Question: 3. (18 points) [You are allowed to answer this question within two pages] A fund manager constructs two funds which are made of four stocks

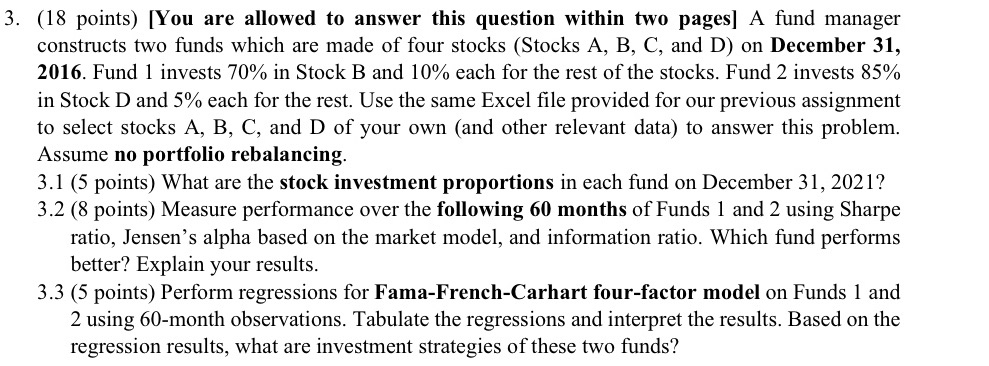

3. (18 points) [You are allowed to answer this question within two pages] A fund manager constructs two funds which are made of four stocks (Stocks A, B, C, and D) on December 31, 2016. Fund 1 invests 70% in Stock B and 10% each for the rest of the stocks. Fund 2 invests 85% in Stock D and 5% each for the rest. Use the same Excel le provided for our previous assignment to select stocks A, B, C, and D of your own (and other relevant data) to answer this problem. Assume no portfolio rebalancing. 3.1 (5 points} What are the stock investment proportions in each fund on December 31, 2021? 3.2 (8 points) Measure performance over the following 60 months of Funds 1 and 2 using Sharpe ratio, Jensen's alpha based on the market model, and information ratio. Which fund performs better? Explain your results. 3.3 (5 points) Perform regressions for FamaFrench-Carhar't four-factor model on Funds 1 and 2 using 60-month observations. Tabulate the regressions and interpret the results. Based on the regression results, what are investment strategies of these two funds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts