Question: (2)(a)What is covered interest arbitrage? How is it different from triangular arbitrage? (b)Consider the following market information: Spot rate for the Canadian dollar C$....$0.90 90-day

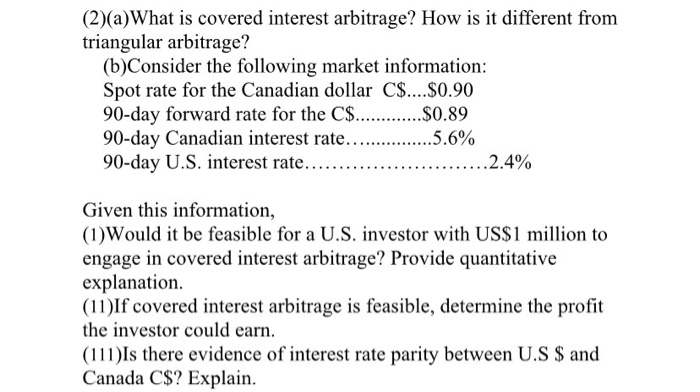

(2)(a)What is covered interest arbitrage? How is it different from triangular arbitrage? (b)Consider the following market information: Spot rate for the Canadian dollar C$....$0.90 90-day forward rate for the C$.............$0.89 90-day Canadian interest rate........... .5.6% 90-day U.S. interest rate.... ..2.4% Given this information, (1)Would it be feasible for a U.S. investor with US$1 million to engage in covered interest arbitrage? Provide quantitative explanation. (11)If covered interest arbitrage is feasible, determine the profit the investor could earn. (111)Is there evidence of interest rate parity between U.S $ and Canada C$? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts