Question: 28 Which statement is most correct regarding capital structure? (2 Points) According to the Trade-Off Model, without its downsides, high financial leverage always reduces total

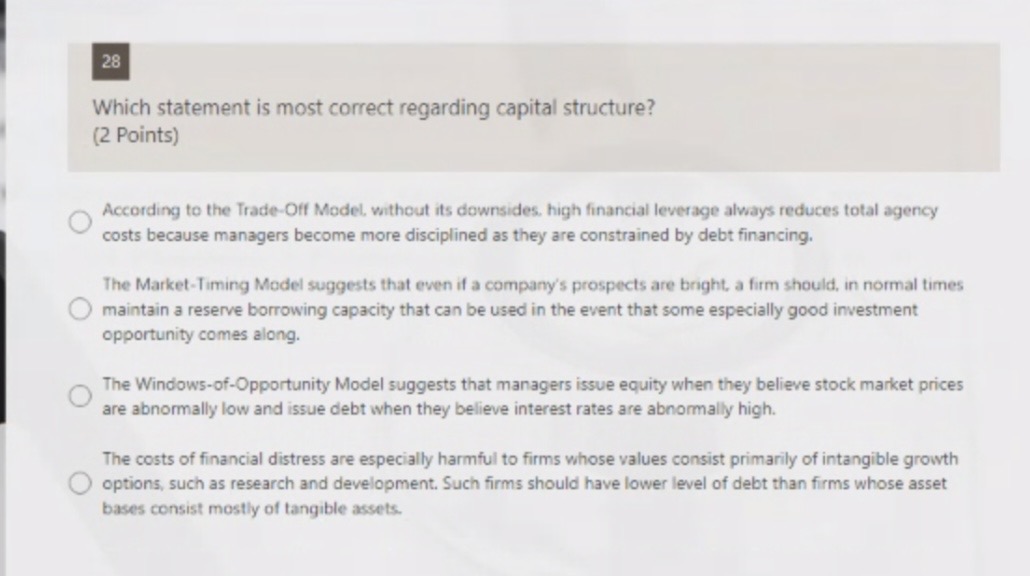

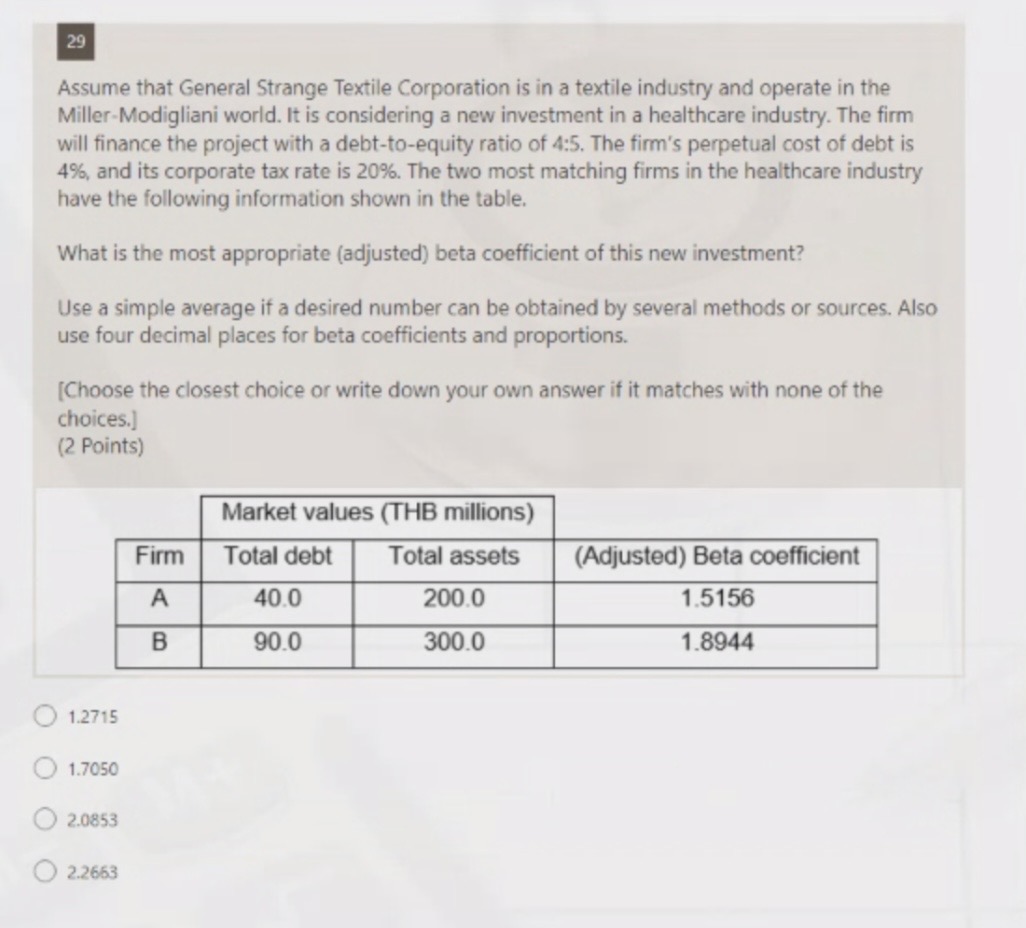

28 Which statement is most correct regarding capital structure? (2 Points) According to the Trade-Off Model, without its downsides, high financial leverage always reduces total agency costs because managers become more disciplined as they are constrained by debt financing. The Market-Timing Model suggests that even if a company's prospects are bright, a firm should, in normal times maintain a reserve borrowing capacity that can be used in the event that some especially good investment opportunity comes along. The Windows-of-Opportunity Model suggests that managers issue equity when they believe stock market prices are abnormally low and issue debt when they believe interest rates are abnormally high. The costs of financial distress are especially harmful to firms whose values consist primarily of intangible growth options, such as research and development. Such firms should have lower level of debt than firms whose asset bases consist mostly of tangible assets. 29 Assume that General Strange Textile Corporation is in a textile industry and operate in the Miller-Modigliani world. It is considering a new investment in a healthcare industry. The firm will finance the project with a debt-to-equity ratio of 4:5. The firm's perpetual cost of debt is 4%, and its corporate tax rate is 20%. The two most matching firms in the healthcare industry have the following information shown in the table. What is the most appropriate (adjusted) beta coefficient of this new investment? Use a simple average if a desired number can be obtained by several methods or sources. Also use four decimal places for beta coefficients and proportions. [Choose the closest choice or write down your own answer if it matches with none of the choices.] (2 Points) Market values (THB millions) Total debt Total assets (Adjusted) Beta coefficient 40.0 200.0 1.5156 90.0 300.0 1.8944 1.2715 1.7050 2.0853 2.2663 Firm A B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts