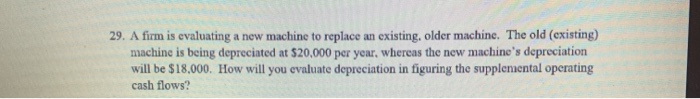

Question: 29. A firm is evaluating a new machine to replace an existing, older machine. The old (existing) machine is being depreciated at $20,000 per year,

29. A firm is evaluating a new machine to replace an existing, older machine. The old (existing) machine is being depreciated at $20,000 per year, whereas the new machine's depreciation will be $18,000. How will you evaluate depreciation in figuring the supplemental operating cash flows? 28. Depreciation must be considered when cvaluating the incremental operating cash flows associated with a capital budgeting project because

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts