Question: 2a. A Venture Capitalist is considering investing $10 million (Round 1) in a start-up venture. She estimates that at the end of year 3 the

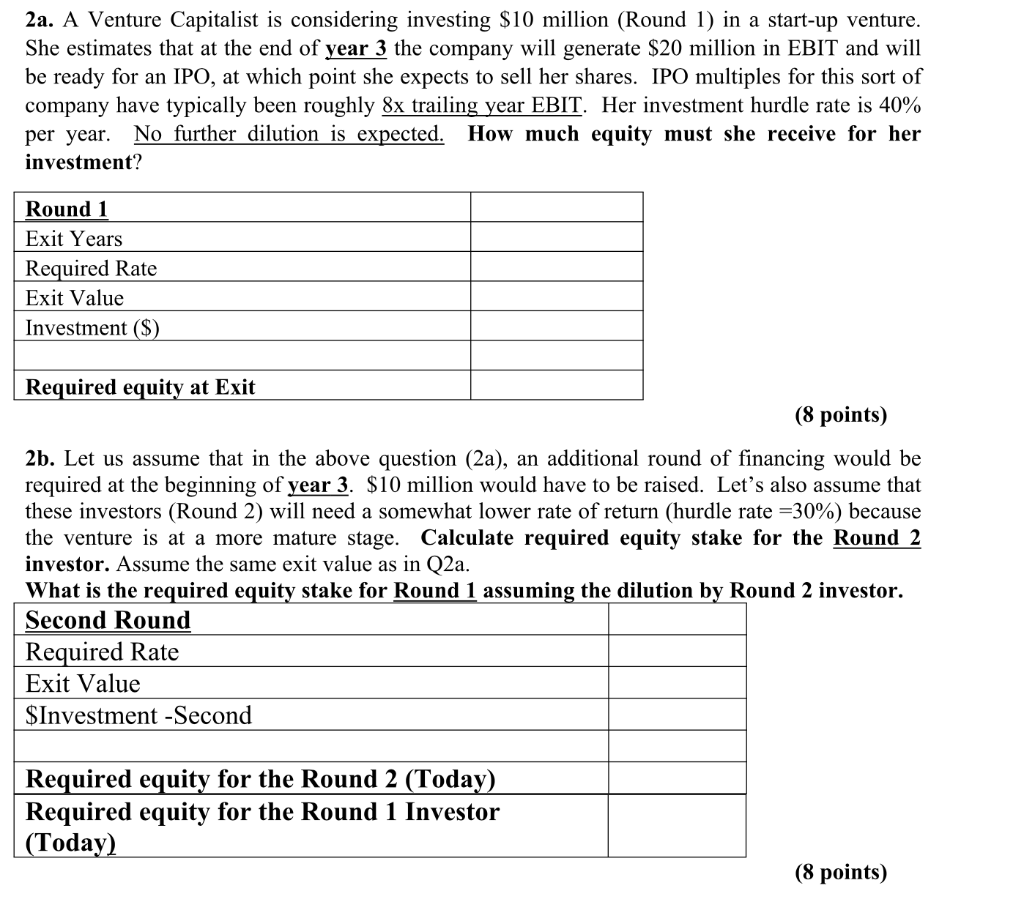

2a. A Venture Capitalist is considering investing $10 million (Round 1) in a start-up venture. She estimates that at the end of year 3 the company will generate $20 million in EBIT and will be ready for an IPO, at which point she expects to sell her shares. IPO multiples for this sort of company have typically been roughly 8x trailing year EBIT. Her investment hurdle rate is 40% per year. No further dilution is expected. How much equity must she receive for her investment? Round 1 Exit Years Required Rate Exit Value Investment ($) Required equity at Exit (8 points) 2b. Let us assume that in the above question (2a), an additional round of financing would be required at the beginning of year 3. $10 million would have to be raised. Let's also assume that these investors (Round 2) will need a somewhat lower rate of return (hurdle rate=30%) because the venture is at a more mature stage. Calculate required equity stake for the Round 2 investor. Assume the same exit value as in Q2a. What is the required equity stake for Round 1 assuming the dilution by Round 2 investor. Second Round Required Rate Exit Value $Investment -Second | Required equity for the Round 2 (Today) Required equity for the Round 1 Investor (Today) (8 points) 2a. A Venture Capitalist is considering investing $10 million (Round 1) in a start-up venture. She estimates that at the end of year 3 the company will generate $20 million in EBIT and will be ready for an IPO, at which point she expects to sell her shares. IPO multiples for this sort of company have typically been roughly 8x trailing year EBIT. Her investment hurdle rate is 40% per year. No further dilution is expected. How much equity must she receive for her investment? Round 1 Exit Years Required Rate Exit Value Investment ($) Required equity at Exit (8 points) 2b. Let us assume that in the above question (2a), an additional round of financing would be required at the beginning of year 3. $10 million would have to be raised. Let's also assume that these investors (Round 2) will need a somewhat lower rate of return (hurdle rate=30%) because the venture is at a more mature stage. Calculate required equity stake for the Round 2 investor. Assume the same exit value as in Q2a. What is the required equity stake for Round 1 assuming the dilution by Round 2 investor. Second Round Required Rate Exit Value $Investment -Second | Required equity for the Round 2 (Today) Required equity for the Round 1 Investor (Today) (8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts