Question: 3 1 Multiple Answer 1 point The justification for using an accelerated method of depreciation such as the double declining method is: It doubles the

Multiple Answer point

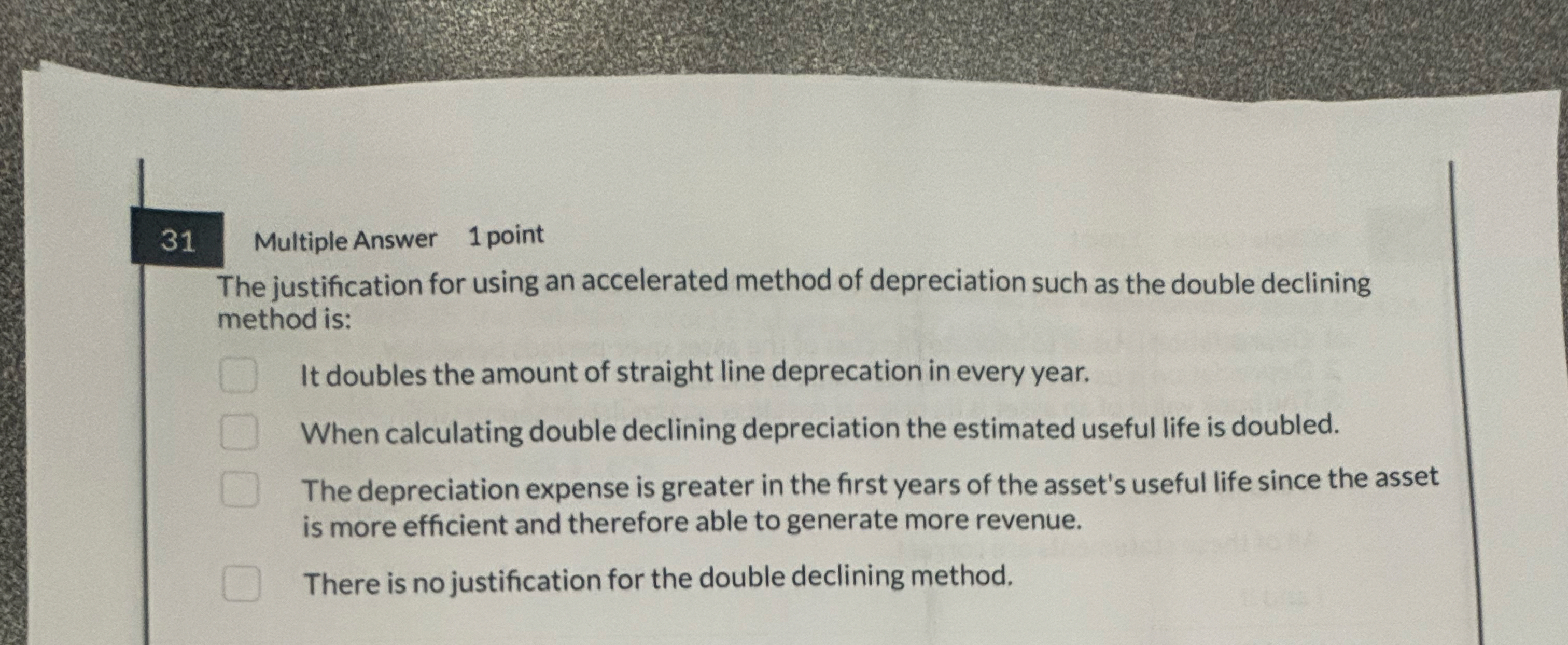

The justification for using an accelerated method of depreciation such as the double declining method is:

It doubles the amount of straight line deprecation in every year.

When calculating double declining depreciation the estimated useful life is doubled.

The depreciation expense is greater in the first years of the asset's useful life since the asset is more efficient and therefore able to generate more revenue.

There is no justification for the double declining method.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock