Question: 2ND TIME POSTING THIS QUESTION, THE FIRST ANSWERS ARE INCORRECT. You are evaluating two different silicon wafer milling machines. The Techron I costs $282,000, has

2ND TIME POSTING THIS QUESTION, THE FIRST ANSWERS ARE INCORRECT.

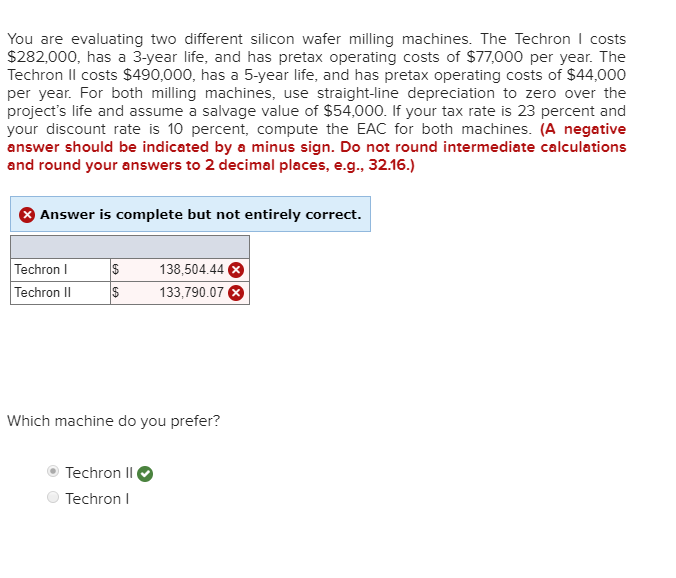

You are evaluating two different silicon wafer milling machines. The Techron I costs $282,000, has a 3-year life, and has pretax operating costs of $77,000 per year. The Techron Il costs $490,000, has a 5-year life, and has pretax operating costs of $44,000 per year. For both milling machines, use straight-line depreciation to zero over the project's life and assume a salvage value of $54,000. If your tax rate is 23 percent and your discount rate is 10 percent, compute the EAC for both machines. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Techron 138,504.44 133,790.07 Techron lI Which machine do you prefer? Techron TechronI You are evaluating two different silicon wafer milling machines. The Techron I costs $282,000, has a 3-year life, and has pretax operating costs of $77,000 per year. The Techron Il costs $490,000, has a 5-year life, and has pretax operating costs of $44,000 per year. For both milling machines, use straight-line depreciation to zero over the project's life and assume a salvage value of $54,000. If your tax rate is 23 percent and your discount rate is 10 percent, compute the EAC for both machines. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Techron 138,504.44 133,790.07 Techron lI Which machine do you prefer? Techron TechronI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts