Question: 28) While reviewing your current financial plan, you discover that you most likely won't achieve your long term financial goals. What should you do first?

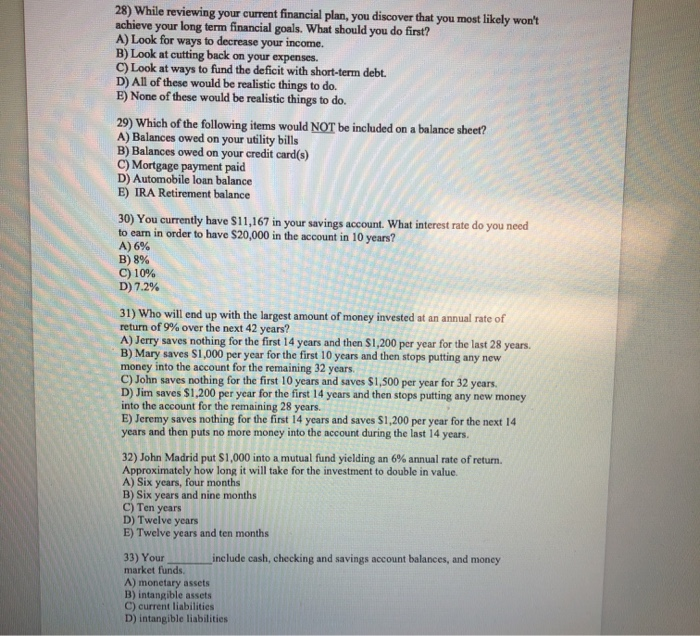

28) While reviewing your current financial plan, you discover that you most likely won't achieve your long term financial goals. What should you do first? A) Look for ways to decrease your income. B) Look at cutting back on your expenses. C) Look at ways to fund the deficit with short-term debt. D) All of these would be realistic things to do. E) None of these would be realistic things to do. 29) Which of the following items would NOT be included on a balance sheet? A) Balances owed on your utility bills B) Balances owed on your credit card(s) C) Mortgage payment paid D) Automobile loan balance E) IRA Retirement balance 30) You currently have $11,167 in your savings account. What interest rate do you need to earn in order to have $20,000 in the account in 10 years? A) 6% B) 896 C)10% D) 7.2% 31) Who will end up with the largest amount of money invested at an annual rate of return of 9% over the next 42 years? A) Jerry saves nothing for the first 14 years and then $1,200 per year for the last 28 years. B) Mary saves $1,000 per year for the first 10 years and then stops putting any new money into the account for the remaining 32 years C) John saves nothing for the first 10 years and saves $1,500 per year for 32 years D) Jim saves $1.200 per year for the first 14 years and then stops putting any new money into the account for the remaining 28 years. E) Jeremy saves nothing for the first 14 years and saves $1,200 per year for the next 14 years and then puts no more money into the account during the last 14 years 32) John Madrid put S 1,000 into a mutual fund yielding an 6% annual rate of return. Approximately how long it will take for the investment to double in value. A) Six years, four months B) Six years and nine months C) Ten years D) Twelve years E) Twelve years and ten months 33) Your include cash, checking and savings account balances, and moncy market fundsnclude A) monetary assets B) intangible assets C) current liabilities D) intangible liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts