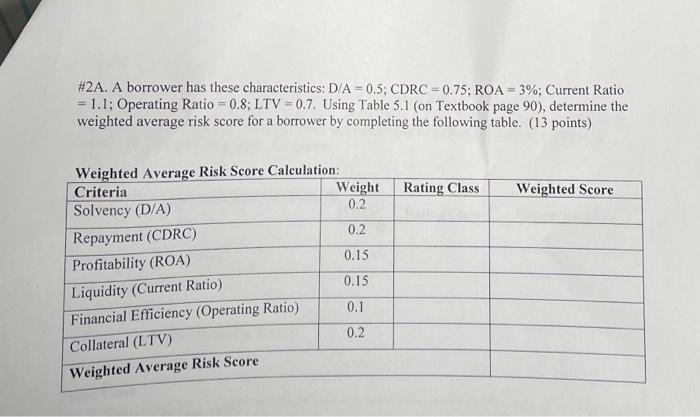

Question: #2A. A borrower has these characteristics: D/A = 0.5; CDRC = 0.75; ROA = 3%, Current Ratio = 1.1: Operating Ratio = 0.8; LTV =

#2A. A borrower has these characteristics: D/A = 0.5; CDRC = 0.75; ROA = 3%, Current Ratio = 1.1: Operating Ratio = 0.8; LTV = 0.7. Using Table 5.1 (on Textbook page 90), determine the weighted average risk score for a borrower by completing the following table. (13 points) Rating Class Weighted Score Weighted Average Risk Score Calculation: Criteria Weight Solvency (D/A) 0.2 Repayment (CDRC) 0.2 Profitability (ROA) 0.15 0.15 Liquidity (Current Ratio) Financial Efficiency (Operating Ratio) 0.1 0.2 Collateral (LTV) Weighted Average Risk Score #2A. A borrower has these characteristics: D/A = 0.5; CDRC = 0.75; ROA = 3%, Current Ratio = 1.1: Operating Ratio = 0.8; LTV = 0.7. Using Table 5.1 (on Textbook page 90), determine the weighted average risk score for a borrower by completing the following table. (13 points) Rating Class Weighted Score Weighted Average Risk Score Calculation: Criteria Weight Solvency (D/A) 0.2 Repayment (CDRC) 0.2 Profitability (ROA) 0.15 0.15 Liquidity (Current Ratio) Financial Efficiency (Operating Ratio) 0.1 0.2 Collateral (LTV) Weighted Average Risk Score

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts