Question: need help with all 3 please! Activity 9 Bond Valuation and YTM The purpose of this assignment is to practice bond valuation and YTM estimation

need help with all 3 please!

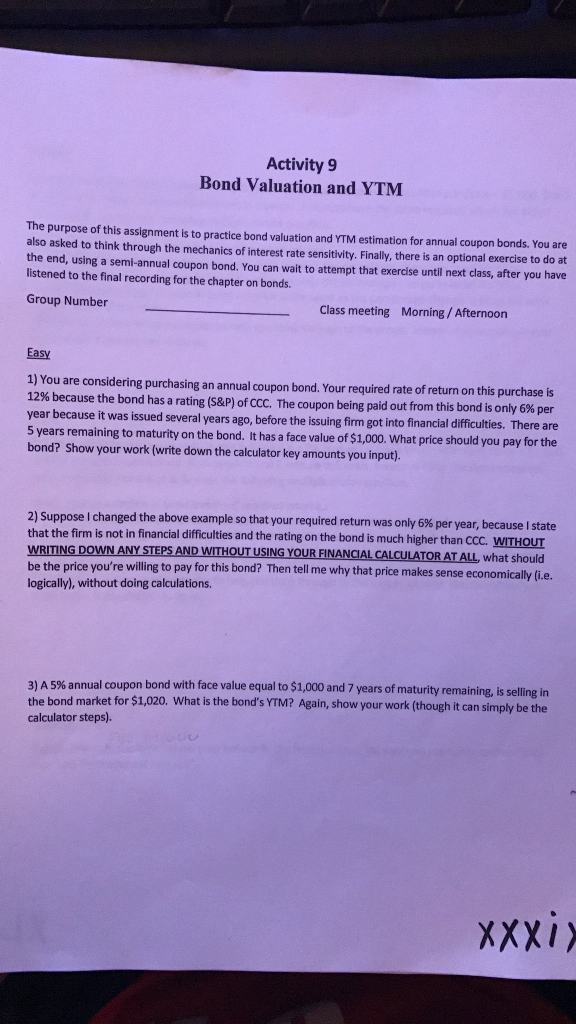

Activity 9 Bond Valuation and YTM The purpose of this assignment is to practice bond valuation and YTM estimation for annual coupon bonds. You are also asked to think through the mechanics of interest rate sensitivity. Finally, there is an optional exercise to do at the end, using a semi-annual coupon bond. You can wait to attempt that exercise until next class, after you have listened to the final recording for the chapter on bonds Group Number Class meeting Morning /Afternoon Easy idering purchasing an annual coupon bond. Your required rate of return on this purchase is id out from this bond is only 6% per d several years ago, before the issuing firm got into financial difficulties. There are 12% because the bond has a rating (S&P) of CCC. The coupon being pa year because it was issue 5 years remaining to maturity on the bond. It has a face value of $1,000. What price should you pay for the bond? Show your work (write down the calculator key amounts you input). I changed the above example so that your required return was only 6% per year, because I state 2) Suppose that the firm is not in financial difficulties and the rating on the bond is much higher than CCC. WRITING DOWN ANY STEPS AND WITHOUT USING YOUR FINANCIAL CALCULATOR AT ALL what should be the price you're willing to pay for this bond? Then tell me why that price makes sense economically logically), without doing calculations. WITHOUT (i.e. bond with face value equal to $1,000 and 7 years of maturity remaining, is selling in 3) A 5% annual coupon the bond market for $1,020. What is the bond's YTM? Again, show your work (though it can simply be the calculator steps) XXXI)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts