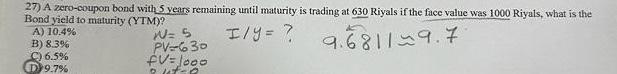

Question: 27) A zero-coupon bond with 5 years remaining until maturity is trading at 630 Riyals if the face value was 1000 Riyals, what is

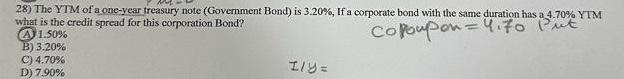

27) A zero-coupon bond with 5 years remaining until maturity is trading at 630 Riyals if the face value was 1000 Riyals, what is the Bond yield to maturity (YTM)? I/y = ? 9.681139.7 A) 10.4% B) 8.3% C) 6.5% D 9.7% N= 5 PV=630 FV = 1000 out-e 28) The YTM of a one-year treasury note (Government Bond) is 3.20%, If a corporate bond with the same duration has a 4.70% YTM what is the credit spread for this corporation Bond? A 1.50% Copoupon = 4.7o Put B) 3.20% C) 4.70% D) 7.90% I/Y=

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

The images youve provided contain two questions related to bond yields Lets solve each one step by s... View full answer

Get step-by-step solutions from verified subject matter experts