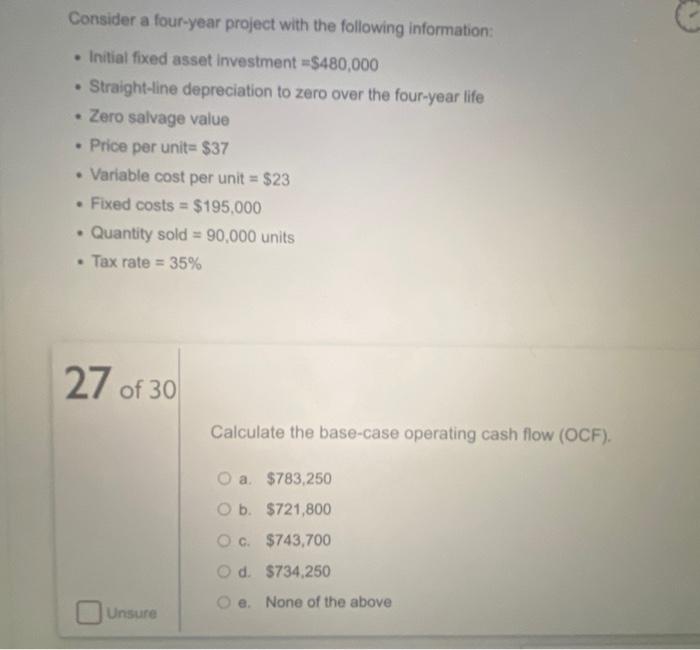

Question: 27-28 Consider a four-year project with the following information: Initial fixed asset investment $480,000 Straight-line depreciation to zero over the four-year life Zero salvage value

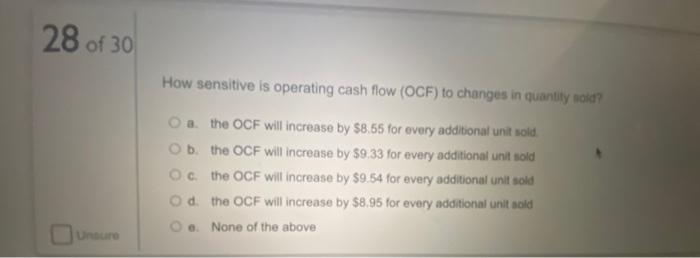

Consider a four-year project with the following information: Initial fixed asset investment $480,000 Straight-line depreciation to zero over the four-year life Zero salvage value Price per unit-$37 Variable cost per unit = $23 Fixed costs = $195.000 Quantity sold = 90,000 units Tax rate = 35% . 27 of 30 Calculate the base-case operating cash flow (OCF). O a $783,250 Ob. $721,800 Oc$743,700 d. $734,250 e. None of the above Unsure 28 of 30 How sensitive is operating cash flow (OCF) to changes in quantity old? O a the OCF will increase by $8.55 for every additional unit sold Ob the OCF will increase by $9.33 for every additional unit sold Oc. the OCF will increase by $9.54 for every additional unit sold Od the OCF will increase by $8.95 for every additional unit sold Oo. None of the above unouro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts