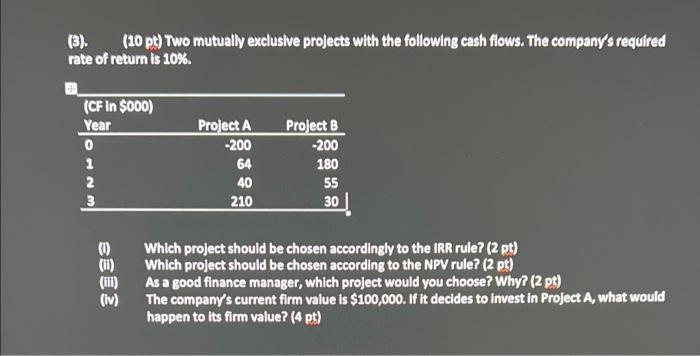

Question: (3). (10 pt) Two mutually exclusive projects with the following cash flows. The company's required rate of return is 10%. (CF in $000) Year

(3). (10 pt) Two mutually exclusive projects with the following cash flows. The company's required rate of return is 10%. (CF in $000) Year 0 1 2 3 (10) (11) (i) (iv) Project A -200 64 40 210 Project B -200 180 55 30 Which project should be chosen accordingly to the IRR rule? (2 pt) Which project should be chosen according to the NPV rule? (2 pt) As a good finance manager, which project would you choose? Why? (2 pt) The company's current firm value is $100,000. If it decides to invest in Project A, what would happen to its firm value? (4 pt)

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

To determine the project that should be chosen according to the Internal Rate of Return IRR rule we need to calculate the IRR for each project and com... View full answer

Get step-by-step solutions from verified subject matter experts