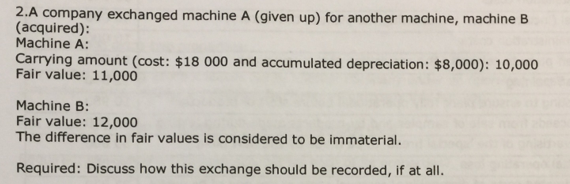

Question: 2.A company exchanged machine A (given up) for another machine, machine B (acquired): Machine A Carrying amount (cost: $18 000 and accumulated depreciation: $8,000): 10,000

2.A company exchanged machine A (given up) for another machine, machine B (acquired): Machine A Carrying amount (cost: $18 000 and accumulated depreciation: $8,000): 10,000 Fair value: 11,000 Machine B Fair value: 12,000 The difference in fair values is considered to be immaterial. Required: Discuss how this exchange should be recorded, if at all

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts