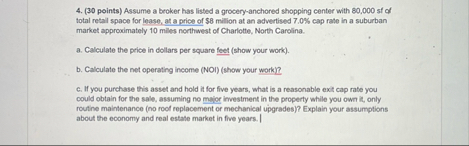

Question: ( 3 0 points ) Assume a broker has listed a grocery - anchored shopping center with 8 0 , 0 0 0 sf of

points Assume a broker has listed a groceryanchored shopping center with sf of total retal space for lease, at a price of $ million at an advertised cap rate in a suburban market approximately miles northwest of Charlotte, North Carolina.

a Calculate the price in dollars per square feet show your work

b Catcutate the net operating income NOIshow your work

c If you purchase this asset and hold it for five years, what is a reasonable exit cap rate you could obtain for the sale, assuming ne malor imestment in the property while you own it only routine maintenance no roof replacement or mechanical upgrades Explain your assumptions about the economy and real estate market in five years.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock