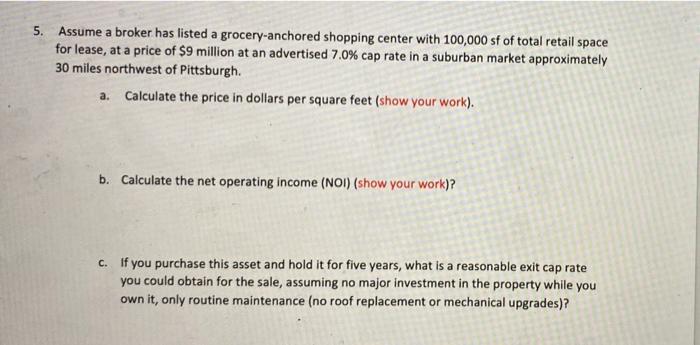

Question: 5. Assume a broker has listed a grocery-anchored shopping center with 100,000 sf of total retail space for lease, at a price of $9 million

5. Assume a broker has listed a grocery-anchored shopping center with 100,000 sf of total retail space for lease, at a price of $9 million at an advertised 7.0 % cap rate in a suburban market approximately 30 miles northwest of Pittsburgh. a. Calculate the price in dollars per square feet (show your work). b. Calculate the net operating income (NOI) (show your work)? c. If you purchase this asset and hold it for five years, what is a reasonable exit cap rate you could obtain for the sale, assuming no major investment in the property while you own it, only routine maintenance (no roof replacement or mechanical upgrades)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts