Question: 28- Barnard Corp. is considering a new project. The project will require $400,000 for new fixed assets, S100,000 for additional networking capital. The project has

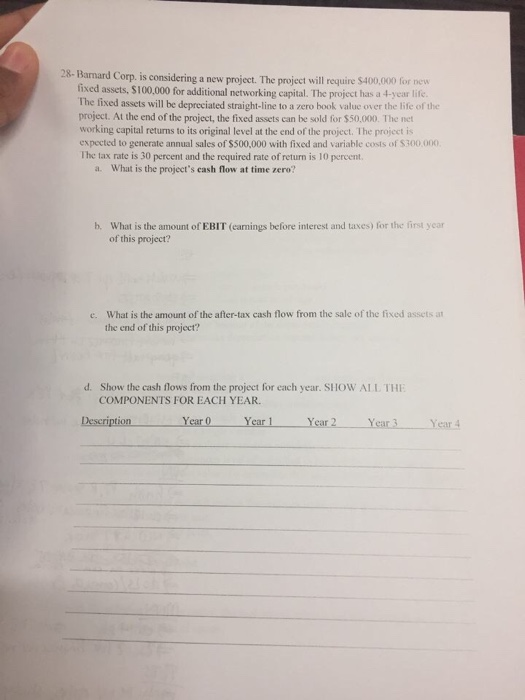

28- Barnard Corp. is considering a new project. The project will require $400,000 for new fixed assets, S100,000 for additional networking capital. The project has a 4-year life. The fixed assets will be depreciated straight-line to a zero book value over the life of the project. At the end of the project, the fixed assets can be sold for $50.000. The net working capital returns to its original level at the end of the project. The project is expected to generate annual sales of $500,000 with fixed and variable costs of S300,000 The tax rate is 30 percent and the required rate of return is 10 percent. What is the project's cash flow at time zero? a. What is the amount of EBIT (earnings before interest and taxes) for the first year of this project? b. What is the amount of the after-tax cash flow from the sale of the fixed assets at the end of this project? c. d. Show the cash flows from the project for each year. SHOW ALL THE COMPONENTS FOR EACH YEAR. Description Year 0 Year1 Year 2 Year3 Year 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts