Question: 28. The primary source of revenue for a wholesaler is A) investment income. B) service revenue. C) the sale of merchandise. D) the sale

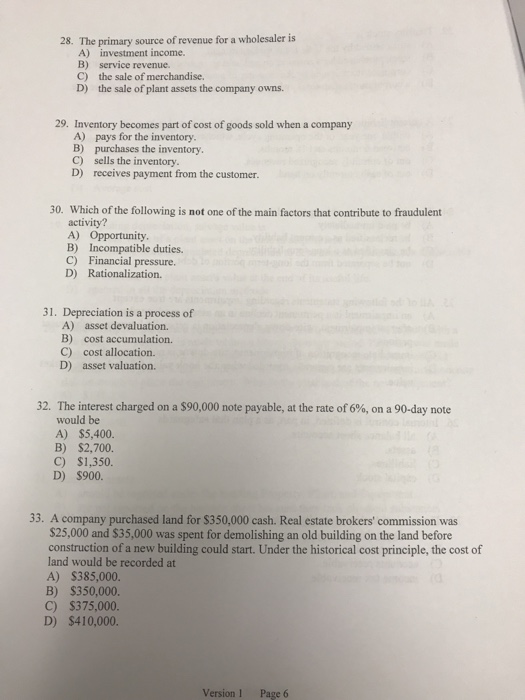

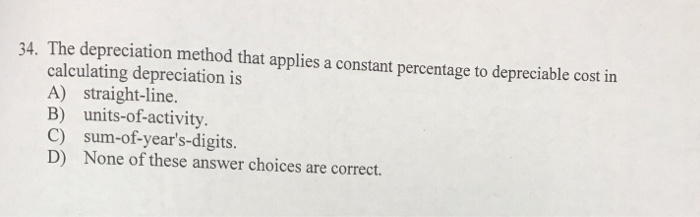

28. The primary source of revenue for a wholesaler is A) investment income. B) service revenue. C) the sale of merchandise. D) the sale of plant assets the company owns. 29. Inventory becomes part of cost of goods sold when a company A) pays for the inventory. B) purchases the inventory. C) sells the inventory. D) receives payment from the customer. 30. Which of the following is not one of the main factors that contribute to fraudulent activity? A) Opportunity. B) Incompatible duties. C) Financial pressure. D) Rationalization. 31. Depreciation is a process of A) asset devaluation. B) cost accumulation. C) cost allocation. D) asset valuation. 32. The interest charged on a $90,000 note payable, at the rate of 6%, on a 90-day note would be A) $5,400. B) $2,700. C) $1,350. D) $900. 33. A company purchased land for $350,000 cash. Real estate brokers' commission was $25,000 and $35,000 was spent for demolishing an old building on the land before construction of a new building could start. Under the historical cost principle, the cost of land would be recorded at A) $385,000. B) $350,000. C) $375,000. D) $410,000. Version 1 Page 6 34. The depreciation method that applies a constant percentage to depreciable cost in calculating depreciation is A) straight-line. B) units-of-activity. C) sum-of-year's-digits. D) None of these answer choices are correct.

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Question 28 The correct option ... View full answer

Get step-by-step solutions from verified subject matter experts