Question: 2nd question Multiple production department factory overhead rate method Instructions Boon warhead Rabies Factory Overhead per Unit Instructions Performance Gloves, Inc. produces three sizes of

2nd question

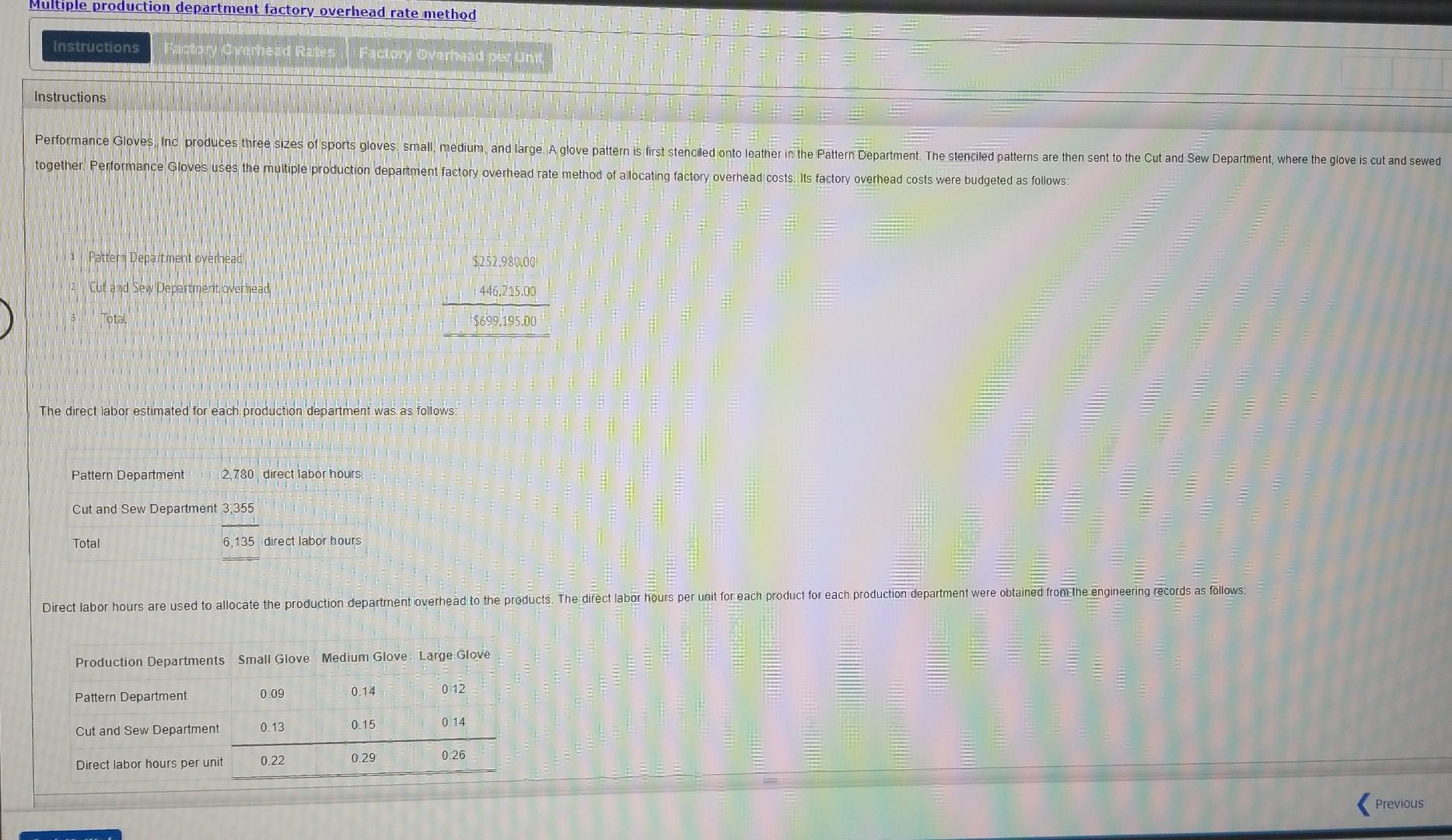

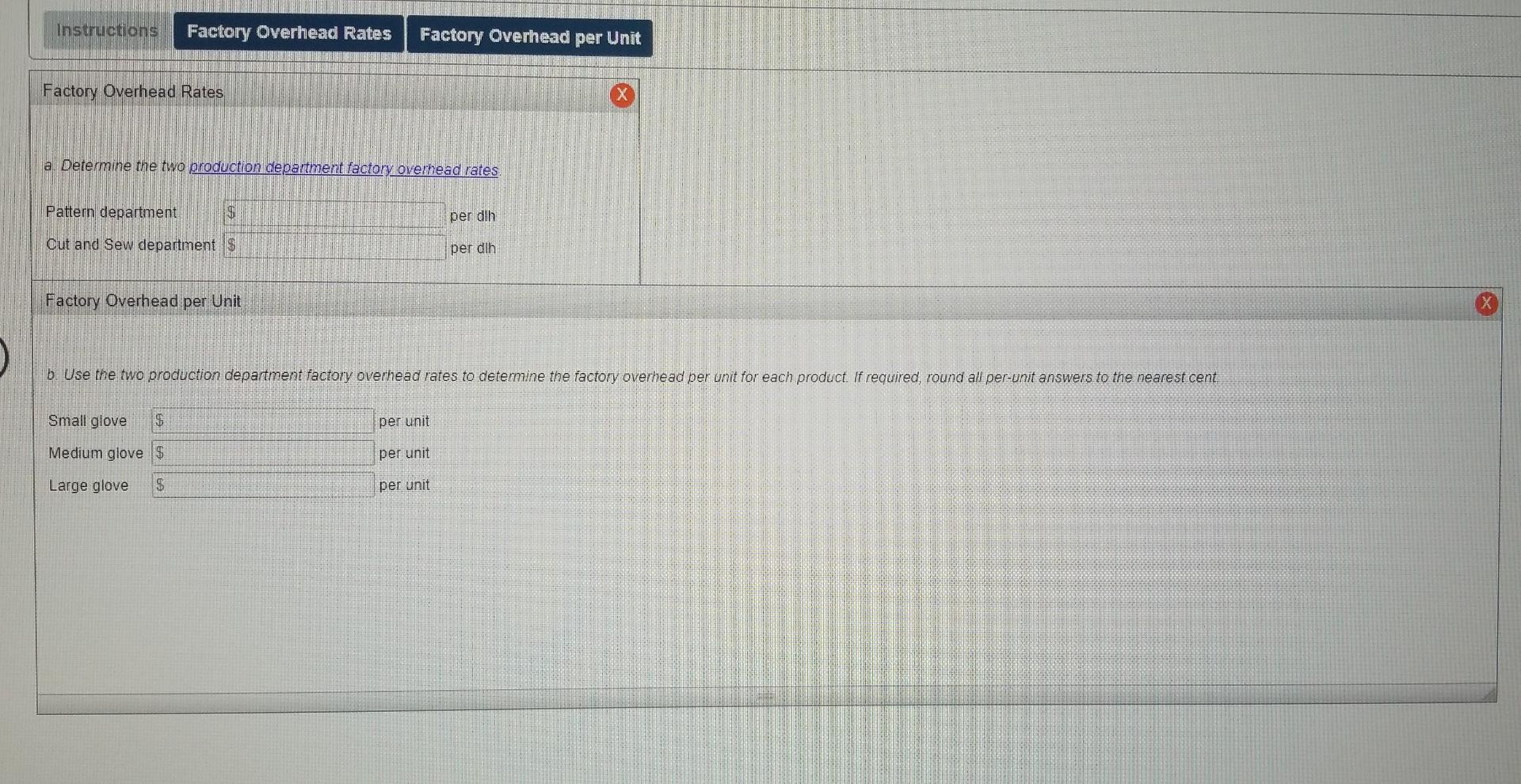

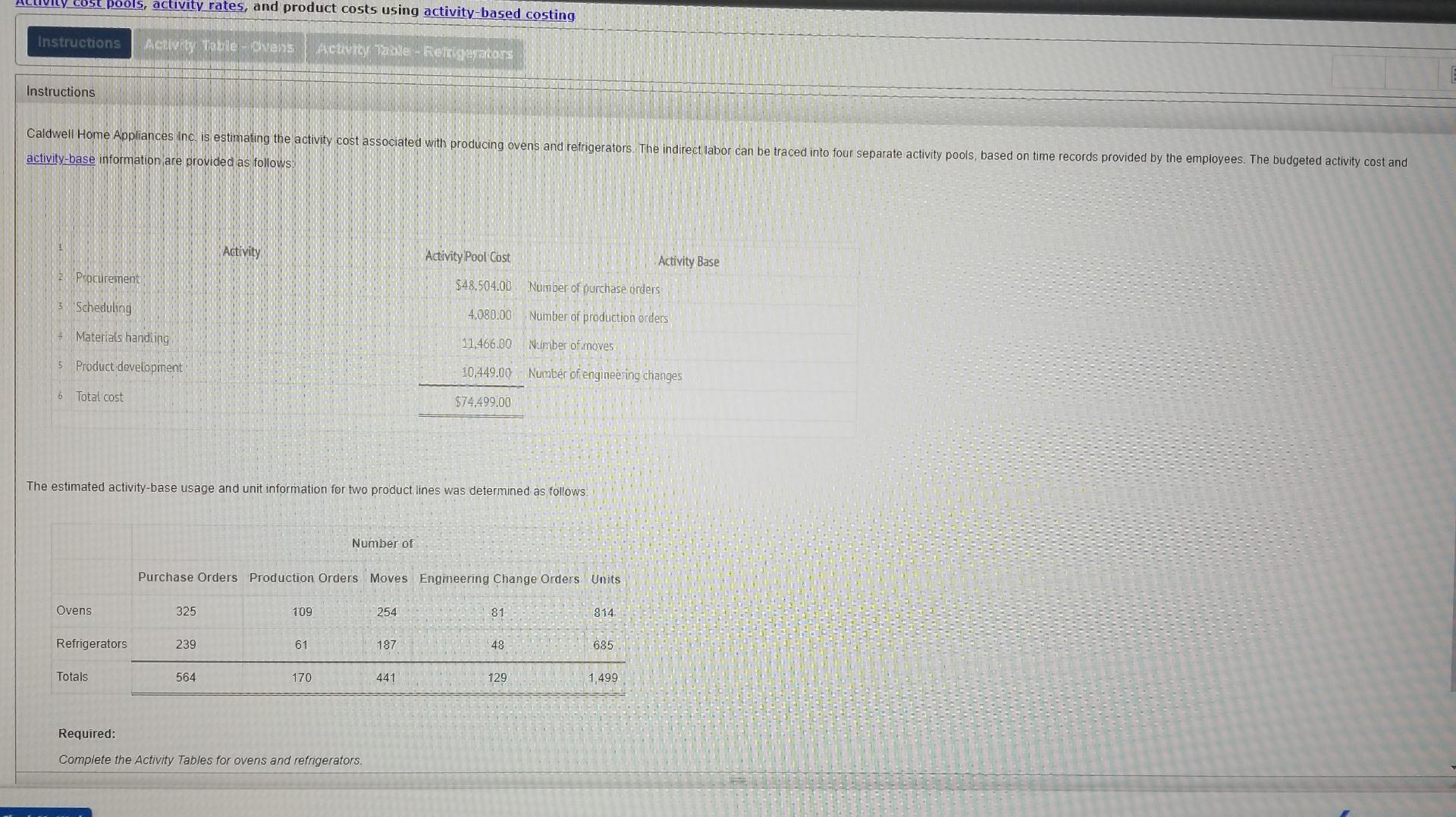

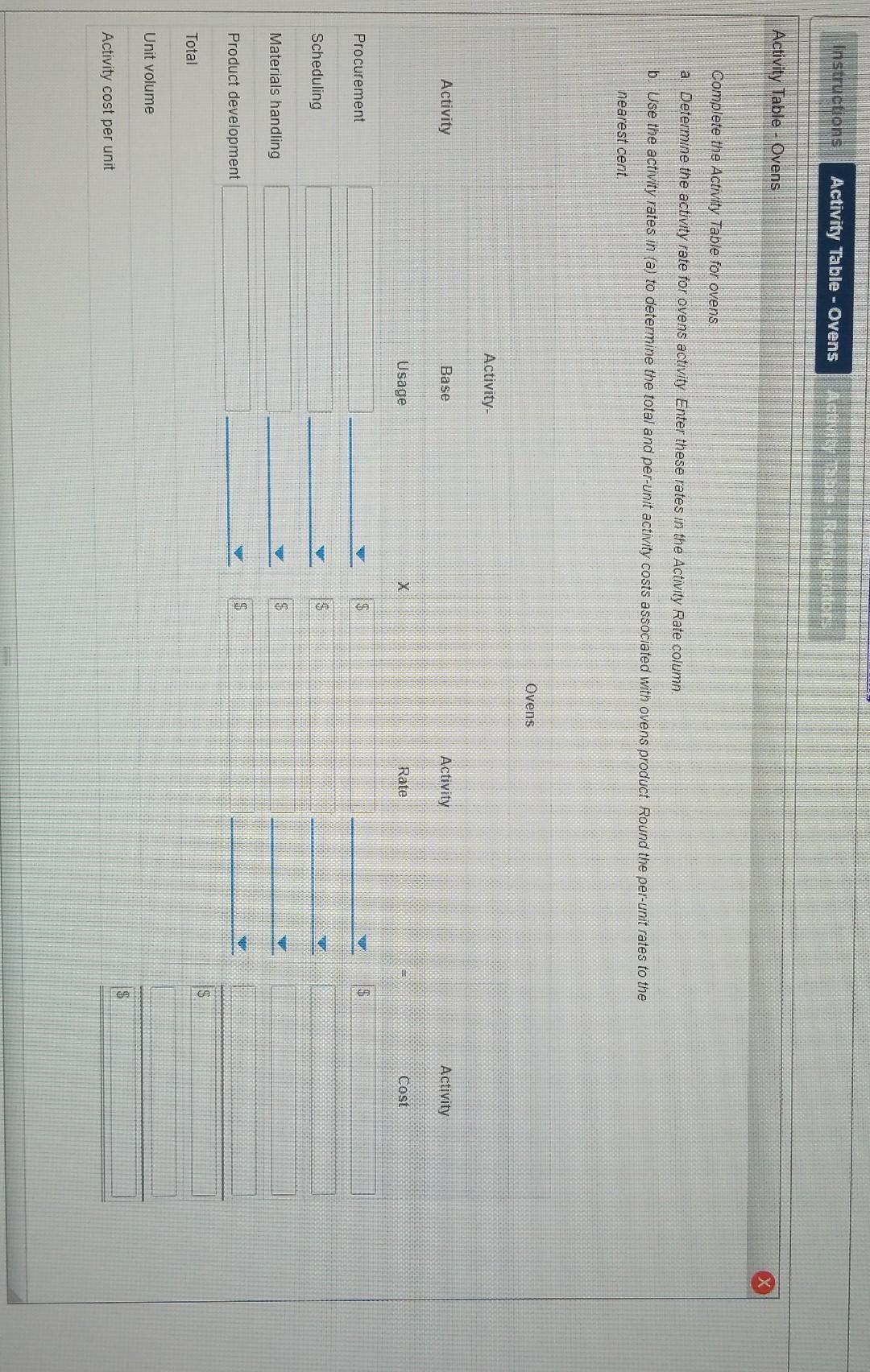

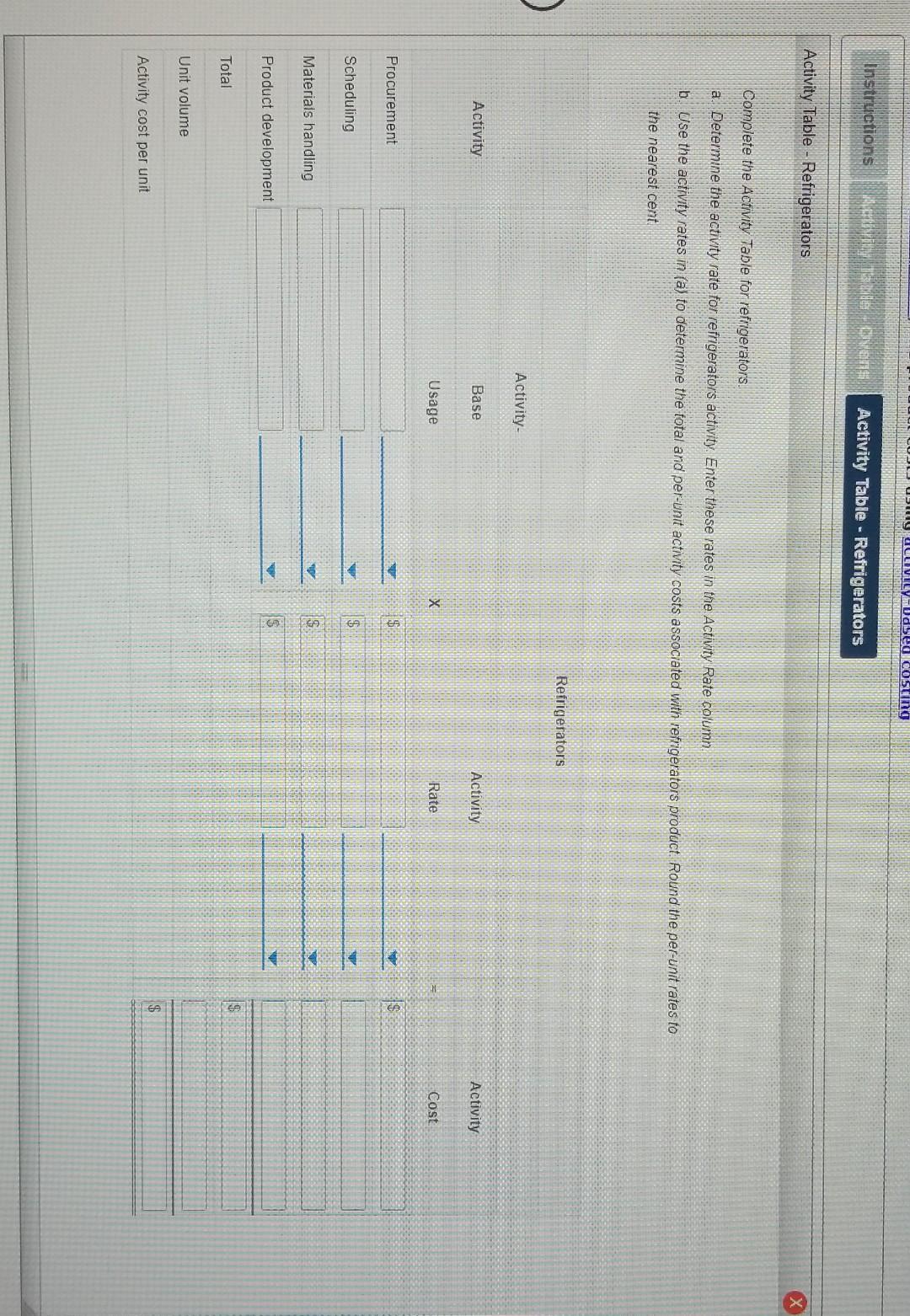

Multiple production department factory overhead rate method Instructions Boon warhead Rabies Factory Overhead per Unit Instructions Performance Gloves, Inc. produces three sizes of sports gloves small, medium, and large. A glove pattern is first stenciled onto leather in the Pattern Department. The stenciled patterns are then sent to the Cut and Sew Department, where the glove is cut and sewed together. Performance Gloves uses the multiple production department factory overhead rate method of allocating factory overhead costs. Its factory overhead costs were budgeted as follows: 1 Pattery Department overhead $252.980.00 cut and Sew Department overhead 446,215.00 Total $699.195.00 The direct labor estimated for each production department was as follows Pattern Department 2,780 direct labor hours Cut and Sew Department 3,355 Total 6,135 direct labor hours Direct labor hours are used to allocate the production department overhead to the products. The direct labor hours per unit for each product for each production department were obtained from the engineering records as follows: Production Departments Small Glove Medium Glove Large Glove Pattern Department 0.09 0.14 0.12 0.13 0.15 0.14 Cut and Sew Department 0.22 0.29 0.26 Direct labor hours per unit Previous Instructions Factory Overhead Rates Factory Overhead per Unit Factory Overhead Rates a. Determine the two production department factory overhead rates Pattern department 9 per dih Cut and Sew department $ per dih Factory Overhead per Unit b. Use the two production department factory overhead rates to determine the factory overhead per unit for each product. If required, round all per-unit answers to the nearest cent. Small glove $ per unit Medium glove $ per unit Large glove $ per unit cost pools, activity rates, and product costs using activity-based costing Instructions Activity Table-ens Activity Table - Refrigerators Instructions Caldwell Home Appliances Inc. is estimating the activity cost associated with producing ovens and refrigerators. The indirect labor can be traced into four separate activity pools, based on time records provided by the employees. The budgeted activity cost and activity-base information are provided as follows: Activity Activity Pool Cost Activity Base Procurement $48.504.00 Number of purchase orders 3 Scheduling 4,080.00 Number of production orders + Materials handung 11,466.00 Number of moves 5 Product development 10,449.00 Number of engineering changes 6 Total cost $74,499.00 The estimated activity-base usage and unit information for two product lines was determined as follows: Number of Purchase Orders Production Orders Moves Engineering Change Orders Units Ovens 325 109 254 81 814 Refrigerators 239 61 187 48 685 Totals 564 170 441 129 1,499 Required: Complete the Activity Tables for ovens and refrigerators. Instructions Activity Table - Ovens energie Activity Table - Ovens Complete the Activity Table for ovens. a. Determine the activity rate for ovens activity Enter these rates in the Activity Rate column b. Use the activity rates in (a) to determine the total and per-unit activity costs associated with ovens product Round the per-unit rates to the nearest cent Ovens Activity- Activity Base Activity Activity Usage Rate Cost Procurement $ Scheduling . Materials handling > S S S Product development 1 1$ Total Unit volume S Activity cost per unit Uly ULLMLLY Udsed Costing Instructions 13 orans Activity Table - Refrigerators Activity Table - Refrigerators Complete the Activity Table for refrigerators. a. Determine the activity rate for refrigerators activity. Enter these rates in the Activity Rate column. b. Use the activity rates in (a) to determine the total and per-unit activity costs associated with refrigerators product. Round the per-unit rates to the nearest cent Refrigerators Activity- Activity Base Activity Activity Usage X Rate Cost Procurement $ Scheduling $ Materials handling $ x 5 Product development 9 Total Unit volume $ Activity cost per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts