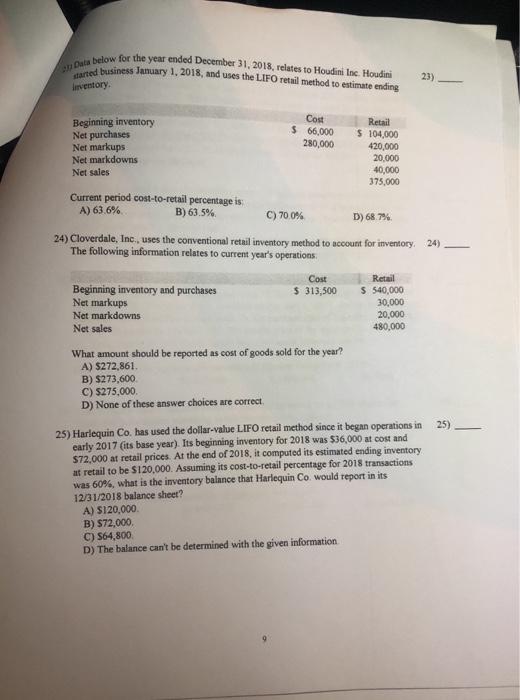

Question: 27 Data below for the year ended December 31, 2018, relates to Houdini Inc. Houdini started business January 1, 2018, and uses the LIFO

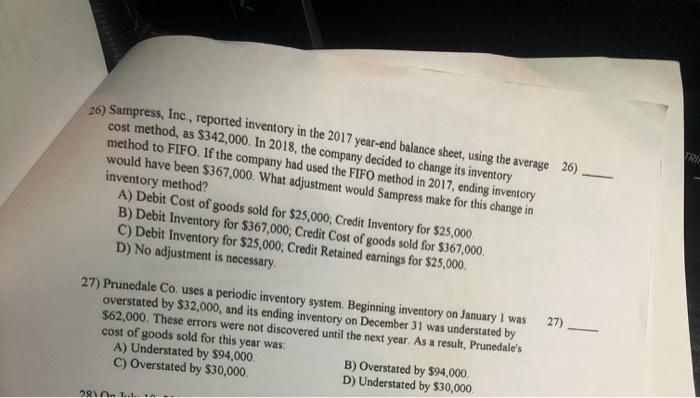

27 Data below for the year ended December 31, 2018, relates to Houdini Inc. Houdini started business January 1, 2018, and uses the LIFO retail method to estimate ending inventory. Beginning inventory Net purchases Net markups Net markdowns Net sales Current period cost-to-retail percentage is: A) 63.6% B) 63.5% Cost $ 66,000 280,000 Beginning inventory and purchases Net markups Net markdowns Net sales C) 70.0% D) 68.7% 24) Cloverdale, Inc., uses the conventional retail inventory method to account for inventory. 24) The following information relates to current year's operations. Cost $ 313,500 What amount should be reported as cost of goods sold for the year? A) $272,861. B) $273,600 C) $275,000. D) None of these answer choices are correct. Retail $ 104,000 420,000 20,000 40,000 375,000 A) $120,000 B) $72,000. C) $64,800. D) The balance can't be determined with the given information 23) Retail $ 540,000 30,000 20,000 480,000 25) 25) Harlequin Co. has used the dollar-value LIFO retail method since it began operations in early 2017 (its base year). Its beginning inventory for 2018 was $36,000 at cost and $72,000 at retail prices. At the end of 2018, it computed its estimated ending inventory at retail to be $120,000. Assuming its cost-to-retail percentage for 2018 transactions was 60%, what is the inventory balance that Harlequin Co. would report in its 12/31/2018 balance sheet? 26) Sampress, Inc., reported inventory in the 2017 year-end balance sheet, using the average 26) cost method, as $342,000. In 2018, the company decided to change its inventory method to FIFO. If the company had used the FIFO method in 2017, ending inventory would have been $367,000. What adjustment would Sampress make for this change in inventory method? A) Debit Cost of goods sold for $25,000, Credit Inventory for $25,000 B) Debit Inventory for $367,000; Credit Cost of goods sold for $367,000. C) Debit Inventory for $25,000, Credit Retained earnings for $25,000. D) No adjustment is necessary. 27) Prunedale Co. uses a periodic inventory system. Beginning inventory on January 1 was overstated by $32,000, and its ending inventory on December 31 was understated by $62,000. These errors were not discovered until the next year. As a result, Prunedale's cost of goods sold for this year was: A) Understated by $94,000. C) Overstated by $30,000. 281 I... B) Overstated by $94,000. D) Understated by $30,000 27)- - TRI

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Q25 Q26 A Debit Inventory for 25000 367000342000 Credit Retained earning... View full answer

Get step-by-step solutions from verified subject matter experts