Question: 2nd time that I ask this question- Please read carefully Suppose an investor with utility function u(R) = E(RP)0.5, where E (RP) is the expected

2nd time that I ask this question- Please read carefully

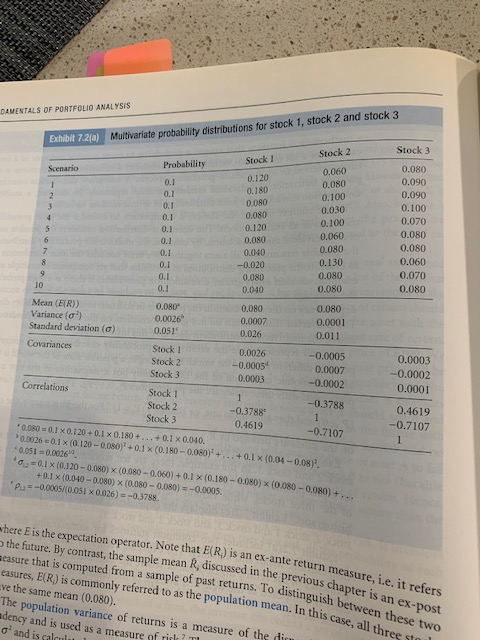

Suppose an investor with utility function u(R) = E(RP)0.5, where E (RP) is the expected return on the portfolio P. The investor wishes to invest in a portfolio that combines the three stocks from Exhibit 7.2a Will he or she prefer an equal-weighted average of the three stocks to holding stocks 2 and 3 only. with corresponding portfolio weights (0;1/4;3/4)?

DAMENTALS OF PORTFOLIO ANALYsiS Stock 3 Stock 2 0.060 0.080 0.100 0.030 0.100 0.060 0.080 0.130 0.080 0.080 EXont 7120) Muitivariate probability distributions for stock 1, stock 2 and stock 3 Stock 1 0.080 0.090 0.090 0.100 0.070 0.080 0.080 0.060 0.070 0.080 Probability Scenario 0.120 0.180 0.080 0,080 0.120 0,080 0.040 0.1 0.1 0.1 0.1 0.1 0.i 0.1 -0.020 0.080 0.040 10 Mean (E(R)) Variance (o) Standard deviation (a) 0.080* 0,0026 0.051 0.080 0.0007 0.026 0.080 0.0001 0.011 Covariances Stock 1 Stock 2 Stock 3 0.0026 -0.0005 0.0003 -0.0005 0.0007 -0.0002 0.0003 -0.0002 0.0001 Correilations Stock 1 Stock 2 Stock 3 -0.3788 -0,3788 0.4619 0.4619 -0.7107 -0.7107 0.080-0.1 x 0.120 +0.1 x0.180+...+0.1 x0040. , 0.0026 0.1 x (0.120-0.080): + 0.1x (0.180-0.080)" + . . . + 0.1x (0.04-008), 0051 0.0026 i2# 0.1 x (0.120-0080) x (0.080-0.060) + 0.1x (0.180-0.0807x (0.080-0.080) + . + 0.1x (0.040-0.080) (0.080-0.080) =-0.0005. Pu =0.0005/(0.051 0.026)s-03788 here E is the expectation operator. Note that E(R) is an ex-ante retu o the future. By contrast, the sample mean R discussed in the previ easure that is computed from a sample of past returns. To distingu easures, E(R) is commonl ve the same mean (0.080). rn measure, i.e. it refers y refered to as the population mean.In this case, all three ste ean. In this case, all three st population variance of returns is a measure of the diru o and is calcu and is used as a measure of ril T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts