Question: 2-LP Formulation (35 pts). Formulate a LP model for the following problem. (Do not solve) NBK Bank has 10 Million KD to invest in different

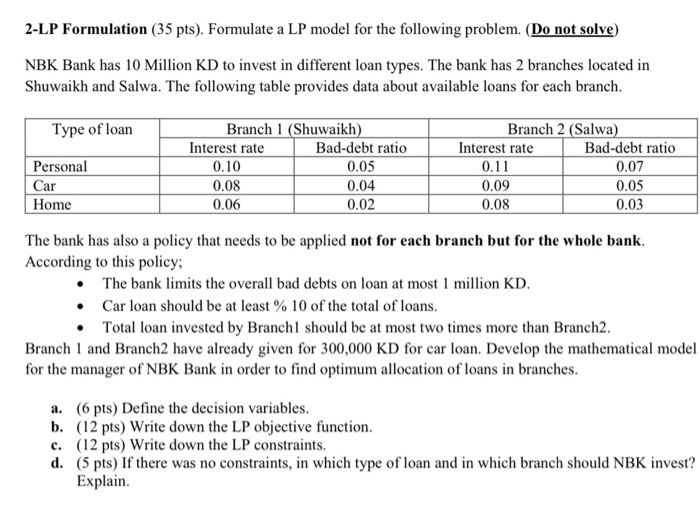

2-LP Formulation (35 pts). Formulate a LP model for the following problem. (Do not solve) NBK Bank has 10 Million KD to invest in different loan types. The bank has 2 branches located in Shuwaikh and Salwa. The following table provides data about available loans for each branch. Type of loan Personal Car Home Branch 1 (Shuwaikh) Interest rate Bad-debt ratio 0.10 0.05 0.08 0.04 0.06 0.02 Branch 2 (Salwa) Interest rate Bad-debt ratio 0.11 0.07 0.09 0.05 0.08 0.03 The bank has also a policy that needs to be applied not for each branch but for the whole bank. According to this policy; The bank limits the overall bad debts on loan at most 1 million KD. Car loan should be at least % 10 of the total of loans. Total loan invested by Branchl should be at most two times more than Branch2. Branch 1 and Branch2 have already given for 300,000 KD for car loan. Develop the mathematical model for the manager of NBK Bank in order to find optimum allocation of loans in branches. a. (6 pts) Define the decision variables. b. (12 pts) Write down the LP objective function. c. (12 pts) Write down the LP constraints. d. (5 pts) If there was no constraints, in which type of loan and in which branch should NBK invest? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts