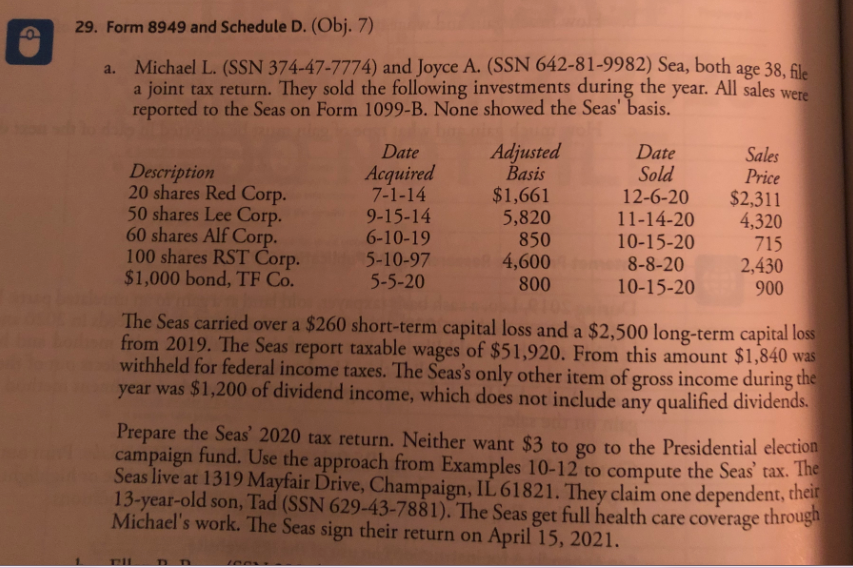

Question: 29. Form 8949 and Schedule D. (Obj. 7) a. Michael L. (SSN 374-47-7774) and Joyce A. (SSN 642-81-9982) Sea, both age 38, file a joint

29. Form 8949 and Schedule D. (Obj. 7) a. Michael L. (SSN 374-47-7774) and Joyce A. (SSN 642-81-9982) Sea, both age 38, file a joint tax return. They sold the following investments during the year. reported to the Seas on Form 1099-B. None showed the Seas' basis. All sales were Sales Price $2,311 Description 20 shares Red Corp. 50 shares Lee Corp. 60 shares Alf Corp. 100 shares RST Corp. $1,000 bond, TF Co. Date Acquired 7-1-14 9-15-14 6-10-19 5-10-97 5-5-20 Adjusted Basis $1,661 5,820 850 4,600 800 Date Sold 12-6-20 11-14-20 10-15-20 8-8-20 10-15-20 4,320 715 2,430 900 The Seas carried over a $260 short-term capital loss and a $2,500 long-term capital loss from 2019. The Seas report taxable wages of $51,920. From this amount $1,840 was withheld for federal income taxes. The Seas's only other item of gross income during the year was $1,200 of dividend income, which does not include any qualified dividends. Prepare the Seas' 2020 tax return. Neither want $3 to go to the Presidential election campaign fund. Use the approach from Examples 10-12 to compute the Seas' tax. The Seas live at 1319 Mayfair Drive, Champaign, IL 61821. They claim one dependent, their 13-year-old son, Tad (SSN 629-43-7881). The Seas get full health care coverage through Michael's work. The Seas sign their return on April 15, 2021. 29. Form 8949 and Schedule D. (Obj. 7) a. Michael L. (SSN 374-47-7774) and Joyce A. (SSN 642-81-9982) Sea, both age 38, file a joint tax return. They sold the following investments during the year. reported to the Seas on Form 1099-B. None showed the Seas' basis. All sales were Sales Price $2,311 Description 20 shares Red Corp. 50 shares Lee Corp. 60 shares Alf Corp. 100 shares RST Corp. $1,000 bond, TF Co. Date Acquired 7-1-14 9-15-14 6-10-19 5-10-97 5-5-20 Adjusted Basis $1,661 5,820 850 4,600 800 Date Sold 12-6-20 11-14-20 10-15-20 8-8-20 10-15-20 4,320 715 2,430 900 The Seas carried over a $260 short-term capital loss and a $2,500 long-term capital loss from 2019. The Seas report taxable wages of $51,920. From this amount $1,840 was withheld for federal income taxes. The Seas's only other item of gross income during the year was $1,200 of dividend income, which does not include any qualified dividends. Prepare the Seas' 2020 tax return. Neither want $3 to go to the Presidential election campaign fund. Use the approach from Examples 10-12 to compute the Seas' tax. The Seas live at 1319 Mayfair Drive, Champaign, IL 61821. They claim one dependent, their 13-year-old son, Tad (SSN 629-43-7881). The Seas get full health care coverage through Michael's work. The Seas sign their return on April 15, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts