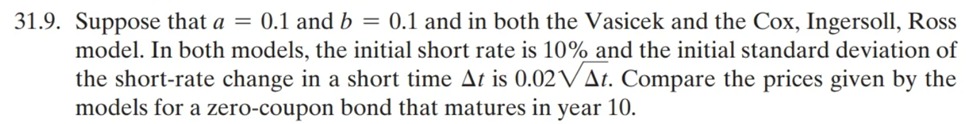

Question: 3 1 . 9 . Suppose that a = 0 . 1 and b = 0 . 1 and in both the Vasicek and the

Suppose that and and in both the Vasicek and the Cox, Ingersoll, Ross

model. In both models, the initial short rate is and the initial standard deviation of

the shortrate change in a short time is Compare the prices given by the

models for a zerocoupon bond that matures in year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock