Question: 2A. Using the Markowitz portfolio optimization method, what would the composition of the optimal risky portfolio of these assets be? 2B. What would the expected

2A. Using the Markowitz portfolio optimization method, what would the composition of the optimal risky portfolio of these assets be?

2B. What would the expected return be on this optimal portfolio?

2C. What would the standard deviation of this optimal portfolio be?

2D. Hector has a coefficient of risk aversion of 1.8. What percentage of his assets should he invest in the risky portfolio?

2E. What would the expected return be on Hectors portfolio?

2F. What would the standard deviation of Hectors portfolio be?

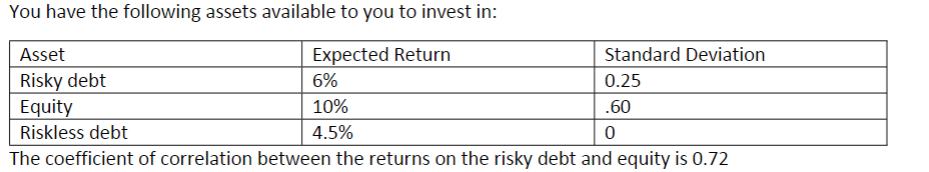

You have the following assets available to you to invest in: Asset Expected Return Standard Deviation Risky debt 6% 0.25 Equity 10% .60 Riskless debt 4.5% The coefficient of correlation between the returns on the risky debt and equity is 0.72

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts