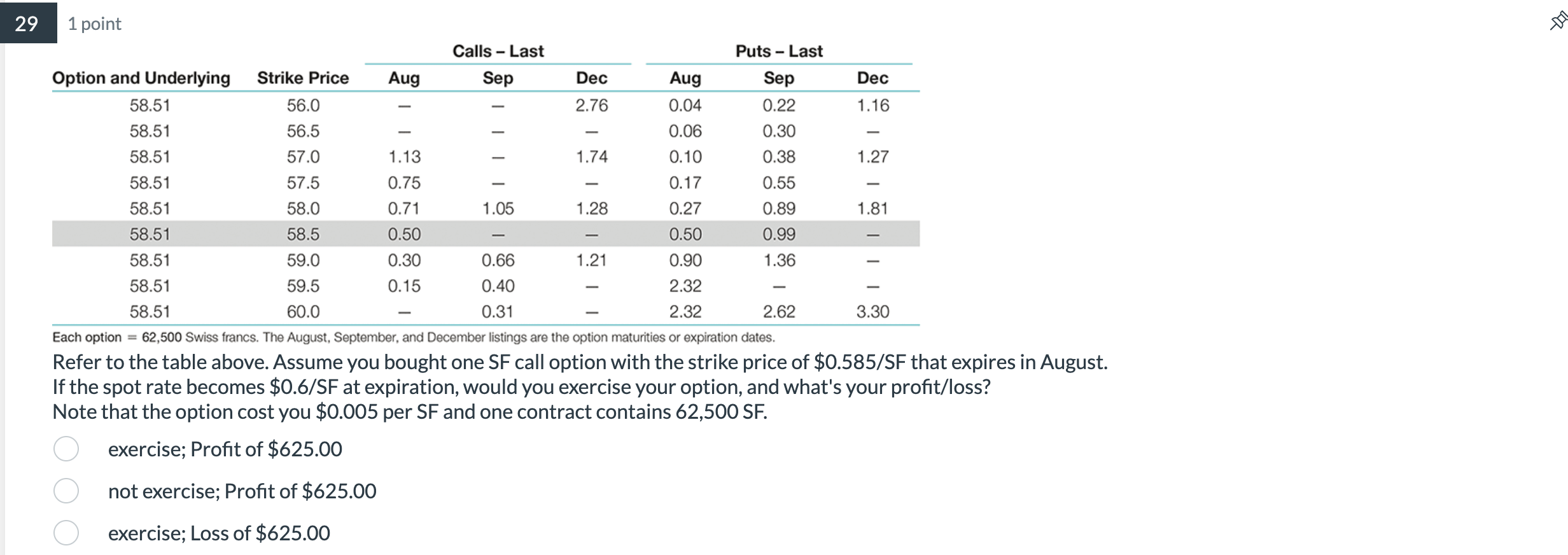

Question: 29 1 point Calls - Last Puts - Last Option and Underlying Strike Price Aug Sep Dec Aug Sep Dec 58.51 56.0 2.76 0.04 0.22

29 1 point Calls - Last Puts - Last Option and Underlying Strike Price Aug Sep Dec Aug Sep Dec 58.51 56.0 2.76 0.04 0.22 1.16 58.51 56.5 - 0.06 0.30 58.51 57.0 1.13 1.74 0.10 0.38 1.27 58.51 57.5 0.75 0.17 0.55 58.51 58.0 0.71 1.05 1.28 0.27 0.89 1.81 58.51 58.5 0.50 0.50 0.99 58.51 59.0 0.30 0.66 1.21 0.90 1.36 58.51 59.5 0.15 0.40 2.32 58.51 60.0 0.31 2.32 2.62 3.30 Each option = 62,500 Swiss francs. The August, September, and December listings are the option maturities or expiration dates. Refer to the table above. Assume you bought one SF call option with the strike price of $0.585/SF that expires in August. If the spot rate becomes $0.6/SF at expiration, would you exercise your option, and what's your profit/loss? Note that the option cost you $0.005 per SF and one contract contains 62,500 SF. exercise; Profit of $625.00 not exercise; Profit of $625.00 exercise; Loss of $625.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts