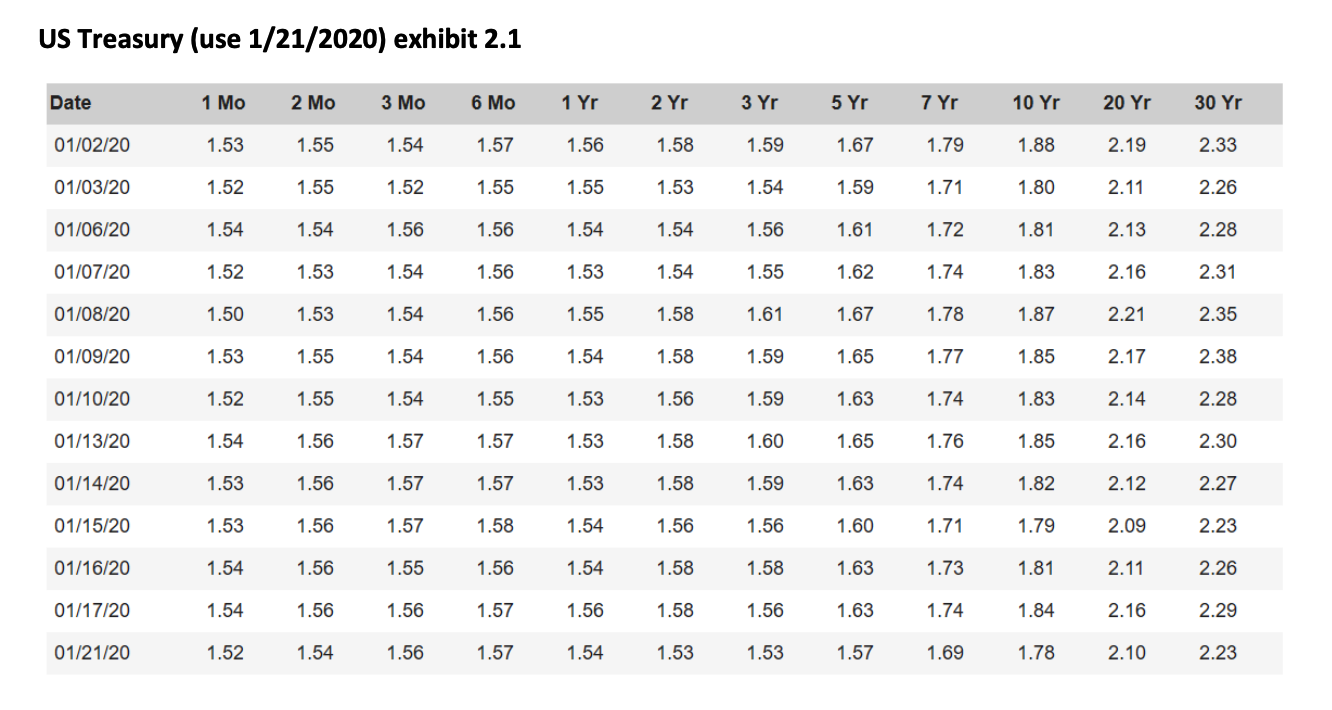

Part 1 (25 points) Using exhibit 2.1 (US treasury rates) assume that the maturity date is exactly 2 or 3 years from now (chapter 12, result 12.4 has the formula for cost of carry - we want to find the costs associated with carrying the asset less the convenience from the futures price less - if there is no last price is listed then use prior settled)

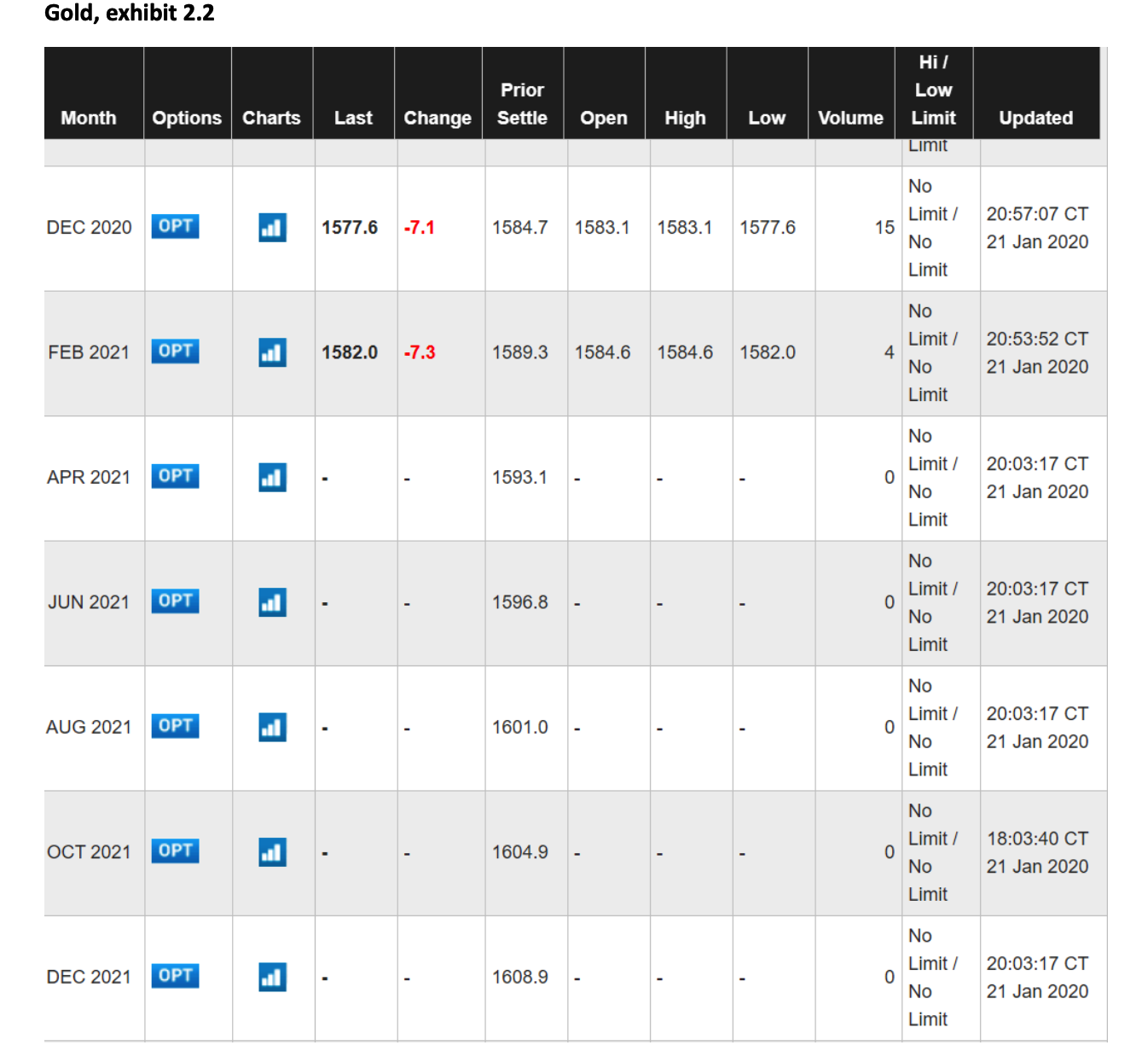

Calculate g-y (cost of carry minus convenience yield) for (Gold, exhibit 2.2), spot price is $1566.30 per ounce:

? Dec 2021

? Dec 2022

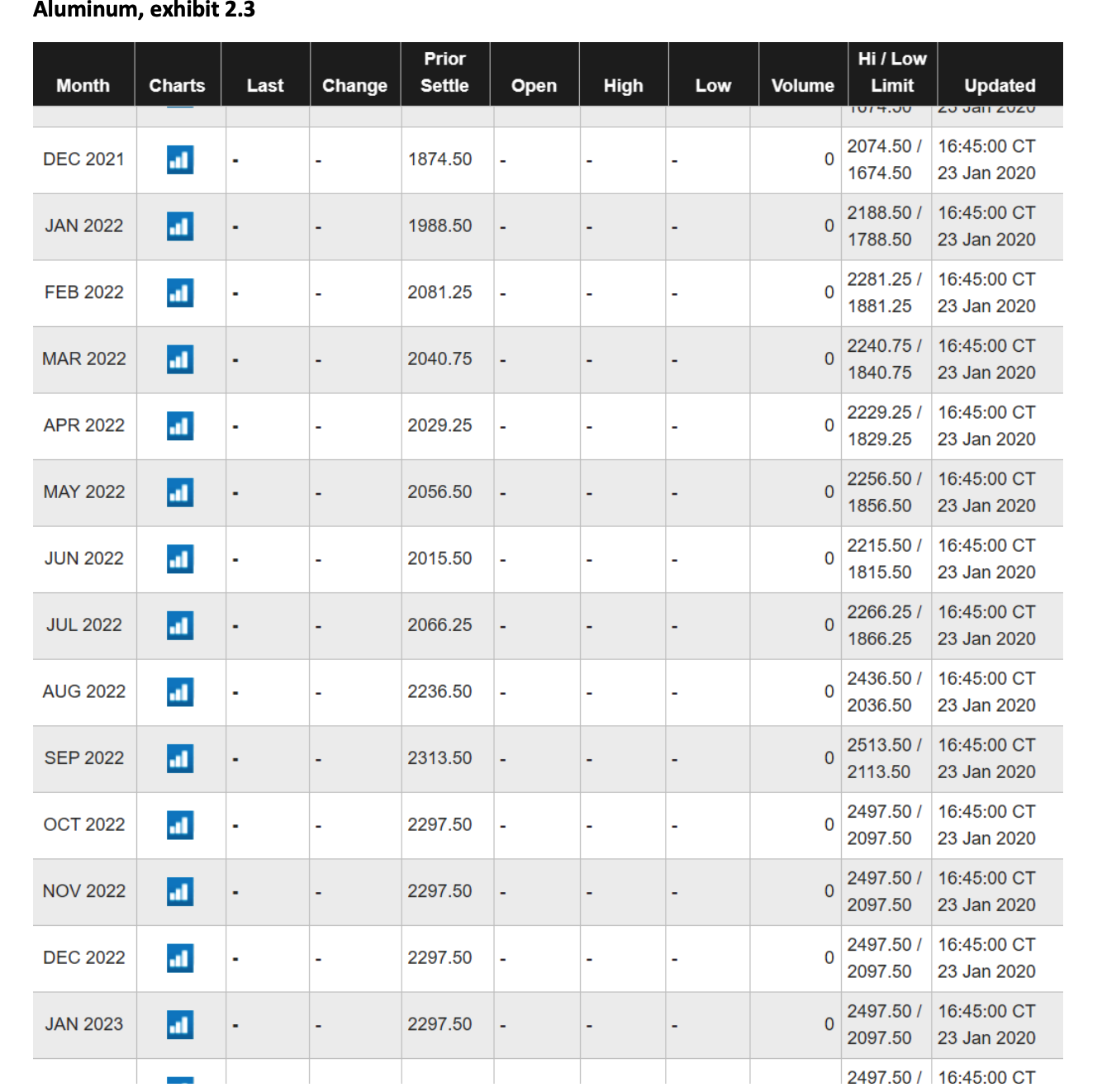

Calculate g-y (cost of carry minus convenience yield) for (Aluminum, exhibit 2.3), spot price is $1811.15 per ton:

? Dec 2021

? Dec 2022

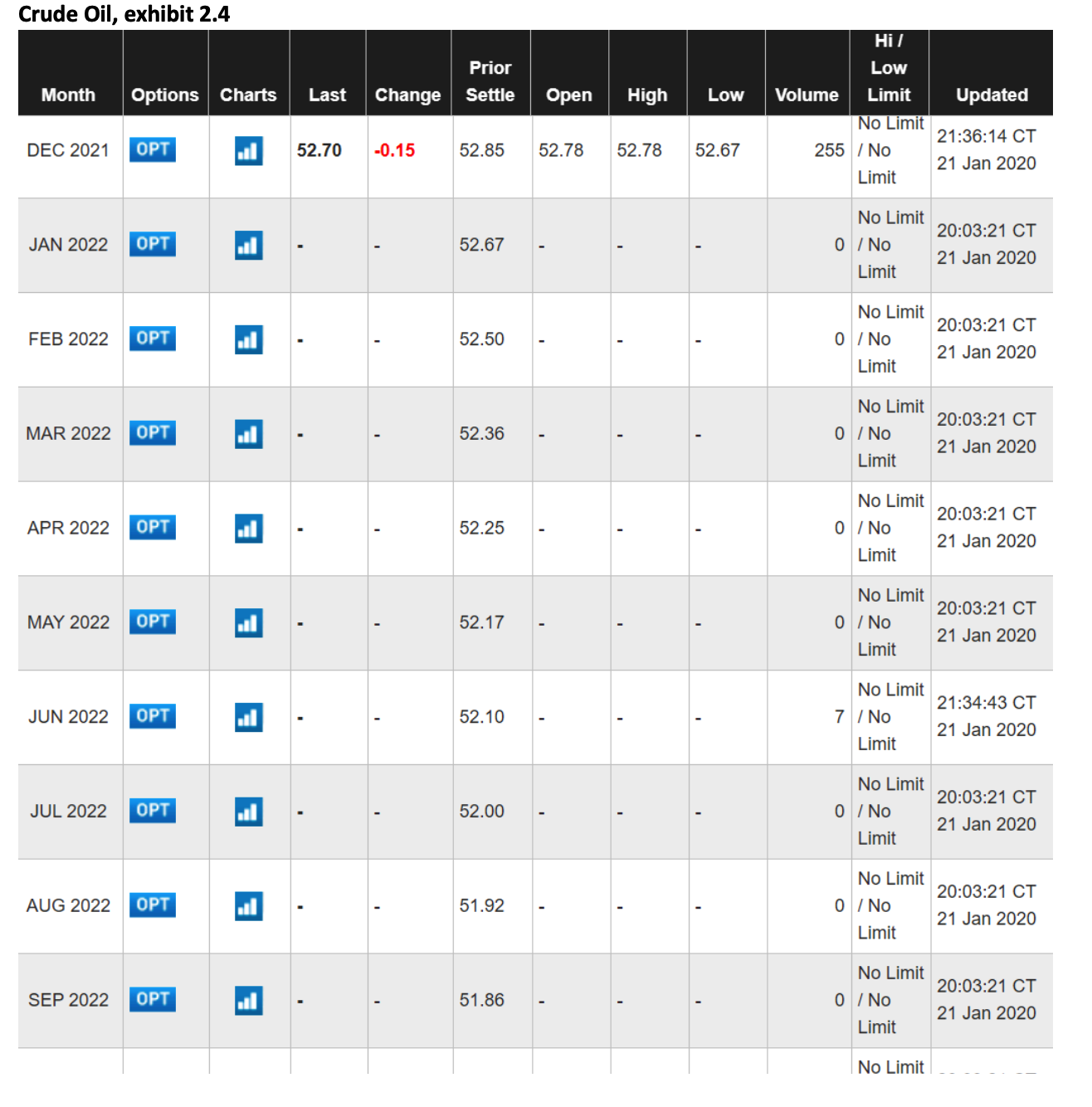

Calculate g-y (cost of carry minus convenience yield) for (Crude Oil, exhibit 2.4) $58.09 per barrel:

? Dec 2021

? Dec 2022 (Trading strategies can be found in Chapter 15)

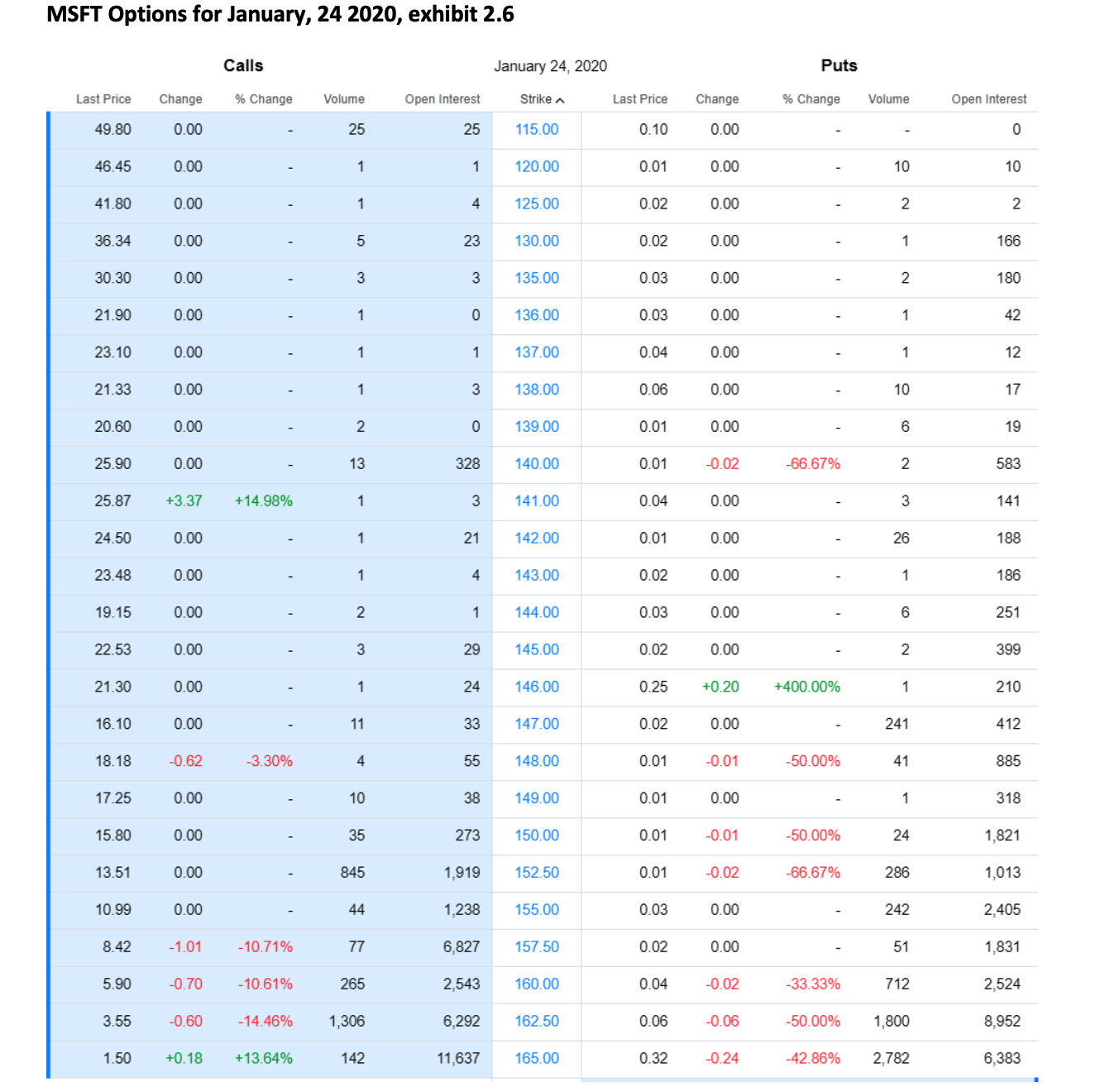

Part 2 (25 points) Using exhibit 2.5 (MSFT) Draw the profit diagram for, please list the strike prices used:

? Covered Call

? Covered Put

? Butterfly

? Condor

? Strangle

? Straddle

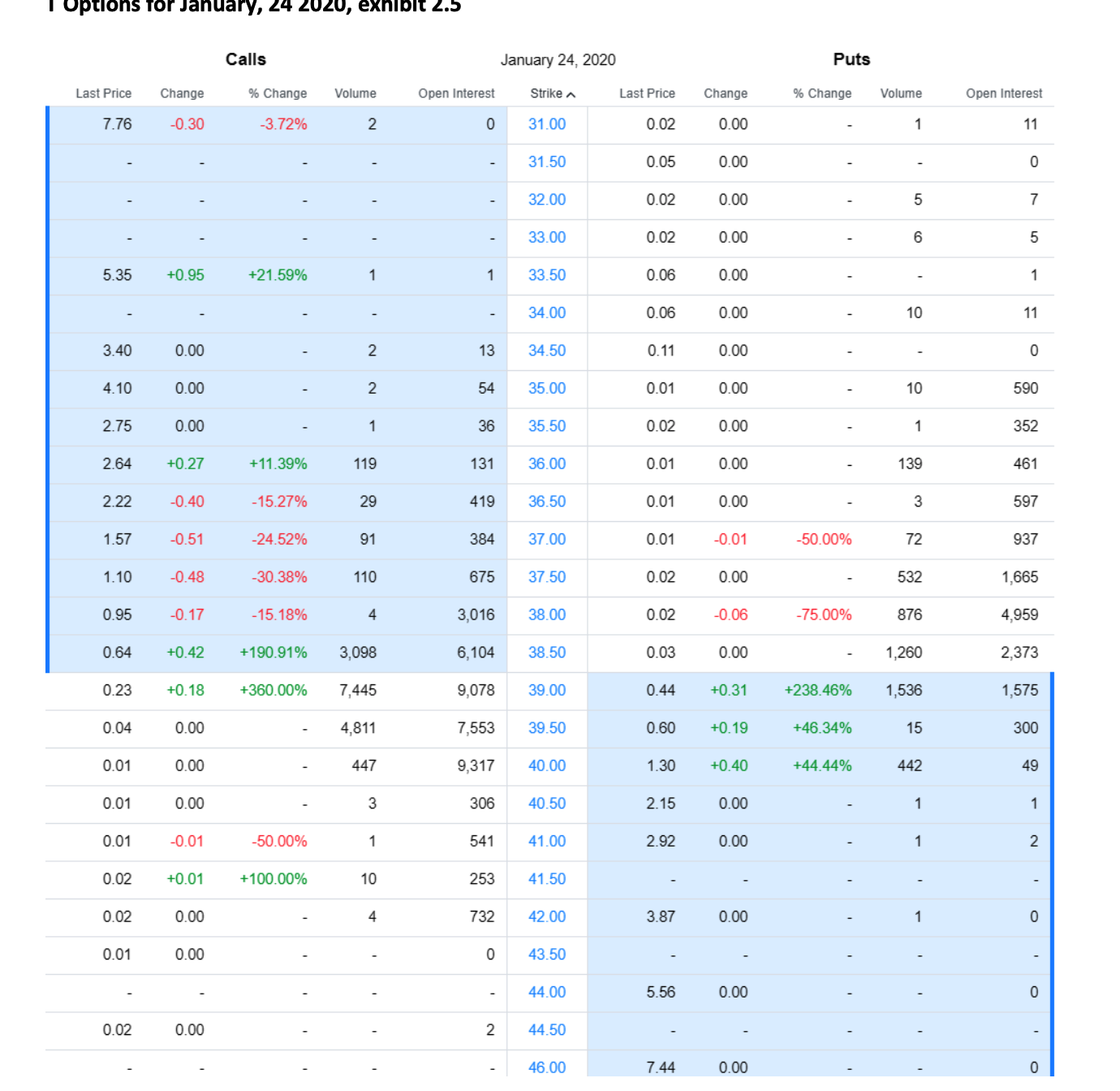

Part 3 (25 points) Using exhibit 2.6 (T) Draw the profit diagram for, please list the strike prices used:

? Covered Call

? Covered Put

? Short Butterfly

? Short Condor

? Short Strangle

? Short Straddle

\fGold, exhibit 2.2 Hi / Prior Low Month Options | Charts Last Change Settle Open High Low Volume Limit Updated Limit No DEC 2020 OPT 1577.6 -7.1 1584.7 1583.1 1583.1 1577.6 15 Limit / 20:57:07 CT No 21 Jan 2020 Limit No 1582.0 -7.3 1589.3 1584.6 4 Limit / FEB 2021 OPT 1584.6 1582.0 20:53:52 CT No 21 Jan 2020 Limit No APR 2021 OPT 1593.1 0 Limit / 20:03:17 CT No 21 Jan 2020 Limit No JUN 2021 OPT 1596.8 Limit / 20:03:17 CT No 21 Jan 2020 Limit No OPT 1601.0 0 Limit / 20:03:17 CT AUG 2021 No 21 Jan 2020 Limit No OCT 2021 OPT 1604.9 0 Limit / 18:03:40 CT No 21 Jan 2020 Limit No 20:03:17 CT DEC 2021 OPT 1608.9 0 Limit / No 21 Jan 2020 LimitAluminum, exhibit 2.3 Prior Hi / Low Month Charts Last Change Settle Open High Low Volume Limit Updated IUIT. JU Zu Jall ZUZU DEC 2021 1874.50 0 2074.50 / 16:45:00 CT 1674.50 23 Jan 2020 JAN 2022 1988.50 0 2188.50 / 16:45:00 CT 1788.50 23 Jan 2020 FEB 2022 2081.25 0 2281.25 / 16:45:00 CT 1881.25 23 Jan 2020 MAR 2022 2040.75 0 2240.75 / 16:45:00 CT 1840.75 23 Jan 2020 2029.25 0 2229.25 / 16:45:00 CT APR 2022 1829.25 23 Jan 2020 MAY 2022 2056.50 0 2256.50 / 16:45:00 CT 1856.50 23 Jan 2020 2015.50 0 2215.50 / 16:45:00 CT JUN 2022 1815.50 23 Jan 2020 JUL 2022 2066.25 2266.25 / 16:45:00 CT 1866.25 23 Jan 2020 AUG 2022 2236.50 0 2436.50 / 16:45:00 CT 2036.50 23 Jan 2020 SEP 2022 2313.50 0 2513.50 / 16:45:00 CT 2113.50 23 Jan 2020 OCT 2022 2297.50 0 2497.50 / 16:45:00 CT 2097.50 23 Jan 2020 NOV 2022 2297.50 0 2497.50 / 16:45:00 CT 2097.50 23 Jan 2020 DEC 2022 2297.50 0 2497.50 / 16:45:00 CT 2097.50 23 Jan 2020 JAN 2023 2297.50 2497.50 / 16:45:00 CT 2097.50 23 Jan 2020 2497.50 / 16:45:00 CTCrude Oil, exhibit 2.4 Hi / Prior Low Month Options Charts Last Change Settle Open High Low Volume Limit Updated No Limit 21:36:14 CT DEC 2021 OPT 52.70 -0.15 52.85 52.78 52.78 52.67 255 / No Limit 21 Jan 2020 No Limit 20:03:21 CT JAN 2022 OPT al 52.67 0 / No Limit 21 Jan 2020 No Limit 0 / No 20:03:21 CT FEB 2022 OPT al 52.50 Limit 21 Jan 2020 No Limit 20:03:21 CT MAR 2022 OPT 52.36 0 / No Limit 21 Jan 2020 No Limit OPT 0 / No 20:03:21 CT APR 2022 52.25 Limit 21 Jan 2020 No Limit MAY 2022 OPT 52.17 0 / No 20:03:21 CT Limit 21 Jan 2020 No Limit JUN 2022 OPT 52.10 7 / No 21:34:43 CT Limit 21 Jan 2020 No Limit 0 / No 20:03:21 CT JUL 2022 OPT 52.00 Limit 21 Jan 2020 No Limit 20:03:21 CT AUG 2022 OPT 51.92 0 / No Limit 21 Jan 2020 No Limit SEP 2022 OPT 0 / No 20:03:21 CT 51.86 Limit 21 Jan 2020 No LimitMSFT Options for January, 24 2020, exhibit 2.6 Calls January 24, 2020 Puts Last Price Change % Change Volume Open Interest Strike A Last Price Change % Change Volume Open Interest 49.80 0.00 25 25 115.00 0.10 0.00 46.45 0.00 1 120.00 0.01 0.00 10 10 41.80 0.00 125.00 0.02 0.00 2 36.34 0.00 5 23 130.00 0.02 0.00 1 166 30.30 0.00 3 135.00 0.03 0.00 2 180 21.90 0.00 1 0 136.00 0.03 0.00 1 42 23.10 0.00 1 137.00 0.04 0.00 1 12 21.33 0.00 1 138.00 0.06 0.00 10 17 20.60 0.00 2 0 139.00 0.01 0.00 6 19 25.90 0.00 12 328 140.00 0.01 -0.02 -66.67% 2 583 25.87 +3.37 +14.98% 1 3 141.00 0.04 0.00 3 141 24.50 0.00 21 142.00 0.01 0.00 26 188 23.48 0.00 1 4 143.00 0.02 0.00 1 186 19.15 0.00 2 1 144.00 0.03 0.00 6 251 22.53 0.00 3 29 145.00 0.02 0.00 2 399 21.30 0.00 1 24 146.00 0.25 +0.20 +400.00% 210 16.10 0.00 11 147.00 0.02 0.00 241 412 18.18 -0.62 -3.30% 4 55 148.00 0.01 -0.01 50.00% 41 885 17.25 0.00 10 38 149.00 0.01 0.00 318 15.80 0.00 35 273 150.00 0.01 -0.01 50.00% 24 1,821 13.51 0.00 845 1.919 152.50 0.01 -0.02 -66.67% 286 1,013 10.99 0.00 44 1.238 155.00 0.03 0.00 242 2,405 8.42 1.01 10.71% 77 6,827 157.50 0.02 0.00 51 1,831 5.90 -0.70 -10.61% 265 2,543 160.00 .04 0.02 33.33% 712 2,524 3.55 -0.60 -14.46% 1,306 6,292 162.50 0.06 -0.06 -50.00% 1,800 8,952 1.50 +0.18 +13.64% 142 11,637 165.00 0.32 -0.24 -42.86% 2,782 6,383Calls January 24, 2020 Puts Last Price Change % Change Volume Open Interest Strike ~ Last Price Change % Change Volume Open Interest 7.76 -0.30 -3.72% 2 0 31.00 0.02 0.00 31.50 0.05 0.00 0 32.00 0.02 0.00 33.00 0.02 0.00 5 5 35 +0.95 +21.59% 33.50 0.06 0.00 1 34.00 0.06 0.00 10 11 3.40 0.00 2 13 34.50 0.11 0.00 0 4.10 0.00 2 54 35.00 0.01 0.00 10 590 2.75 0.00 1 36 35.50 0.02 0.00 1 352 2.64 +0.27 +11.39% 119 131 36.00 0.01 0.00 139 461 2.22 -0.40 -15.27% 29 419 36.50 0.01 0.00 3 597 1.57 -0.51 -24.52% 91 384 37.00 0.01 -0.01 50.00% 72 937 1.10 -0.48 -30.38% 110 675 37.50 0.02 0.00 532 1,665 0.95 -0.17 -15.18% 3.016 38.00 0.02 0.06 -75.00% 876 1.959 0.64 +0.42 +190.91% 3,098 6,104 38.50 0.03 0.00 1,260 2,373 0.23 +0.18 +360.00% 7,445 9,078 39.00 0.44 +0.31 +238.46% 1,536 1,575 0.04 0.00 4,811 7.553 39.50 0.60 +0 19 +46.34% 15 300 0.01 0.00 447 9,317 40.00 1.30 +0.40 +44.44% 442 49 0.01 0.00 3 306 40.50 2.15 0.00 1 0.01 -0.01 50.00% 541 41.00 2.92 0.00 N 0.02 +0.01 +100.00% 10 253 41.50 0.02 0.00 4 732 42.00 3.87 0.00 O 0.01 0.00 43.50 44.00 5.56 0.00 O 0.02 0.00 2 44.50 46.00 7.44 0.00