Question: 2.You must choose between a no-load, open-end mutual fund with an annual expense ratio of 0.85 percent but no transaction cost and an ETF with

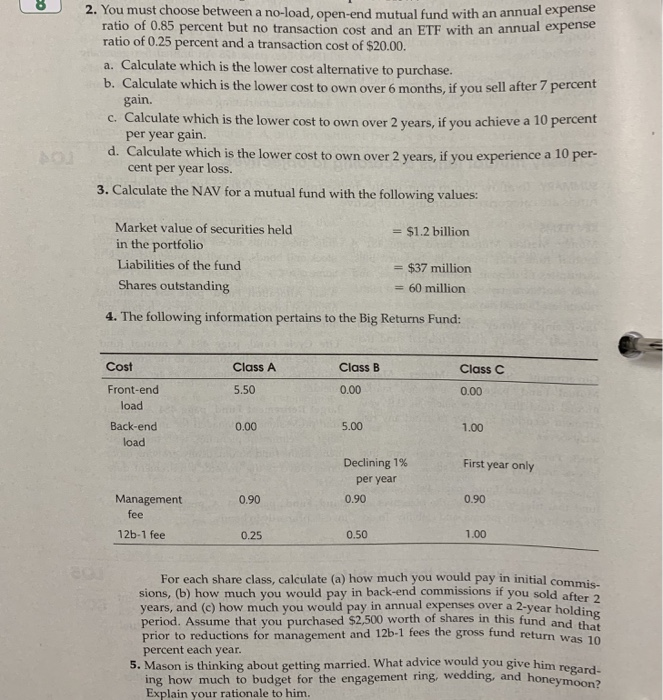

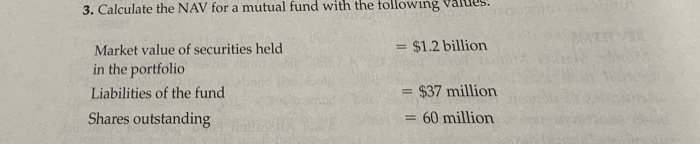

2.You must choose between a no-load, open-end mutual fund with an annual expense ratio of 0.85 percent but no transaction cost and an ETF with an annual expense ratio of 0.25 percent and a transaction cost of $20.00. a. Calculate which is the lower cost alternative to purchase. b. Calculate which is the lower cost to own over 6 months, if you sell after 7 percent gain. per year gain. cent per year loss. c. Calculate which is the lower cost to own over 2 years, if you achieve a 10 percent d. Calculate which is the lower cost to own over 2 years, if you experience a 10 per 3. Calculate the NAV for a mutual fund with the following values: Market value of securities held in the portfolio Liabilities of the fund Shares outstanding - $1.2 billion = $37 million 60 million 4. The following information pertains to the Big Returns Fund: Cost Class A Class B Class C Front-end load Back-encd load 5.50 0.00 0.00 0.00 5.00 1.00 Declining 1% First year only per year 0.90 Management 0.90 0.90 fee 12b-1 fee 0.25 0.50 1.00 For each share class, calculate (a) how much you would pay in initial co sions, (b) how much you would pay in back-end commissions if you sold after2 years, and (c) how much you would pay in annual expenses over a 2-year holdin period. Assume that you purchased $2,500 worth of shares in this fund and prior to reductions for management and percent each year mmis- 12b-1 fees the gross fund return was 10 5. Mason is thinking about getting married. What advice would you give him regard ing how much to budget for the engagement ring, wedding, and honeymoonz Explain your rationale to him. 3. Calculate the NAV for a mutual fund with the following vaiues - $1.2 billion Market value of securities held in the portfolio Liabilities of the fund Shares outstanding - $37 million -60 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts