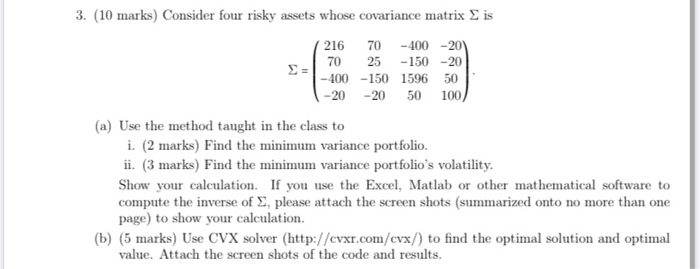

Question: 3. (10 marks) Consider four risky assets whose covariance matrix is S ( 216 70 1-400 -20 70 25 - 150 -20 -400 -20 -150-20

3. (10 marks) Consider four risky assets whose covariance matrix is S ( 216 70 1-400 -20 70 25 - 150 -20 -400 -20 -150-20 1596 50 50 100) (a) Use the method taught in the class to i. (2 marks) Find the minimum variance portfolio. ii. (3 marks) Find the minimum variance portfolio's volatility. Show your calculation. If you use the Excel, Matlab or other mathematical software to compute the inverse of E, please attach the screen shots (summarized onto no more than one page) to show your calculation. (b) (5 marks) Use CVX solver (http://cvxr.com/cvx/) to find the optimal solution and optimal value. Attach the screen shots of the code and results. 3. (10 marks) Consider four risky assets whose covariance matrix is S ( 216 70 1-400 -20 70 25 - 150 -20 -400 -20 -150-20 1596 50 50 100) (a) Use the method taught in the class to i. (2 marks) Find the minimum variance portfolio. ii. (3 marks) Find the minimum variance portfolio's volatility. Show your calculation. If you use the Excel, Matlab or other mathematical software to compute the inverse of E, please attach the screen shots (summarized onto no more than one page) to show your calculation. (b) (5 marks) Use CVX solver (http://cvxr.com/cvx/) to find the optimal solution and optimal value. Attach the screen shots of the code and results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts