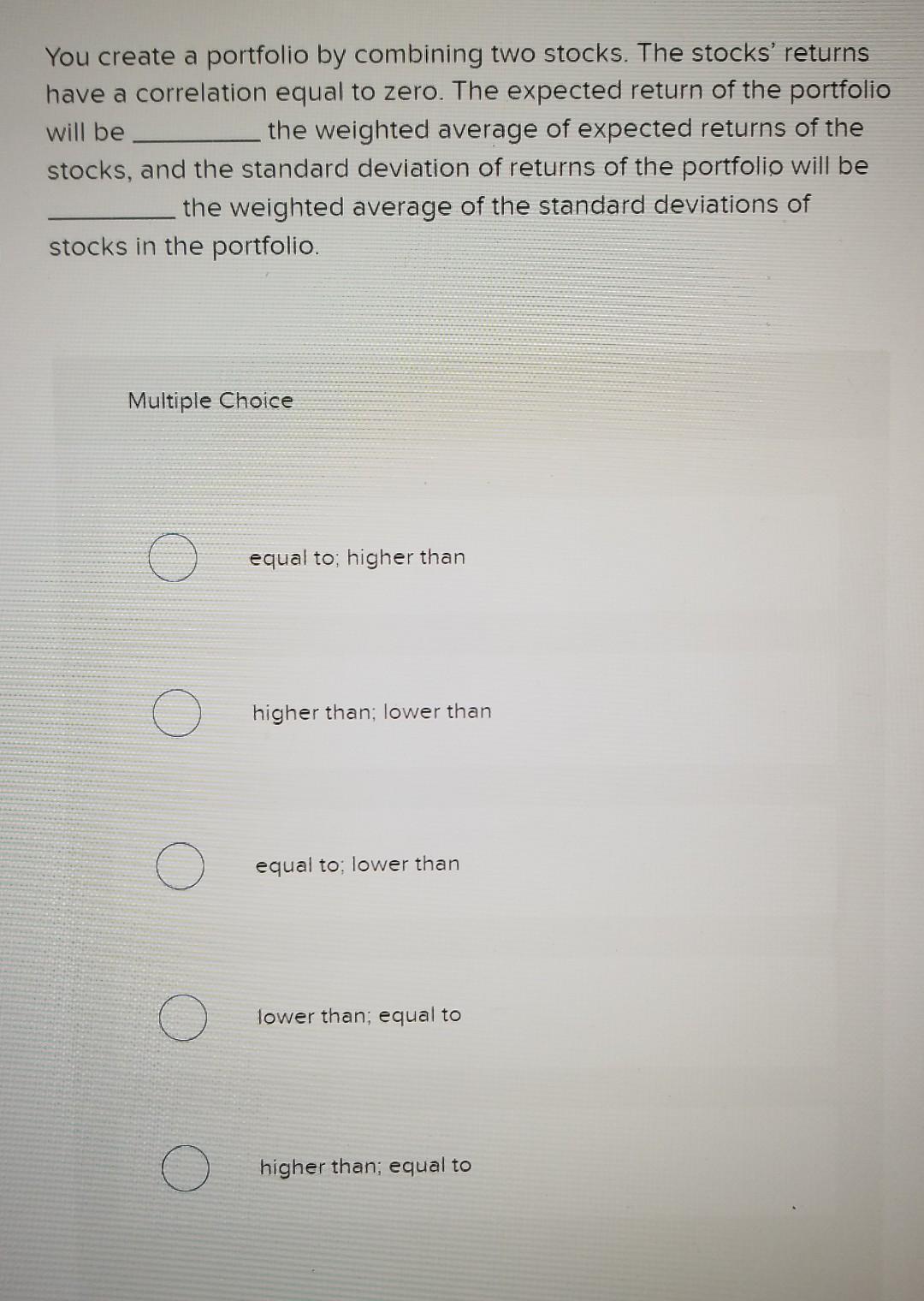

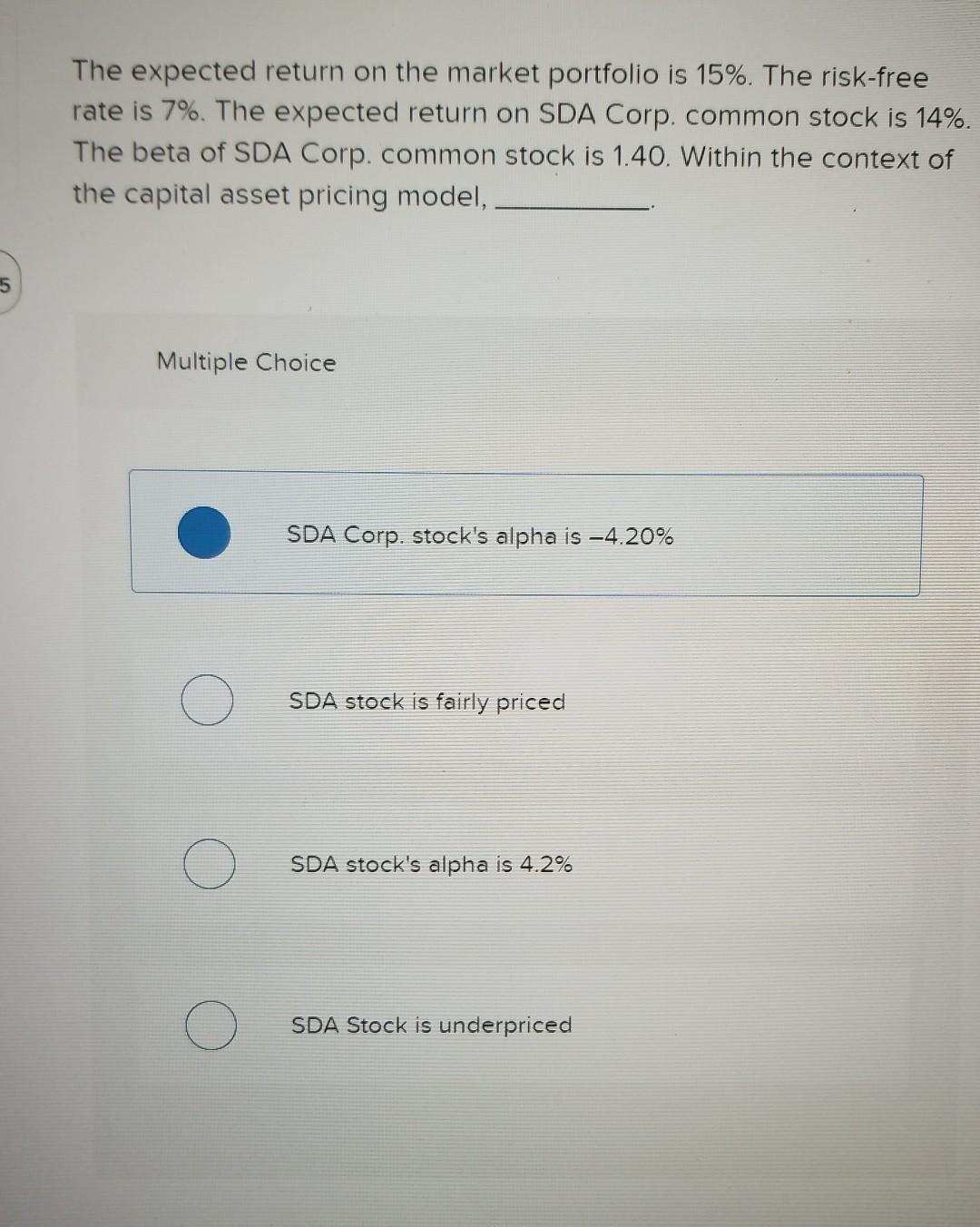

eate a portfolio by combining two stocks. The stocks a correlation equal to zero. The expected return of the the weighted average of expected returns s, and the standard deviation of returns of the portfolic the weighted average of the standard deviations s in the portfolio. Multiple Choice O equal to; higher than ( ) higher than; lower than ( ) equal to; lower than () lower than; equal to You create a portfolio by combining two stocks. The stocks' returns have a correlation equal to zero. The expected return of the portfolio will be the weighted average of expected returns of the stocks, and the standard deviation of returns of the portfolio will be the weighted average of the standard deviations of stocks in the portfolio. Multiple Choice equal to; higher than ( ) higher than; lower than equal to; lower than lower than; equal to higher than; equal to The expected return on the market portfolio is 15%. The risk-free rate is 7%. The expected return on SDA Corp. common stock is 14%. The beta of SDA Corp. common stock is 1.40. Within the context of the capital asset pricing model, 5 Multiple Choice SDA Corp. stock's alpha is -4.20% SDA stock is fairly priced SDA stock's alpha is 4.2% SDA Stock is underpriced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts