Question: I need the step b , c , d , e and F with explanation and steps to get the resulta please The correlation coefficient

I need the step bcde and F with explanation and steps to get the resulta please

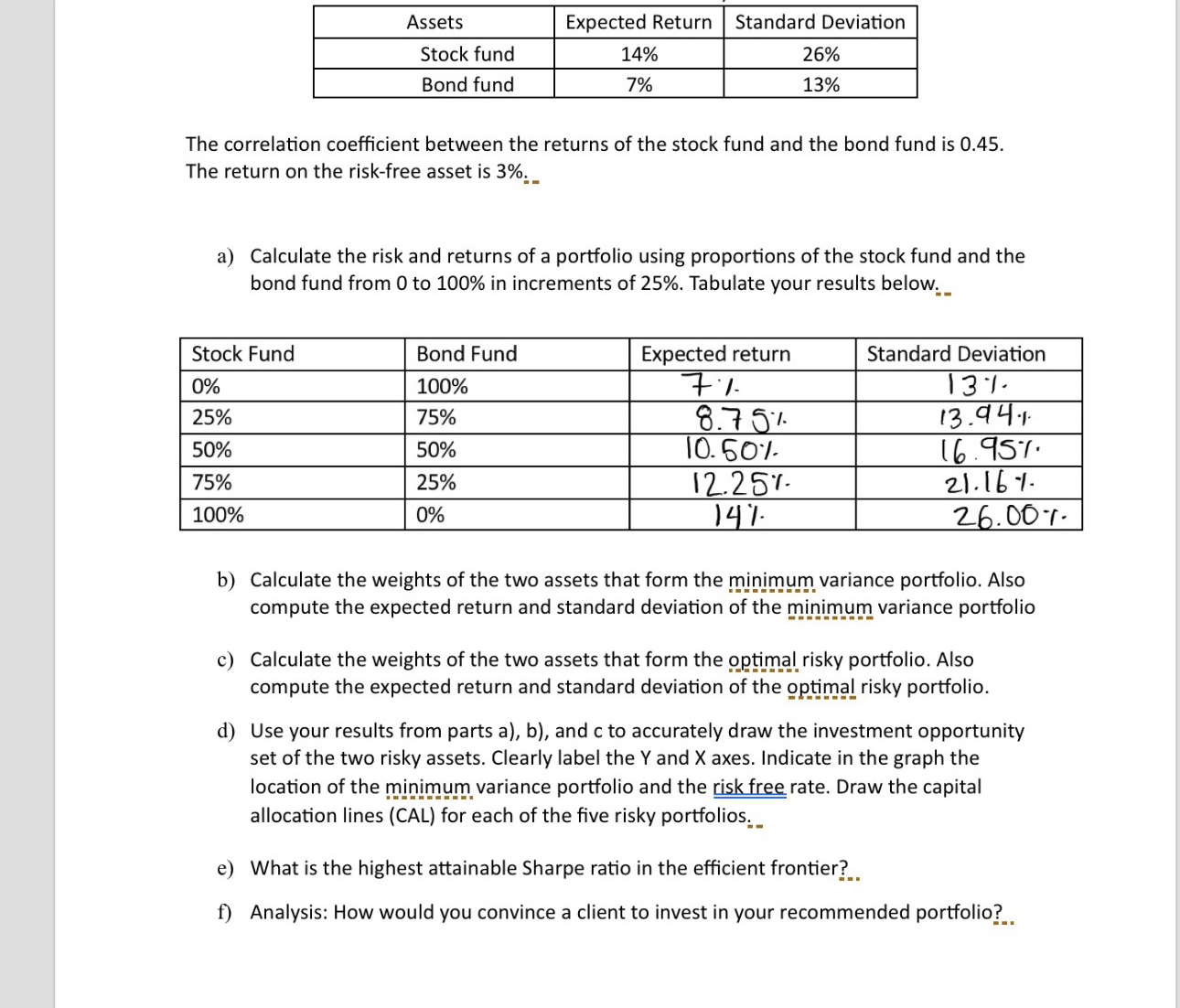

The correlation coefficient between the returns of the stock fund and the bond fund is

The return on the riskfree asset is

a Calculate the risk and returns of a portfolio using proportions of the stock fund and the

bond fund from to in increments of Tabulate your results below.

b Calculate the weights of the two assets that form the minimum variance portfolio. Also

c Calculate the weights of the two assets that form the optimal risky portfolio. Also

compute the expected return and standard deviation of the optimal risky portfolio.

d Use your results from parts a b and c to accurately draw the investment opportunity

set of the two risky assets. Clearly label the and axes. Indicate in the graph the

location of the minimum variance portfolio and the risk free rate. Draw the capital

allocation lines CAL for each of the five risky portfolios.

e What is the highest attainable Sharpe ratio in the efficient frontier?..

f Analysis: How would you convince a client to invest in your recommended portfolio?..

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock