Question: 27. Consider a bond with 10 year to maturity, 10% coupon rate, and 15% yield to maturity. Suppose its modified duration is 8.5 years,

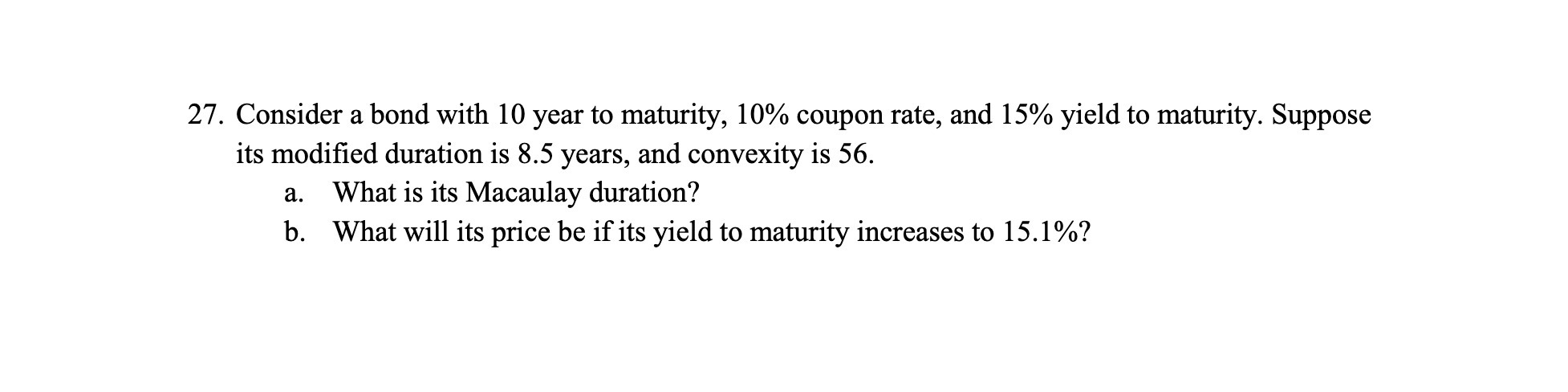

27. Consider a bond with 10 year to maturity, 10% coupon rate, and 15% yield to maturity. Suppose its modified duration is 8.5 years, and convexity is 56. a. What is its Macaulay duration? b. What will its price be if its yield to maturity increases to 15.1%?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

a Macaulay duration is calculated as the weighted average time until the bonds cash flows are received where the weights are the present values of the ... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock