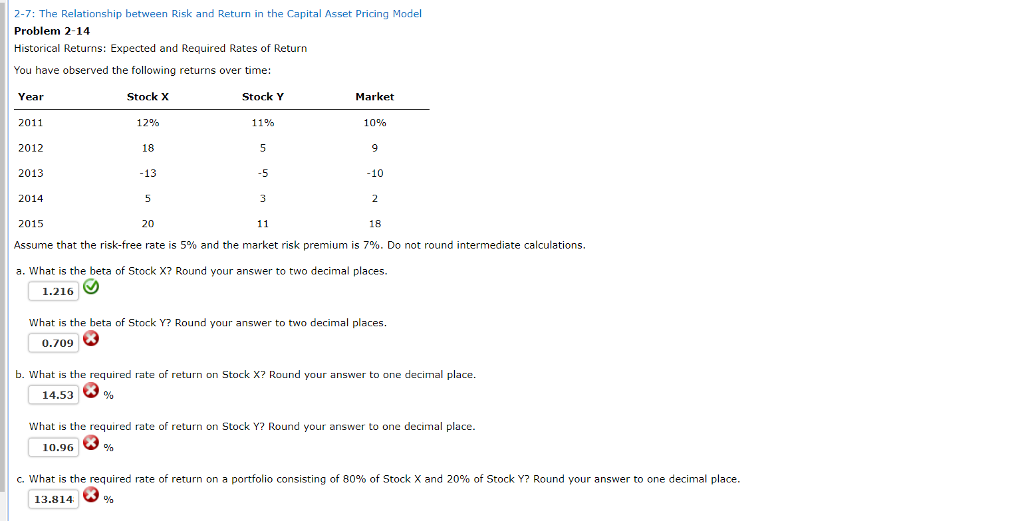

Question: 2-7: The Relationship between Risk and Return in the Capital Asset Pricing Model Problem 2-14 Historical Returns: Expected and Required Rates of Return You have

2-7: The Relationship between Risk and Return in the Capital Asset Pricing Model Problem 2-14 Historical Returns: Expected and Required Rates of Return You have observed the following returns over time: Market Stock X 1 296 18 13 Year Stock Y 2011 2012 2013 2014 2015 Assume that the risk-free rate is 5% and the market risk premium is 7%. Do not round intermediate calculations. a. What is the beta of Stock X? Round your answer to two decimal places 11% 10% 10 20 18 1.216 What is the beta of Stock Y? Round your answer to two decimal places. 0.709 b. What is the required rate of return on Stock X? Round your answer to one decimal place. 14.53 What is the required rate of return on Stock Y? Round your answer to one decimal place. 10.96 C. what is the required rate of return on a portfolio consisting of 80% of Stock X and 20% of Stock Y? Round your answer to one decimal place. 13.814

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts