Question: 29. Form 8949 and Schedule D. (Obj. 7) a. Michael L. (SSN 374-47-7774) and Joyce A. (SSN 642-81-9982) Sea, both age 38, file a joint

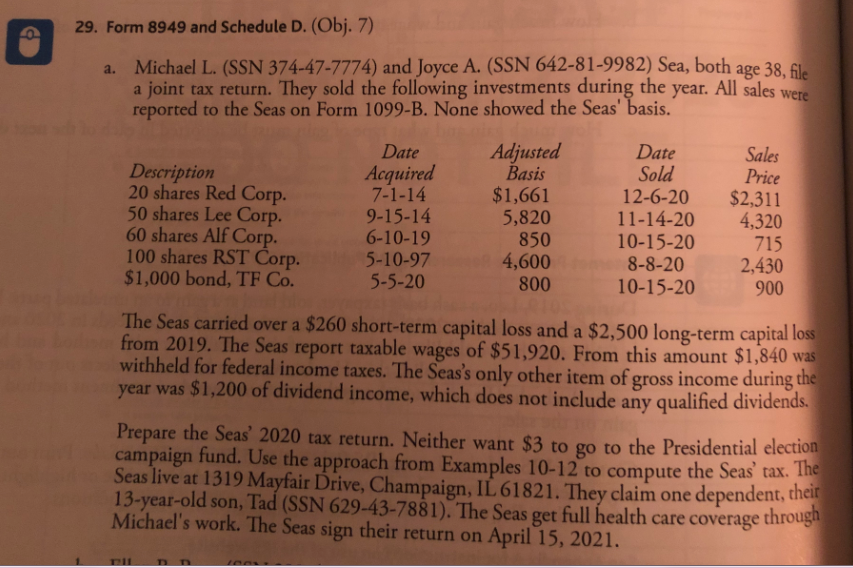

29. Form 8949 and Schedule D. (Obj. 7) a. Michael L. (SSN 374-47-7774) and Joyce A. (SSN 642-81-9982) Sea, both age 38, file a joint tax return. They sold the following investments during the year. All sales were reported to the Seas on Form 1099-B. None showed the Seas' basis. Date Adjusted Date Sales Description Acquired Basis Sold Price 20 shares Red Corp. 7-1-14 $1,661 12-6-20 $2,311 50 shares Lee Corp. 9-15-14 5,820 11-14-20 4,320 60 shares Alf Corp. 6-10-19 850 10-15-20 715 100 shares RST Corp. 5-10-97 4,600 8-8-20 2,430 $1,000 bond, TF Co. 5-5-20 800 10-15-20 900 The Seas carried over a $260 short-term capital loss and a $2,500 long-term capital loss from 2019. The Seas report taxable wages of $51,920. From this amount $1,840 was withheld for federal income taxes. The Seas's only other item of gross income during the year was $1,200 of dividend income, which does not include any qualified dividends. Prepare the Seas' 2020 tax return. Neither want $3 to go to the Presidential election campaign fund. Use the approach from Examples 10-12 to compute the Seas' tax. The Seas live at 1319 Mayfair Drive, Champaign, IL 61821. They claim one dependent, their 13-year-old son, Tad (SSN 629-43-7881). The Seas get full health care coverage through Michael's work. The Seas sign their return on April 15, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts