Question: 29.. I need the solution, the full, correct solution!I will give a thumbs up! A developer has 20 acres of real estate for a project.

29.. I need the solution, the full, correct solution!I will give a thumbs up!

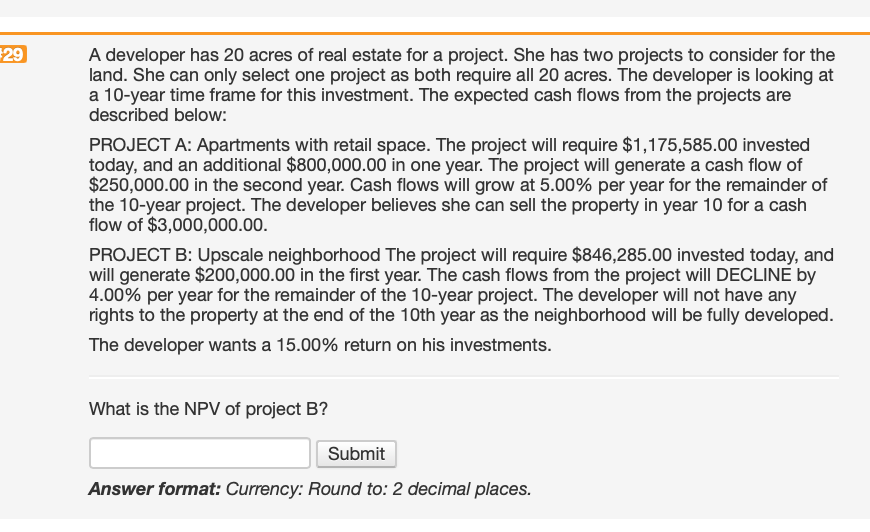

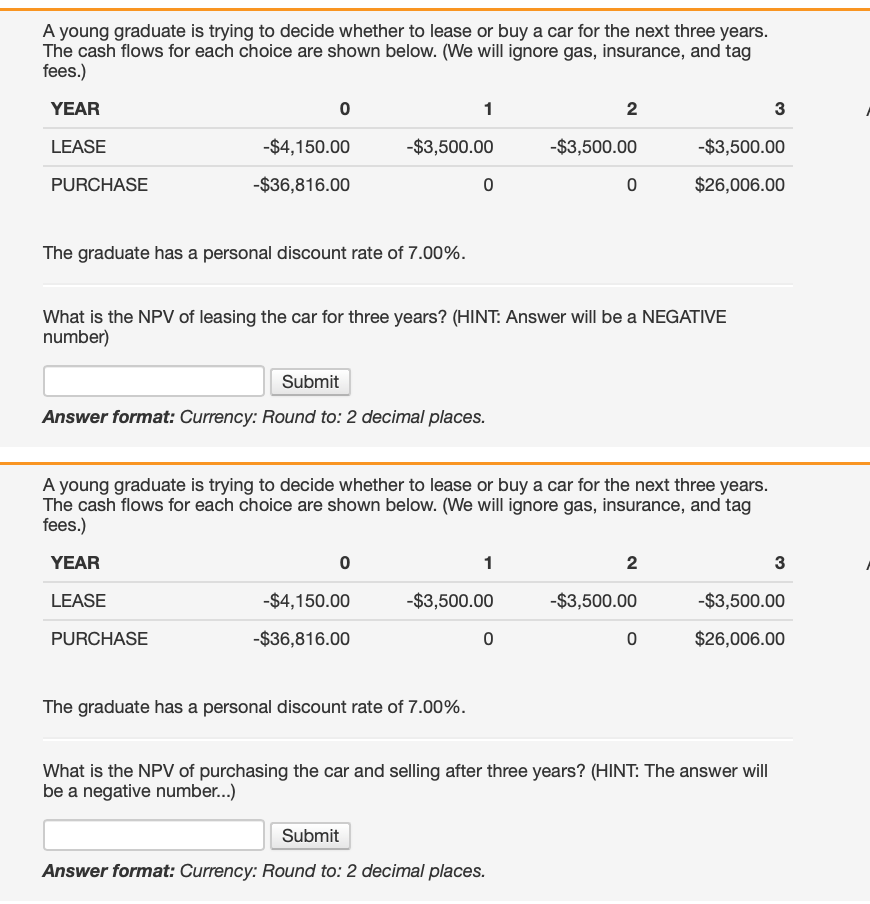

A developer has 20 acres of real estate for a project. She has two projects to consider for the land. She can only select one project as both require all 20 acres. The developer is looking at a 10-year time frame for this investment. The expected cash flows from the projects are described below: PROJECT A: Apartments with retail space. The project will require $1,175,585.00 invested today, and an additional $800,000.00 in one year. The project will generate a cash flow of $250,000.00 in the second year. Cash flows will grow at 5.00% per year for the remainder of the 10-year project. The developer believes she can sell the property in year 10 for a cash flow of $3,000,000.00. PROJECT B: Upscale neighborhood The project will require $846,285.00 invested today, and will generate $200,000.00 in the first year. The cash flows from the project will DECLINE by 4.00% per year for the remainder of the 10 -year project. The developer will not have any rights to the property at the end of the 10th year as the neighborhood will be fully developed. The developer wants a 15.00% return on his investments. What is the NPV of project B? Answer format: Currency: Round to: 2 decimal places. A young graduate is trying to decide whether to lease or buy a car for the next three years. The cash flows for each choice are shown below. (We will ignore gas, insurance, and tag fees.) The graduate has a personal discount rate of 7.00%. What is the NPV of leasing the car for three years? (HINT: Answer will be a NEGATIVE number) Answer format: Currency: Round to: 2 decimal places. A young graduate is trying to decide whether to lease or buy a car for the next three years. The cash flows for each choice are shown below. (We will ignore gas, insurance, and tag fees.) The graduate has a personal discount rate of 7.00%. What is the NPV of purchasing the car and selling after three years? (HINT: The answer will be a negative number...) Answer format: Currency: Round to: 2 decimal places

A developer has 20 acres of real estate for a project. She has two projects to consider for the land. She can only select one project as both require all 20 acres. The developer is looking at a 10-year time frame for this investment. The expected cash flows from the projects are described below: PROJECT A: Apartments with retail space. The project will require $1,175,585.00 invested today, and an additional $800,000.00 in one year. The project will generate a cash flow of $250,000.00 in the second year. Cash flows will grow at 5.00% per year for the remainder of the 10-year project. The developer believes she can sell the property in year 10 for a cash flow of $3,000,000.00. PROJECT B: Upscale neighborhood The project will require $846,285.00 invested today, and will generate $200,000.00 in the first year. The cash flows from the project will DECLINE by 4.00% per year for the remainder of the 10 -year project. The developer will not have any rights to the property at the end of the 10th year as the neighborhood will be fully developed. The developer wants a 15.00% return on his investments. What is the NPV of project B? Answer format: Currency: Round to: 2 decimal places. A young graduate is trying to decide whether to lease or buy a car for the next three years. The cash flows for each choice are shown below. (We will ignore gas, insurance, and tag fees.) The graduate has a personal discount rate of 7.00%. What is the NPV of leasing the car for three years? (HINT: Answer will be a NEGATIVE number) Answer format: Currency: Round to: 2 decimal places. A young graduate is trying to decide whether to lease or buy a car for the next three years. The cash flows for each choice are shown below. (We will ignore gas, insurance, and tag fees.) The graduate has a personal discount rate of 7.00%. What is the NPV of purchasing the car and selling after three years? (HINT: The answer will be a negative number...) Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts